- Adidas AG (ADDYY, Financial) sees a robust 13% increase in currency-neutral sales in Q1.

- Analysts project a promising upside of 24.10% from the current stock price.

- The stock receives an "Outperform" recommendation with a 1.7 average rating.

Adidas AG (ADDYY) showcased substantial growth in the first quarter by achieving a remarkable 13% increase in currency-neutral sales, totaling €6.15 billion. The Adidas brand experienced a robust 17% expansion, which significantly contributed to the gross margin rise to 52.1%. Additionally, operating profit surged to €610 million, while net income more than doubled to €436 million.

Wall Street Analysts Forecast

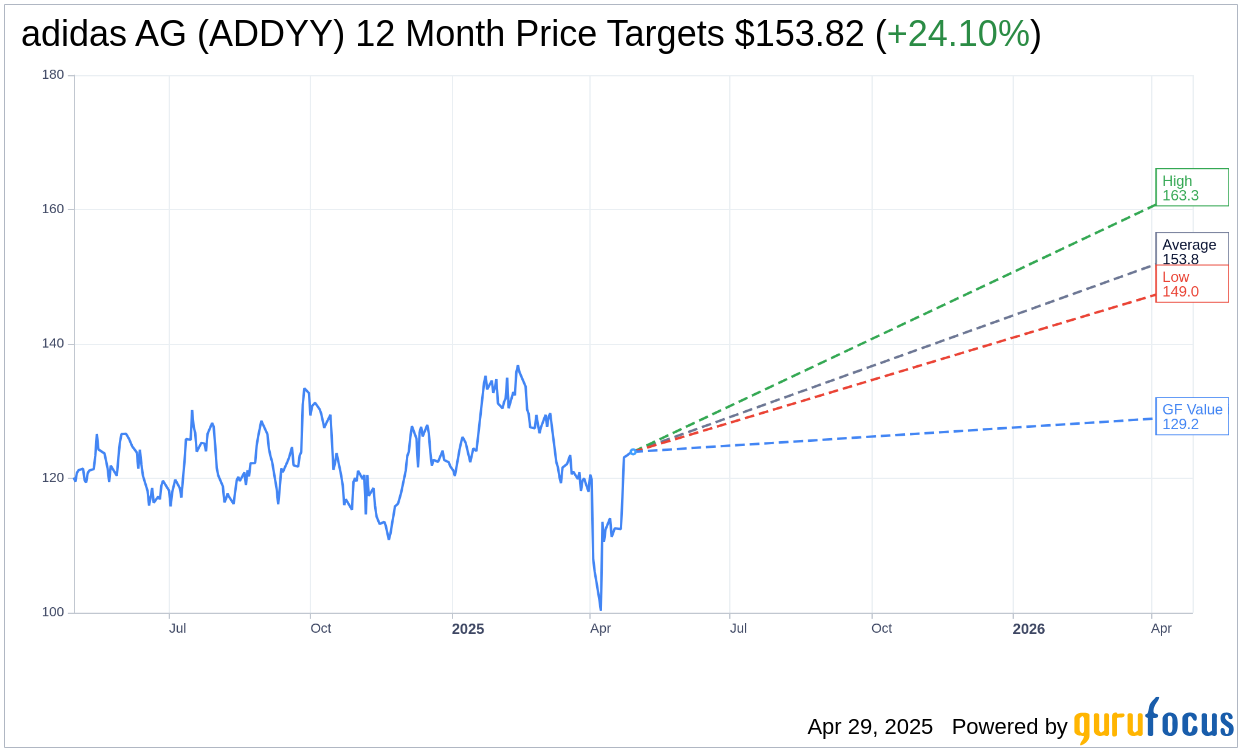

Market analysts are optimistic about the one-year outlook for Adidas AG (ADDYY, Financial), with the average price target set at $153.82. This prediction is based on insights from three analysts, providing a high estimate of $163.31 and a low of $148.97. The current stock price stands at $123.94, suggesting a potential upside of 24.10%. For more comprehensive projections, investors can visit the adidas AG (ADDYY) Forecast page.

The consensus among three brokerage firms assigns Adidas AG a favorable average brokerage recommendation of 1.7, indicating an "Outperform" status. This assessment is part of a rating scale where 1 represents a Strong Buy, and 5 indicates a Sell.

According to GuruFocus estimates, the projected GF Value for Adidas AG (ADDYY, Financial) in one year is $129.24, which suggests a moderate upside of 4.28% from the current price of $123.94. The GF Value is calculated by considering historical trading multiples, previous business growth, and future performance estimates. Investors interested in more detailed data can explore the adidas AG (ADDYY) Summary page.