Sherwin-Williams (SHW, Financial) reported its first-quarter revenue at $5.31 billion, falling short of the anticipated $5.41 billion. Despite facing unpredictable demand conditions, the company achieved robust results, with improvements in gross margins and effective cost management. The consolidated sales figures fell within the company's projected range, primarily driven by the Paint Stores Group. Additionally, Sherwin-Williams achieved mid-single-digit growth in both adjusted diluted net income per share and adjusted EBITDA.

In line with its ongoing capital allocation strategy, the company invested $351.7 million in share repurchases and raised its dividend by 10.5% during the quarter. Chair, President, and CEO Heidi G. Petz expressed satisfaction with the company's performance amidst challenging conditions, emphasizing the strategic execution that led to these results.

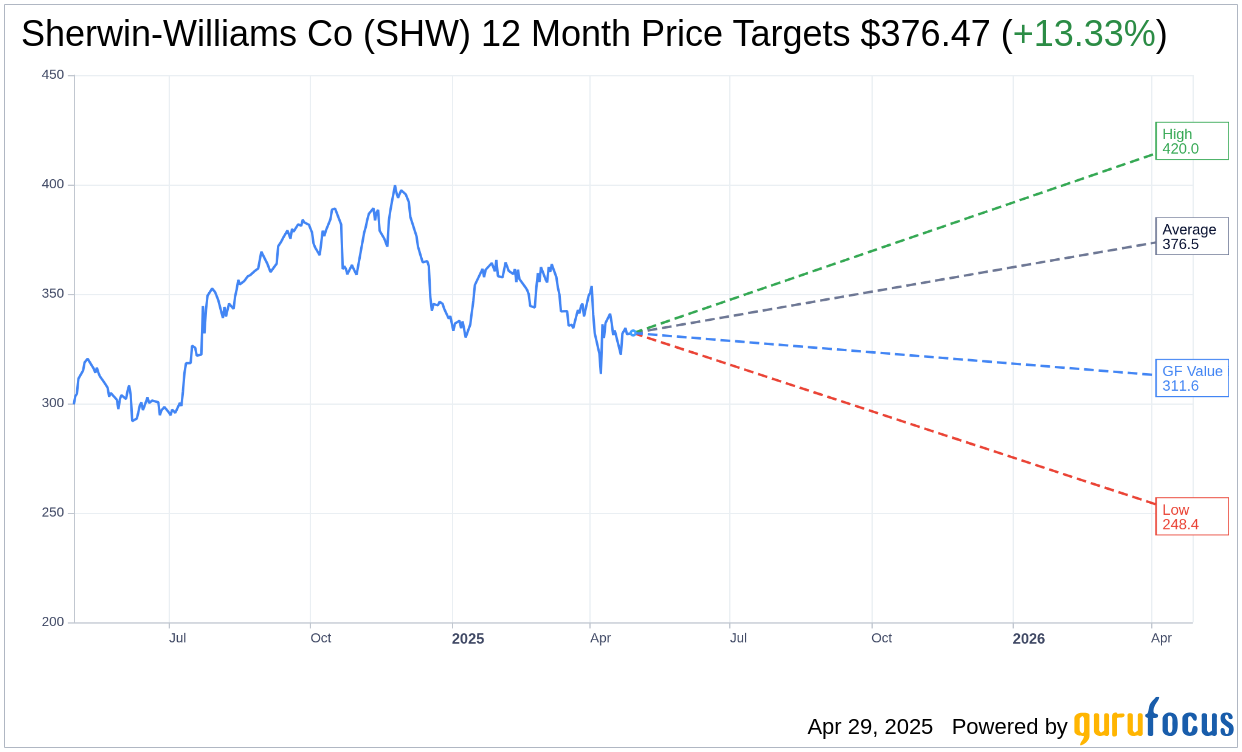

Wall Street Analysts Forecast

Based on the one-year price targets offered by 22 analysts, the average target price for Sherwin-Williams Co (SHW, Financial) is $376.47 with a high estimate of $420.00 and a low estimate of $248.43. The average target implies an upside of 13.33% from the current price of $332.20. More detailed estimate data can be found on the Sherwin-Williams Co (SHW) Forecast page.

Based on the consensus recommendation from 30 brokerage firms, Sherwin-Williams Co's (SHW, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Sherwin-Williams Co (SHW, Financial) in one year is $311.63, suggesting a downside of 6.19% from the current price of $332.2. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Sherwin-Williams Co (SHW) Summary page.

SHW Key Business Developments

Release Date: January 30, 2025

- Adjusted Earnings Per Share (EPS): Increased by near-double-digit percentage to $11.33 for the full year; fourth-quarter adjusted EPS increased by 15.5%.

- Consolidated Sales: Increased slightly for the full year; fourth-quarter sales increased by low single-digit percentage.

- Gross Margin: Expanded slightly over a very strong level from the previous year.

- Cash Generation: $3.2 billion or 13.7% of sales for the full year.

- Shareholder Returns: $2.5 billion returned through share repurchases and dividends.

- Capital Expenditures (CapEx): $1.1 billion, including $532 million for new headquarters and R&D center.

- Net Debt to Adjusted EBITDA Ratio: Ended 2024 at 2.2 times.

- Paint Stores Group Sales: Grew by a low single-digit percentage for the full year; high single-digit growth in residential repaint and protective and marine in Q4.

- Consumer Brands Group Sales: Decreased due to unfavorable FX; adjusted segment margin expanded.

- Performance Coatings Group Sales: Slightly below expectations; adjusted segment margin expanded to 18%.

- New Store Openings: Expect to open 80 to 100 new stores in the US and Canada in 2025.

- Dividend Increase: Proposed annual dividend increase of 10.5% to $3.16 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Sherwin-Williams Co (SHW, Financial) delivered strong fourth-quarter results, concluding a record year with near-double-digit growth in adjusted earnings per share.

- The company achieved significant margin expansion across all three operating segments, with adjusted segment margins reaching the highest level since the Valspar acquisition in 2017.

- Sherwin-Williams Co (SHW) generated $3.2 billion in cash, representing 13.7% of sales, and returned $2.5 billion to shareholders through share repurchases and dividends.

- The company plans to open 80 to 100 new stores in the US and Canada in 2025, indicating confidence in future growth opportunities.

- Sherwin-Williams Co (SHW) is implementing targeted price increases and expects to achieve gross margin expansion in 2025 despite raw material cost pressures.

Negative Points

- The demand environment remains choppy, with several end markets not expected to improve until 2026, impacting growth prospects.

- Consumer brands group sales decreased due to soft DIY demand and unfavorable foreign exchange impacts.

- Sherwin-Williams Co (SHW) anticipates higher interest expenses in 2025 due to refinancing debt at higher rates and financing activities for new buildings.

- The company faces potential additional tariffs on raw materials, which could necessitate further price increases.

- Non-residential construction is expected to remain soft throughout 2025, with commercial completions anticipated to be weak.