Bank of America (BofA) has elevated its rating on Chord Energy (CHRD, Financial) to Buy from Neutral, adjusting the price target to $114 from the previous $125. This revision factors in the expectation that by 2027, 80% of Chord's development program will feature extended laterals. Consequently, BofA has reduced its sustaining capital expenditure estimate by $100 million, bringing it down to $1.3 billion. This adjustment provides an $8 boost to the company's valuation.

BofA highlights Chord's robust balance sheet, noting its potential advantage in maneuvering through the unpredictable oil market environment. The firm anticipates that recent developments, which have not yet been accounted for, will distinguish Chord Energy from its competitors, paving the way for future growth opportunities.

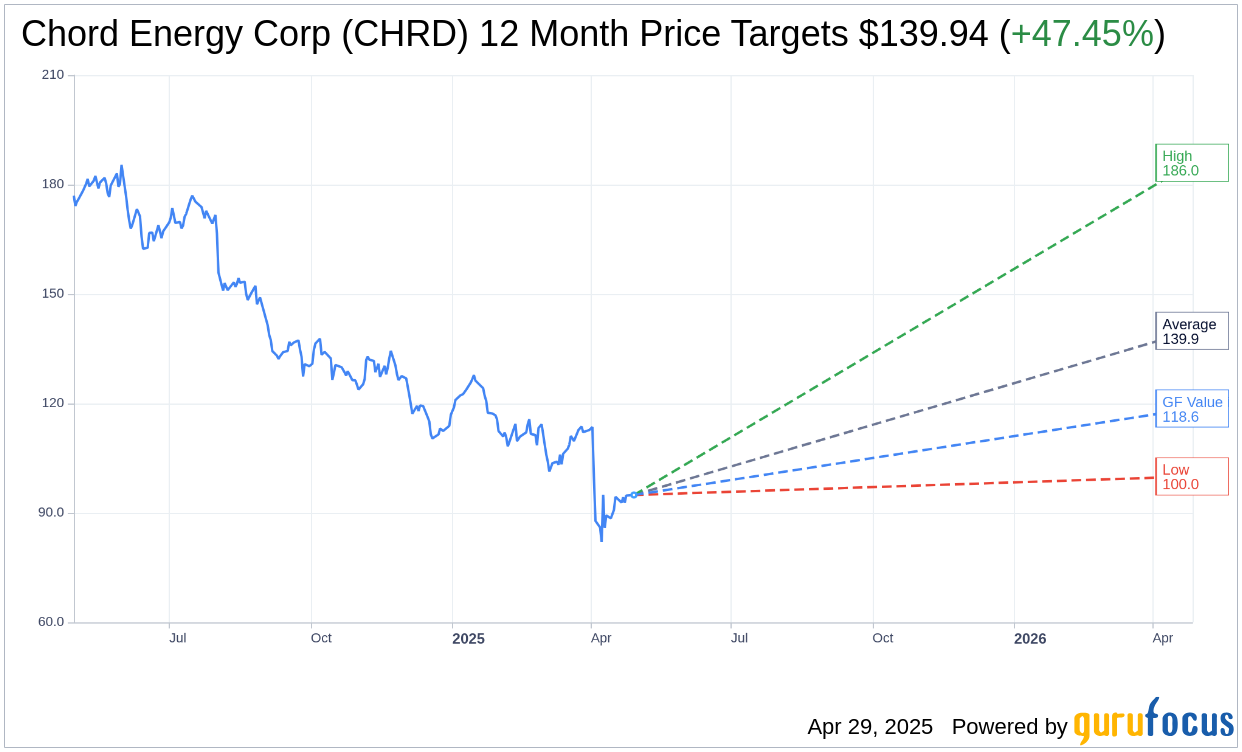

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Chord Energy Corp (CHRD, Financial) is $139.94 with a high estimate of $186.00 and a low estimate of $100.00. The average target implies an upside of 47.45% from the current price of $94.91. More detailed estimate data can be found on the Chord Energy Corp (CHRD) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Chord Energy Corp's (CHRD, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Chord Energy Corp (CHRD, Financial) in one year is $118.63, suggesting a upside of 24.99% from the current price of $94.91. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Chord Energy Corp (CHRD) Summary page.

CHRD Key Business Developments

Release Date: February 26, 2025

- Adjusted Free Cash Flow (Q4 2024): $282 million.

- Shareholder Returns (2024): $944 million returned to shareholders.

- Share Repurchases: Greater than 5% of shares outstanding repurchased since Enerplus transaction.

- Base Dividend Increase: 4% increase to $1.30 per share.

- Oil Production Growth (3-Year CAGR): 12% compounded annual growth rate.

- Capital Investment (2025): $1.4 billion planned, $90 million less than 2024.

- Expected Free Cash Flow (2025): Approximately $860 million at benchmark prices.

- Operating Expenses (Q4 2024): Below expectations.

- Oil Volumes (Q4 2024): Above midpoint of guidance.

- LOE (Q4 2024): $9.60 per BOE.

- Cash G&A (Q4 2024): $31.2 million, excluding merger-related costs.

- Adjusted CapEx (Q4 2024): $325 million, $10 million below midpoint guidance.

- Net Leverage (Year-End 2024): 0.3x.

- Borowing Base (February 2025): $2.75 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Chord Energy Corp (CHRD, Financial) successfully integrated with Enerplus, extracting significant value and operational synergies.

- The company returned $944 million to shareholders in 2024 and repurchased over 5% of its shares outstanding.

- Chord Energy Corp (CHRD) achieved a 12% compounded annual growth rate in oil production per share over the last three years.

- Fourth-quarter oil volumes exceeded guidance, and operating expenses were below expectations, leading to strong free cash flow.

- The company plans to maintain a low reinvestment rate, generating approximately $860 million of free cash flow in 2025.

Negative Points

- Chord Energy Corp (CHRD) faces potential widening of oil differentials in the first quarter of 2025 due to increased basin production.

- The company's 2025 guidance reflects modest escalation in lease operating expenses compared to 2024.

- There is uncertainty regarding the impact of tariffs on oil and gas NGL realizations.

- The integration of Enerplus required adjustments to reserves under U.S. SEC rules, potentially affecting inventory assessments.

- Chord Energy Corp (CHRD) acknowledges that its non-core Marcellus position may require strategic decisions to maximize shareholder value.