Meta (META, Financial) has rolled out a new feature on WhatsApp, allowing users to interact with ChatGPT by messaging 1-800-ChatGPT. This innovation enables users to receive the latest search results through the messaging platform. Meanwhile, ChatGPT, backed by Microsoft, reported that over a billion web searches were conducted in the past week, showcasing its growing popularity.

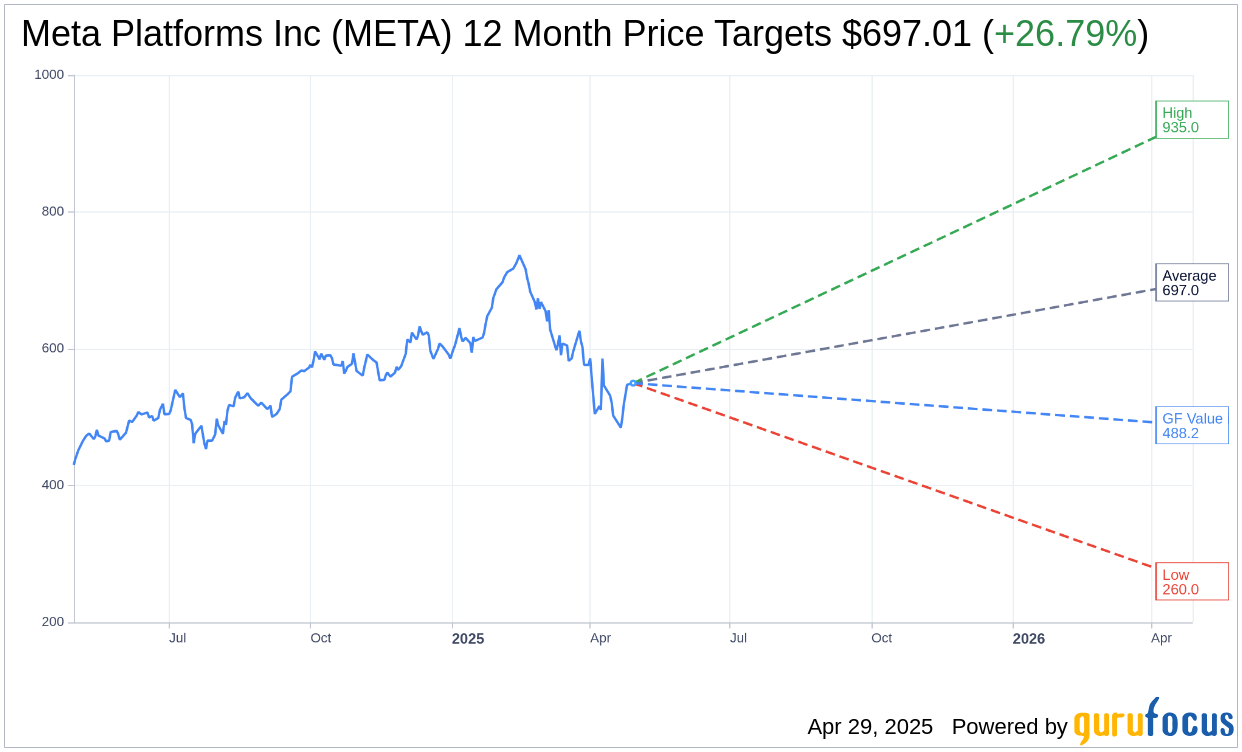

Wall Street Analysts Forecast

Based on the one-year price targets offered by 62 analysts, the average target price for Meta Platforms Inc (META, Financial) is $697.01 with a high estimate of $935.00 and a low estimate of $260.00. The average target implies an upside of 26.79% from the current price of $549.74. More detailed estimate data can be found on the Meta Platforms Inc (META) Forecast page.

Based on the consensus recommendation from 72 brokerage firms, Meta Platforms Inc's (META, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Meta Platforms Inc (META, Financial) in one year is $488.22, suggesting a downside of 11.19% from the current price of $549.74. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Meta Platforms Inc (META) Summary page.

META Key Business Developments

Release Date: January 29, 2025

- Q4 Total Revenue: $48.4 billion, up 21% year over year.

- Q4 Total Expenses: $25 billion, up 5% year over year.

- Operating Income: $23.4 billion, representing a 48% operating margin.

- Net Income: $20.8 billion or $8.2 per share.

- Capital Expenditures: $14.8 billion.

- Free Cash Flow: $13.2 billion.

- Cash and Marketable Securities: $77.8 billion.

- Debt: $28.8 billion.

- Family of Apps Revenue: $47.3 billion, up 21% year over year.

- Family of Apps Ad Revenue: $46.8 billion, up 21% year over year.

- Reality Labs Revenue: $1.1 billion, up 1% year over year.

- Reality Labs Operating Loss: $5 billion.

- Q1 2025 Revenue Guidance: $39.5 billion to $41.8 billion.

- Full Year 2025 Expense Guidance: $114 billion to $119 billion.

- Full Year 2025 CapEx Guidance: $60 billion to $65 billion.

- Full Year 2025 Tax Rate Guidance: 12% to 15%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Meta Platforms Inc (META, Financial) reported a strong Q4 2024 with total revenue of $48.4 billion, up 21% year over year.

- The company has more than 3.3 billion daily active users across its family of apps, indicating strong user engagement.

- Meta AI is expected to reach over 1 billion users, positioning it as a leading AI assistant with a focus on personalization.

- The company is making significant investments in AI infrastructure, including a new data center with a capacity of up to 2 gigawatts.

- Meta Platforms Inc (META) is seeing strong growth in its ad revenue, particularly in the online commerce vertical, with a 21% increase year over year.

Negative Points

- Meta Platforms Inc (META) faces high expenses, with Q4 total expenses reaching $25 billion, driven by infrastructure and employee compensation costs.

- The Reality Labs segment reported an operating loss of $5 billion, highlighting ongoing challenges in this area.

- The company anticipates significant capital expenditures in 2025, ranging from $60 billion to $65 billion, which could impact profitability.

- Meta Platforms Inc (META) is navigating a complex regulatory landscape, particularly in the EU and US, which could affect its business operations.

- The monetization of Meta AI is still in its early stages, with the company focusing on building a strong consumer experience before exploring revenue opportunities.