Highlights:

- Banco Bilbao Vizcaya Argentaria, S.A. (BBVA, Financial) reports a non-GAAP EPS of €0.45 for Q1.

- Net interest income is €6.4 billion, showing a 1.7% year-over-year decline.

- BBVA plans to launch Bitcoin and Ether trading services in Spain.

1. BBVA's Financial Performance Overview

Banco Bilbao Vizcaya Argentaria, S.A. (BBVA) reported its first-quarter financial results, showcasing a non-GAAP earnings per share of €0.45. Despite challenges, the bank's net interest income reached €6.4 billion, representing a 1.7% decline compared to the previous year. In a strategic move to embrace digital currencies, BBVA also plans to introduce Bitcoin and Ether trading services in Spain, underlining its commitment to innovation.

2. Analyst Predictions for BBVA

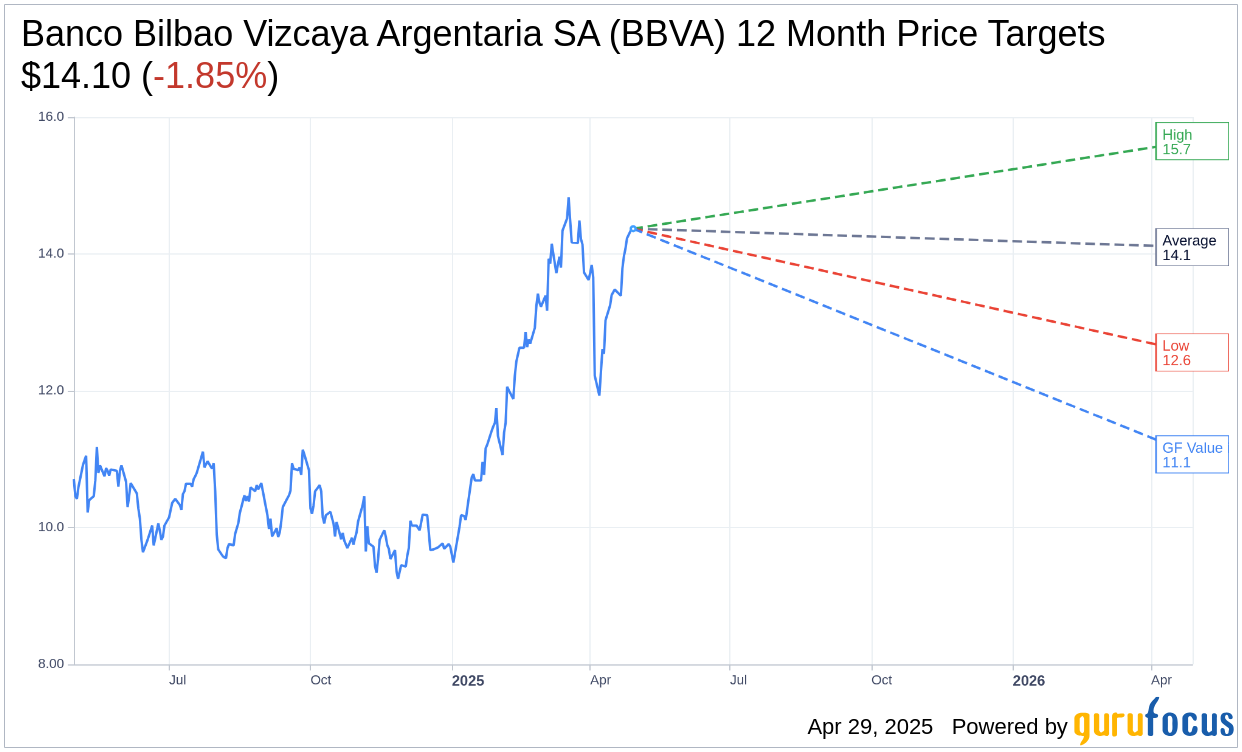

Wall Street analysts have provided a one-year price target for BBVA, averaging at $14.10, with estimates ranging from a high of $15.65 to a low of $12.56. This suggests a potential downside of 1.85% from the current trading price of $14.37. For investors seeking deeper insights, more detailed estimate data is available on the Banco Bilbao Vizcaya Argentaria SA (BBVA, Financial) Forecast page.

3. Brokerage Recommendations

According to consensus from two brokerage firms, BBVA is rated with an average brokerage recommendation of 2.0, indicating an "Outperform" status. The recommendation scale spans from 1, which means Strong Buy, to 5, indicating a Sell position. This suggests optimism among analysts regarding BBVA's performance in the market.

4. Evaluating BBVA's GF Value

The GF Value metric provided by GuruFocus estimates BBVA's fair value in one year to be $11.07, pointing to a potential downside of 22.96% from the current price of $14.37. GF Value is calculated based on the stock's historical multiples, past business growth, and projected future performance. For further analysis, investors can explore more detailed data on the Banco Bilbao Vizcaya Argentaria SA (BBVA, Financial) Summary page.