Citi has revised its price target for Paylocity (PCTY, Financial), decreasing it from $246 to $225 while maintaining a Buy rating on the stock. This adjustment comes as the firm approaches its Q1 earnings with caution, particularly concerning valuation setups within the payroll sector. Citi acknowledges Paylocity's recent strong performance but flags it as a potential risk due to heightened investor sentiment, viewing it largely as a self-driven success story.

The firm highlights that the human capital management sector, often considered a defensive option, may lag as investment interest shifts within the software industry towards growth opportunities. Citi's analysis suggests that such rotations could impact Paylocity's future performance, according to a note shared with investors.

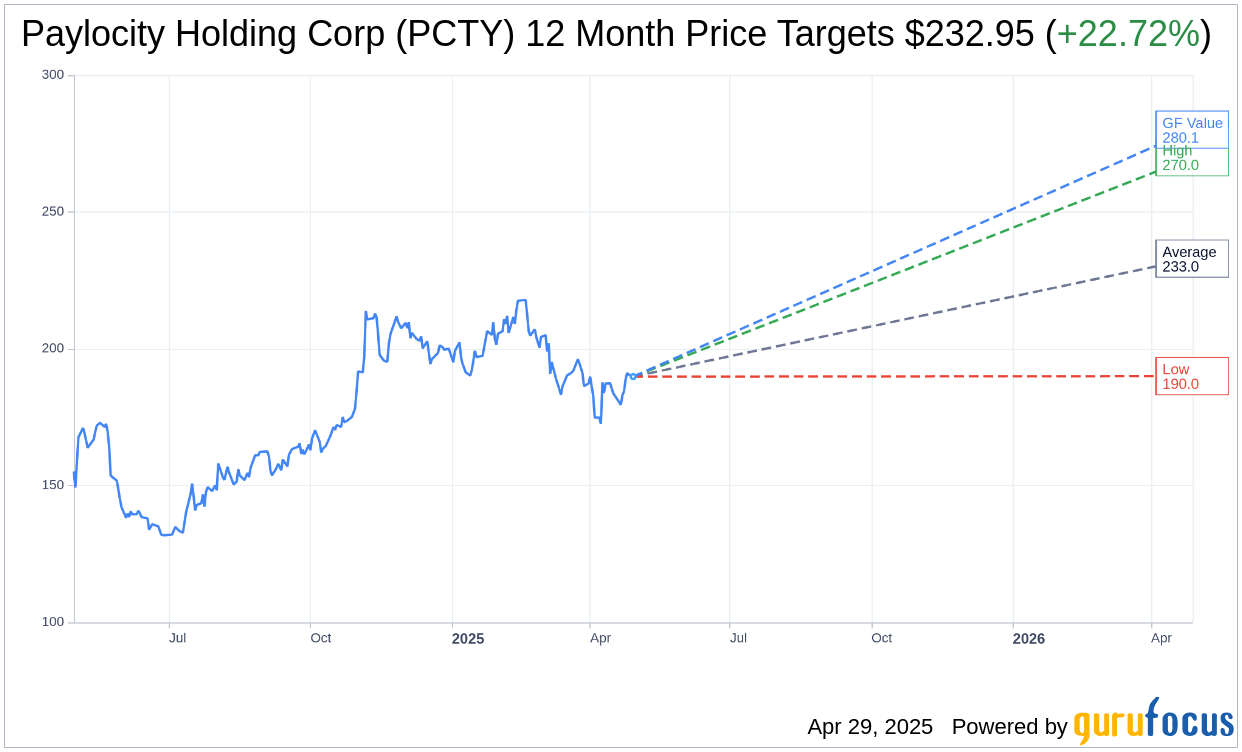

Wall Street Analysts Forecast

Based on the one-year price targets offered by 19 analysts, the average target price for Paylocity Holding Corp (PCTY, Financial) is $232.95 with a high estimate of $270.00 and a low estimate of $190.00. The average target implies an upside of 22.72% from the current price of $189.82. More detailed estimate data can be found on the Paylocity Holding Corp (PCTY) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Paylocity Holding Corp's (PCTY, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Paylocity Holding Corp (PCTY, Financial) in one year is $280.10, suggesting a upside of 47.56% from the current price of $189.82. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Paylocity Holding Corp (PCTY) Summary page.

PCTY Key Business Developments

Release Date: February 06, 2025

- Total Revenue: $377 million, up 16% from the same period last year.

- Recurring and Other Revenue: $347.7 million, an increase of 17% year-over-year.

- Adjusted Gross Profit Margin: 73.8%, up from 72.7% in the previous year.

- Adjusted EBITDA: $126.2 million, or 33.5% margin, exceeding guidance by $8.2 million.

- Net Income: $37.5 million for Q2.

- Cash and Cash Equivalents: $482.4 million at the end of the quarter.

- Debt Outstanding: $325 million related to the Airbase acquisition.

- Share Repurchase: $8.6 million or approximately 40,000 shares repurchased at an average price of $197.90 per share.

- Q3 Revenue Guidance: Total revenue expected between $439 million to $444 million.

- Fiscal Year '25 Revenue Guidance: Total revenue expected between $1.558 billion to $1.568 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Paylocity Holding Corp (PCTY, Financial) reported a 17% increase in recurring and other revenue, with total revenue growing 16% year-over-year.

- The company achieved its target of increasing max PEPY from $550 to $600, driven by new product launches and expansion into the office of the CFO.

- Paylocity's AI Assistant chatbot has seen a 30% increase in utilization, improving user efficiency by reducing report search time by over 20%.

- The company received recognition as a leader in 10 HCM product categories in G2's Winter 2025 grid reports and won the TrustRadius Buyer's Choice Award.

- Strong performance in the broker referral network, contributing over 25% of new business in Q2, highlights the effectiveness of Paylocity's broker channel strategy.

Negative Points

- Despite strong revenue growth, the contribution from the Airbase acquisition remains relatively small, representing only about 1% of total revenue.

- The company faces ongoing competitive pressure in the market, particularly from well-capitalized private competitors in the down-market segment.

- Paylocity's free cash flow growth appears less expansive year-over-year, partly due to the Airbase acquisition impacting financials.

- The integration of Airbase is expected to take 12 to 24 months, indicating a long-term effort before realizing full cross-sell opportunities.

- Guidance for Q4 suggests recurring revenue growth may slow to around 10% or below, raising concerns about potential conservatism in projections.