OneMain (OMF, Financial) has announced its first-quarter revenue, reaching an impressive $1.5 billion, which significantly exceeded the market forecast of $1.16 billion. The company's reported book value per share stands at $27.50.

The Chairman and CEO of OneMain, Doug Shulman, expressed confidence in the firm's robust positioning as they advance through 2025. He emphasized OneMain's dedication to offering innovative financial solutions while maintaining strict credit and balance sheet discipline, aiming to deliver exceptional value to both customers and shareholders.

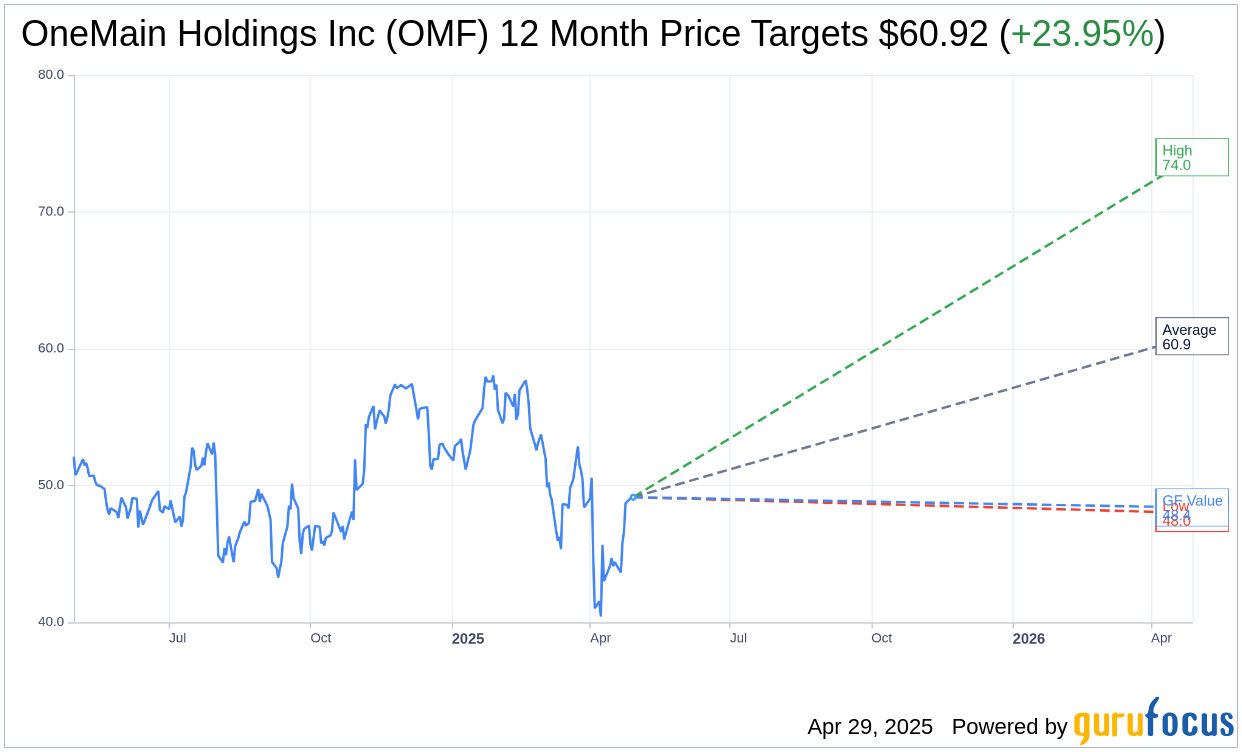

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for OneMain Holdings Inc (OMF, Financial) is $60.92 with a high estimate of $74.00 and a low estimate of $48.00. The average target implies an upside of 23.95% from the current price of $49.15. More detailed estimate data can be found on the OneMain Holdings Inc (OMF) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, OneMain Holdings Inc's (OMF, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for OneMain Holdings Inc (OMF, Financial) in one year is $48.40, suggesting a downside of 1.53% from the current price of $49.15. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the OneMain Holdings Inc (OMF) Summary page.

OMF Key Business Developments

Release Date: January 31, 2025

- Capital Generation: $685 million for the full year 2024; $183 million in Q4 2024.

- Receivables Growth: 11% year-over-year, reaching $24.7 billion.

- Total Revenue Growth: 9% year-over-year in Q4 2024.

- Net Income: GAAP net income of $126 million in Q4 2024; $1.05 per diluted share.

- C&I Adjusted Earnings: $1.16 per diluted share in Q4 2024.

- Originations: $3.5 billion in Q4 2024, with 11% organic growth year-over-year.

- Net Charge-Offs: 7.9% in Q4 2024, up 36 basis points from the previous quarter.

- Delinquency Rate: 30 to 89-day delinquency at 3.06%, down 22 basis points year-over-year.

- Interest Income: $1.3 billion in Q4 2024, up 11% year-over-year.

- Interest Expense: $310 million in Q4 2024, up $39 million from the prior year.

- Operating Expenses: $422 million in Q4 2024, up 10% year-over-year.

- Auto Receivables: Increased by $105 million in Q4 2024, totaling $2.4 billion.

- Credit Card Receivables: Added $93 million in Q4 2024, totaling $643 million.

- Dividend: $4.16 per share annually, yielding about 7%.

- Share Repurchases: Approximately 755,000 shares repurchased for $35 million in 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- OneMain Holdings Inc (OMF, Financial) achieved significant growth in its customer base, increasing by 15% to 3.4 million customers.

- The company generated $685 million of capital in 2024, despite peak loan losses at the beginning of the year.

- Receivables grew by 11% to $24.7 billion, driven by growth in the auto business and BrightWay credit cards.

- OneMain Holdings Inc (OMF) successfully integrated its acquisition of Foursight, enhancing its auto lending capabilities.

- The company maintained a strong balance sheet and funding program, raising $3.9 billion in funding, including high-yield bond issuances and secure funding.

Negative Points

- Fourth quarter GAAP net income decreased to $126 million or $1.05 per diluted share, down from $1.38 per diluted share in the fourth quarter of 2023.

- Interest expense for the quarter increased by $39 million year-over-year, driven by an increase in average debt and higher cost of funds.

- Net charge-offs were 7.9% in the quarter, up 36 basis points from the previous quarter.

- The company faces continued uncertainty around inflation and unemployment, impacting its reserve calculations.

- Operating expenses increased by 10% compared to the previous year, driven by the Foursight acquisition and business investments.