Key Takeaways:

- Quad/Graphics is anticipated to reveal a quarterly earnings decline.

- Analysts predict significant upside potential from the current stock price.

- The GF Value suggests potential downside, indicating mixed signals for investors.

Quad/Graphics (QUAD, Financial) is poised to release its first-quarter earnings report on April 29th after the market closes. Analysts are forecasting an EPS of $0.09, representing a 10% decrease compared to the previous year. The company is also expected to report revenues of $588.05 million, reflecting a 10.2% decline. Historically, Quad/Graphics has outperformed EPS expectations 75% of the time, although it has only beaten revenue estimates 38% of the time.

Wall Street Analysts Forecast

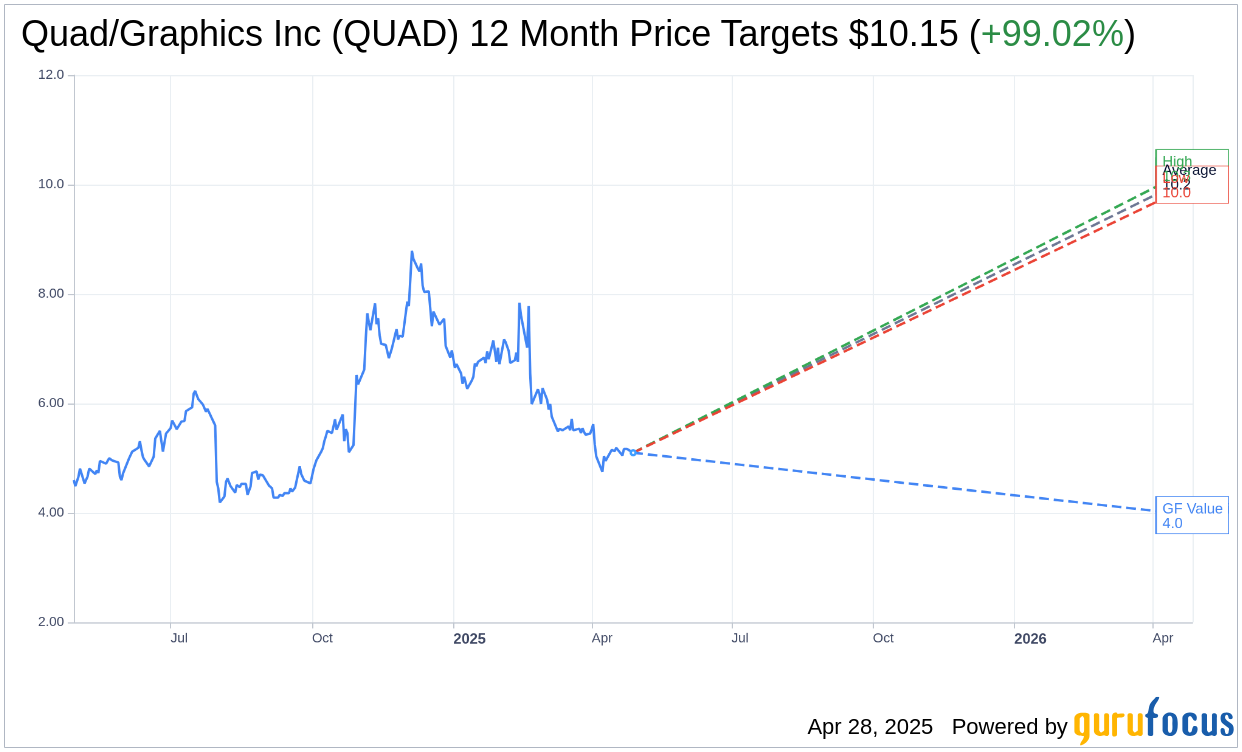

According to the one-year price targets provided by two analysts, the average target price for Quad/Graphics Inc (QUAD, Financial) is $10.15. This includes a high estimate of $10.30 and a low estimate of $10.00, indicating a significant potential upside of 99.02% from the current stock price of $5.10. Investors can find more detailed estimate data on the Quad/Graphics Inc (QUAD) Forecast page.

The consensus recommendation from two brokerage firms is a 1.5 for Quad/Graphics Inc (QUAD, Financial), signifying a "Buy" rating. The brokerage recommendation scale ranges from 1 to 5, with 1 representing a Strong Buy and 5 a Sell recommendation.

On the other hand, GuruFocus' estimates suggest the GF Value for Quad/Graphics Inc (QUAD, Financial) in one year is $3.96. This implies a downside of 22.35% from the current price of $5.10. The GF Value is GuruFocus' assessment of the fair value at which the stock should be traded, calculated based on historical trading multiples, past business growth, and future performance estimates. For more comprehensive data, please visit the Quad/Graphics Inc (QUAD) Summary page.