- Uber is changing its office attendance policy and extending sabbatical eligibility for employees.

- Analyst forecasts suggest a potential upside for Uber's stock price.

- GuruFocus estimates reveal a potential downside based on GF Value.

Uber Technologies Inc (NYSE: UBER) is undergoing strategic policy adjustments aimed at enhancing workforce efficiency and employee satisfaction. Starting June, Uber will mandate in-office attendance three days a week, a shift from the prior two-day requirement. Additionally, the company has broadened the scope of its paid sabbatical program, now available to employees post eight years of service, as opposed to the former five-year criterion.

Wall Street Analysts' Insights

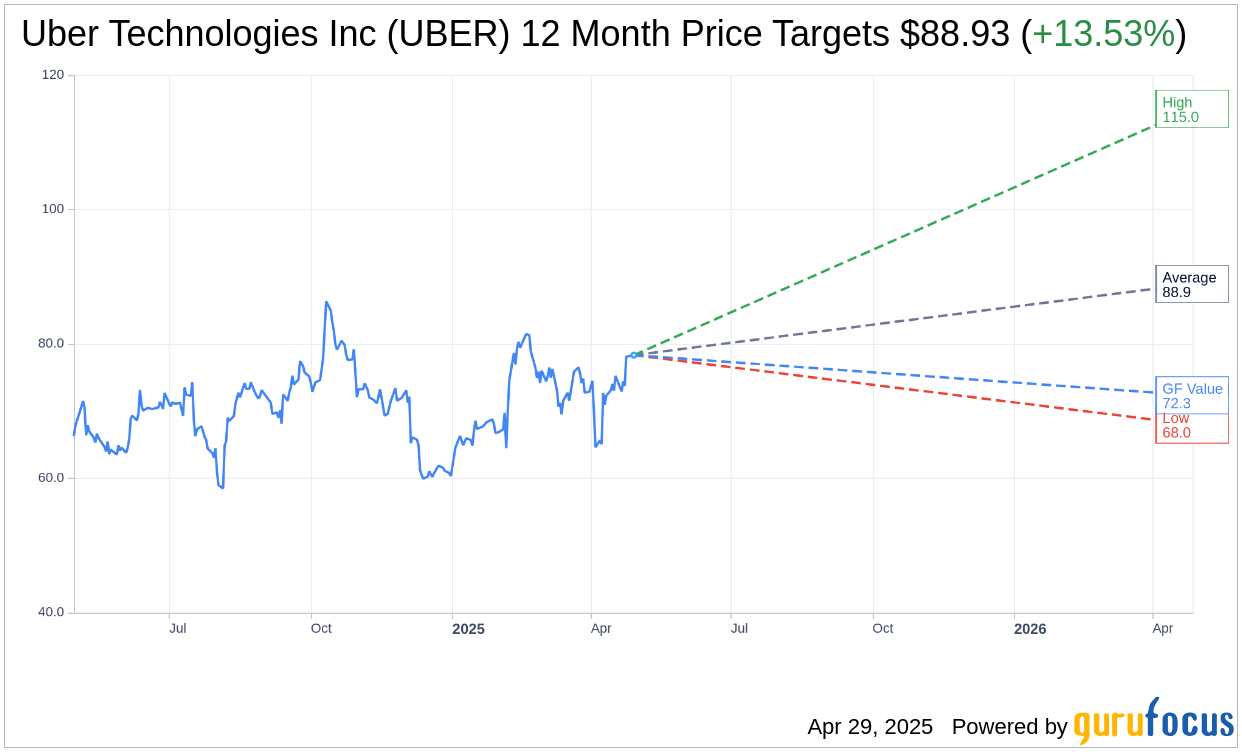

The financial community remains optimistic about Uber's market potential. Analyzing predictions from 40 financial experts, the average one-year price target for Uber Technologies Inc stands at $88.93. This target encompasses expectations as high as $115.00 and as low as $68.00, suggesting an anticipated upside of 13.53% from Uber's current trading price of $78.33. For a more comprehensive exploration of these projections, visit the Uber Technologies Inc (UBER, Financial) Forecast page.

Furthermore, the consensus among 53 brokerages assigns Uber a commendable average recommendation of 1.9. This rating falls under the "Outperform" category on a scale where 1 denotes Strong Buy and 5 represents Sell.

GuruFocus GF Value Assessment

Despite the positive sentiment from brokerage firms, GuruFocus's GF Value estimation presents a more cautious outlook. The projected GF Value for Uber in one year is $72.35, indicating a potential downside of 7.63% relative to its current market price. The GF Value reflects what GuruFocus deems as the justifiable trading value of the stock, based on historical trading patterns, past growth metrics, and future business performance forecasts. Investors can further delve into these calculations on the Uber Technologies Inc (UBER, Financial) Summary page.