Key Takeaways:

- Rambus Inc. (RMBS, Financial) reports a significant revenue surge in Q1 2025, buoyed by DDR5 RCD product sales.

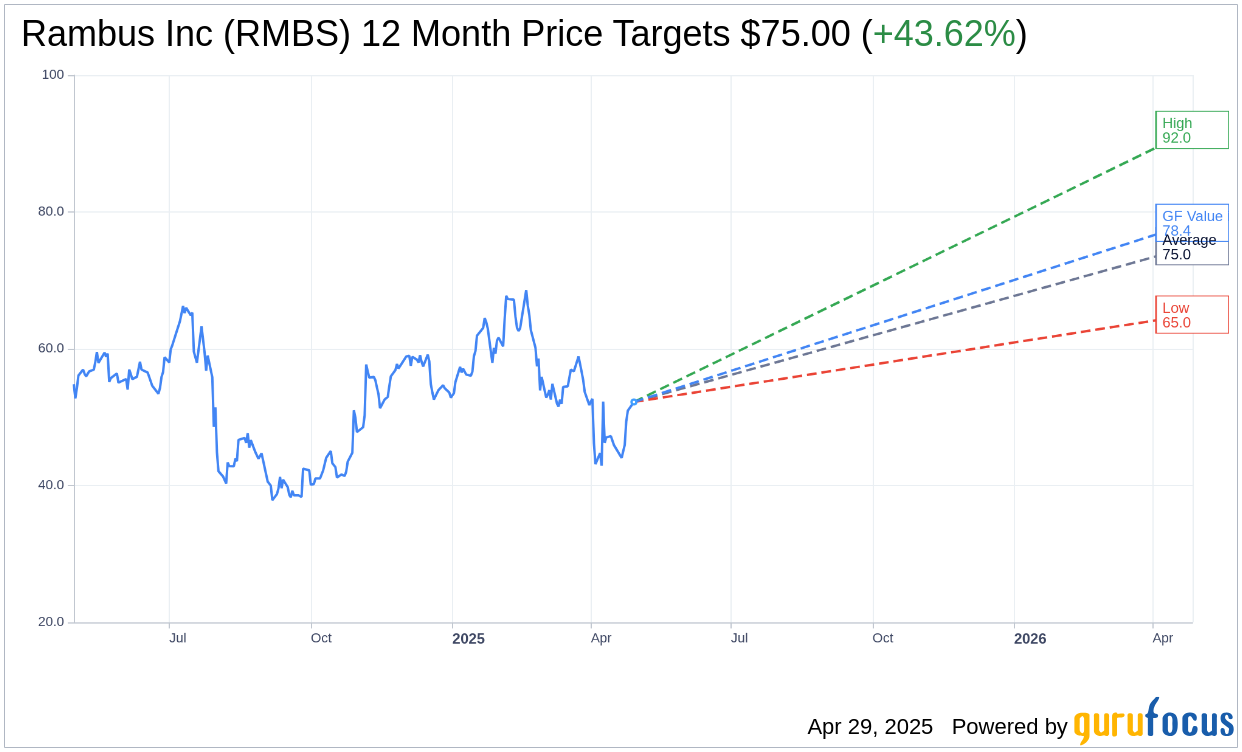

- Analysts predict a potential 43.62% upside in RMBS stock, driven by strong market performance.

- GuruFocus estimates suggest an even higher potential upside of 50.17% based on fair value projections.

Rambus Inc.'s Impressive Q1 2025 Financial Performance

Rambus Inc. (RMBS) delivered remarkable financial results in the first quarter of 2025, reporting a substantial revenue of $166.7 million. This impressive increase was largely propelled by a 52% surge in DDR5 RCD product sales. Additionally, the company achieved a record-breaking $76.3 million in product revenue, underscoring its strong market position. Looking ahead, Rambus is optimistic about sustaining its growth momentum with upcoming platform launches. The revenue guidance for the second quarter is projected to be between $167 million and $173 million.

Wall Street Analysts' Forecast for Rambus Inc. (RMBS, Financial)

According to insights from eight analysts, Rambus Inc. (RMBS, Financial) has a compelling one-year average price target of $75.00, with estimates ranging from a high of $92.00 to a low of $65.00. This average target suggests a potential 43.62% upside from the current share price of $52.22. Investors seeking more in-depth forecast data can visit the Rambus Inc (RMBS) Forecast page.

Brokerage Recommendations and GuruFocus's Insight

The consensus recommendation from nine brokerage firms currently rates Rambus Inc. (RMBS, Financial) at an average brokerage recommendation of 2.0, indicating an "Outperform" status. This rating operates on a scale from 1 to 5, where 1 represents a Strong Buy and 5 signifies a Sell.

Additionally, based on GuruFocus metrics, the estimated GF Value for Rambus Inc. (RMBS, Financial) in one year is anticipated to be $78.42. This suggests an attractive potential upside of 50.17% from the current stock price of $52.22. The GF Value is GuruFocus’s appraisal of the stock's fair trading value, calculated through historical trading multiples, past business growth, and future business performance forecasts. For a deeper dive into these analytics, visit the Rambus Inc (RMBS) Summary page.