Apollo, through its infrastructure funds, has signed an agreement to acquire the European colocation segment of Stack Infrastructure, a company within Blue Owl Digital Infrastructure Advisors' portfolio. This transaction involves the transfer of seven data center facilities located in strategically important European regions, namely Stockholm, Oslo, Copenhagen, Milan, and Geneva. These centers cater to high-profile enterprise clients across telecommunications, IT, and finance sectors.

Following the transaction, the current management and employees of Stack's EMEA colocation division will transition to the new company. This venture will be rebranded, shedding the "STACK Infrastructure" identity. Meanwhile, Stack Infrastructure plans to continue expanding its hyperscale operations within the EMEA market. The completion of this acquisition is contingent upon meeting certain predefined conditions, including obtaining relevant regulatory approvals.

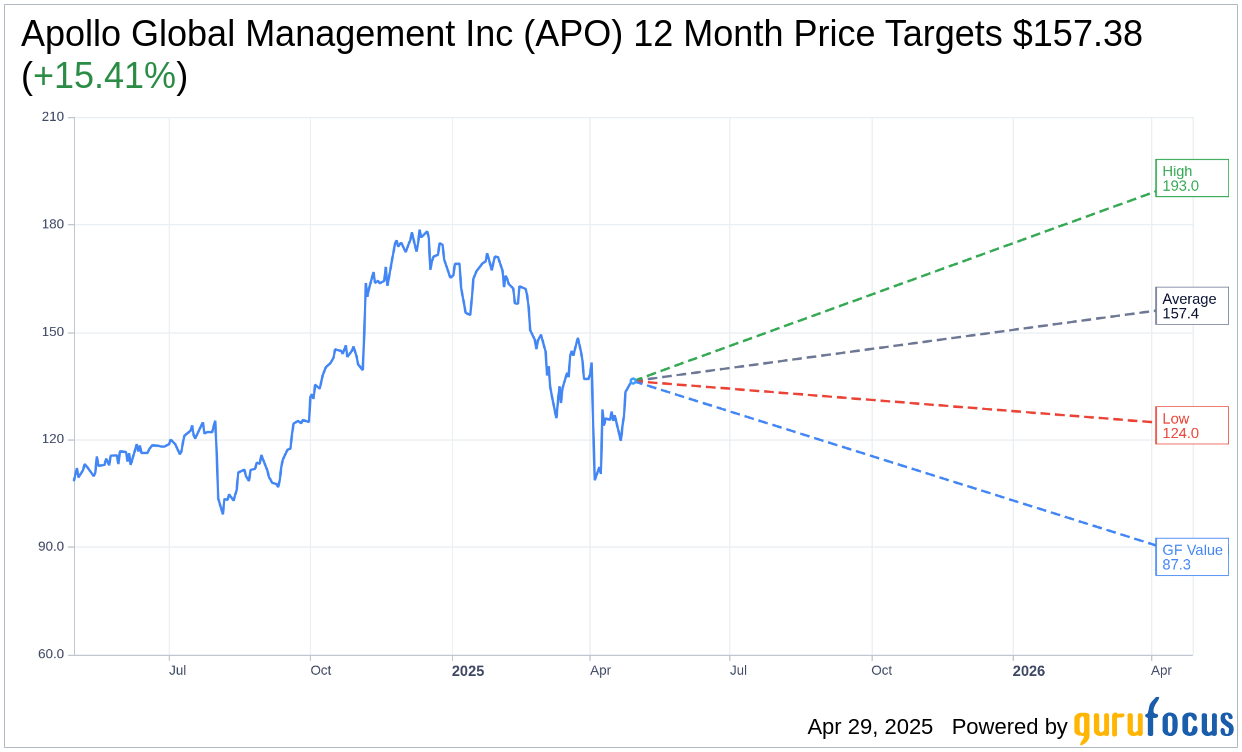

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for Apollo Global Management Inc (APO, Financial) is $157.38 with a high estimate of $193.00 and a low estimate of $124.00. The average target implies an upside of 15.41% from the current price of $136.36. More detailed estimate data can be found on the Apollo Global Management Inc (APO) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Apollo Global Management Inc's (APO, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Apollo Global Management Inc (APO, Financial) in one year is $87.29, suggesting a downside of 35.99% from the current price of $136.36. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Apollo Global Management Inc (APO) Summary page.

APO Key Business Developments

Release Date: February 04, 2025

- Fee-Related Earnings (FRE): $554 million or $0.90 per share for Q4; $2.1 billion for the full year, up 17% year-over-year.

- Spread-Related Earnings (SRE): $841 million or $1.37 per share for Q4; $3.2 billion for the full year.

- Adjusted Net Income (ANI): $1.4 billion or $2.22 per share for Q4; record annual ANI of $4.6 billion.

- Assets Under Management (AUM): Record $751 billion.

- Total Inflows: $150 billion.

- Origination Volume: Over $220 billion.

- Athene Organic Inflows: More than $70 billion for the year.

- Net Spread ex Notables: 137 basis points.

- Net Accrued Performance Fee Balance: $1.7 billion or $2.75 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Apollo Global Management Inc (APO, Financial) reported record fee-related earnings of $554 million or $0.90 per share for the fourth quarter.

- The company was added to the S&P 500 in December, reflecting its remarkable growth and institutionalization.

- Apollo achieved a record annual adjusted net income of $4.6 billion, showcasing strong financial performance.

- The firm reported a record AUM of $751 billion, with total inflows of $150 billion and origination volume over $220 billion.

- Apollo's strategy focuses on sustainable growth, aiming to grow fee-related earnings at an average annual rate of 20% over the next five years.

Negative Points

- The company faces internal challenges in executing its five-year plan, as identified by 90% of its partners.

- There is a risk of increased competition in the retirement market, which could impact growth in that segment.

- Apollo's cost of funding for Athene rose by 12 basis points sequentially, indicating potential pressure on spread-related earnings.

- The firm acknowledges regulatory uncertainties, particularly in the insurance and retirement sectors, which could impact future operations.

- Despite strong performance, the company is cautious about not growing disproportionately in any one quarter, which may limit short-term gains.