Entergy (ETR, Financial) has kicked off the year on a strong note, making significant strides in achieving its primary goals. The company's leadership remains optimistic about future opportunities and is committed to implementing strategies that enhance value for both customers and stakeholders. This positive outlook is backed by the progress made in the initial months, indicating a promising trajectory for Entergy moving forward.

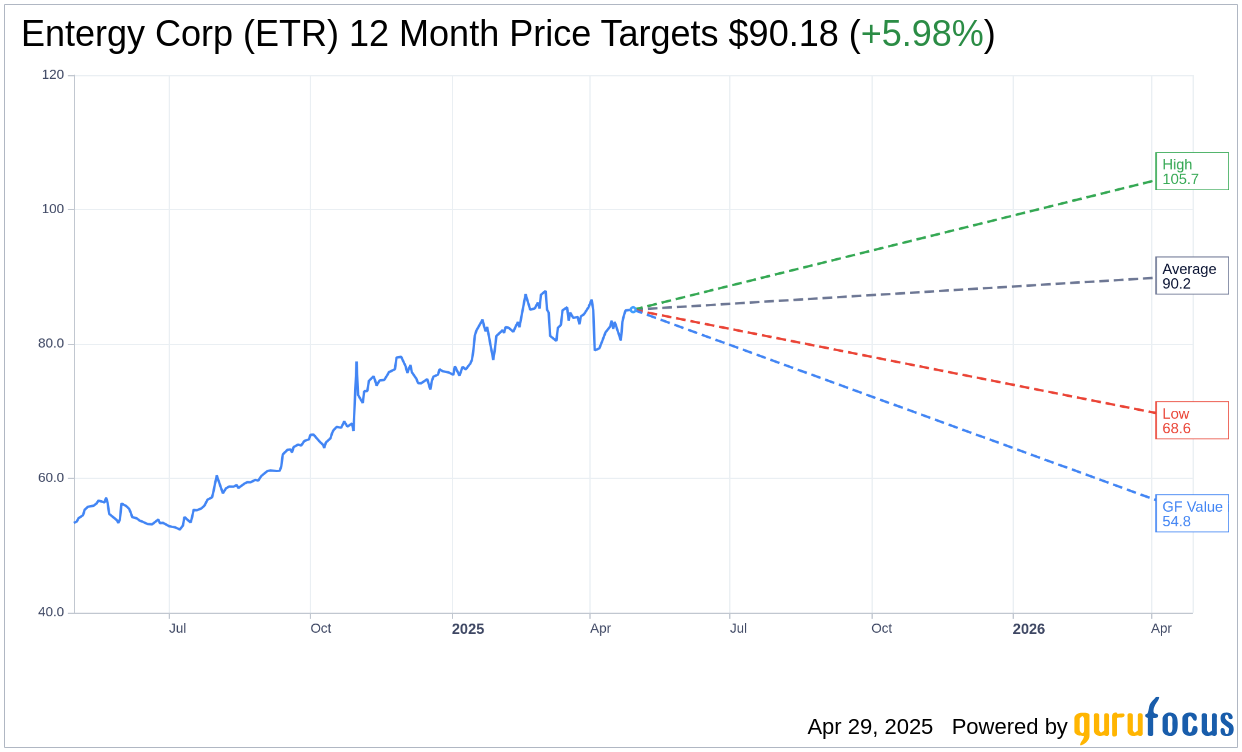

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for Entergy Corp (ETR, Financial) is $90.18 with a high estimate of $105.72 and a low estimate of $68.64. The average target implies an upside of 5.98% from the current price of $85.09. More detailed estimate data can be found on the Entergy Corp (ETR) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Entergy Corp's (ETR, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Entergy Corp (ETR, Financial) in one year is $54.78, suggesting a downside of 35.62% from the current price of $85.09. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Entergy Corp (ETR) Summary page.

ETR Key Business Developments

Release Date: February 18, 2025

- Adjusted EPS for 2024: $3.65, in the top half of guidance range.

- Industrial Sales Growth: 8% for the year, 15% for the fourth quarter.

- Weather-Adjusted Retail Sales Growth: Approximately 4% for 2024.

- Book FFO to Adjusted Debt: 14.7% at the end of 2024.

- Capital Plan: $37 billion over the next four years (2025-2028), $2.7 billion higher than previous plan.

- Equity Needs: Increased by $300 million in 2026, with $1.4 billion already secured for 2025 and 2026.

- 2025 Adjusted EPS Guidance Range: $3.75 to $3.95.

- 2025 Weather-Adjusted Retail Sales Growth Forecast: 6%, with industrial growth at 11% to 12%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Entergy Corp (ETR, Financial) reported strong financial performance with 2024 adjusted EPS of $3.65, which is in the top half of their guidance range.

- The company is raising its capital outlook beyond 2025, with growth opportunities exceeding the previous range of 8% to 9%.

- Entergy Corp (ETR) has seen significant growth in its industrial segment, with industrial sales up 8% for the year and 15% for the fourth quarter.

- The company plans to invest $37 billion over the next four years, focusing on expanding its renewables portfolio and modernizing gas plants.

- Entergy Corp (ETR) has secured critical long lead time equipment and has strong partnerships with vendors, supporting additional growth potential.

Negative Points

- The company faces potential risks from regulatory processes, with a busy regulatory calendar in 2025 that includes several formula rate plan filings.

- There are challenges in managing credit metrics, although the company has made positive progress, maintaining a focus on healthy credit metrics.

- Entergy Corp (ETR) is dealing with the aftermath of two hurricanes in 2024, which required significant restoration efforts.

- The company anticipates needing to clarify cost recovery for the 2024 storms, which could impact financial planning.

- There is uncertainty around new nuclear investments, with no imminent announcements expected, and the company is carefully managing financial risk in this area.