On April 29, 2025, CECO Environmental Corp (CECO, Financial) released its 8-K filing detailing its financial results for the first quarter of 2025. The company, which serves the energy, industrial, and niche markets through its Engineered Systems and Industrial Process Solutions segments, reported significant growth in several key financial metrics.

Performance and Challenges

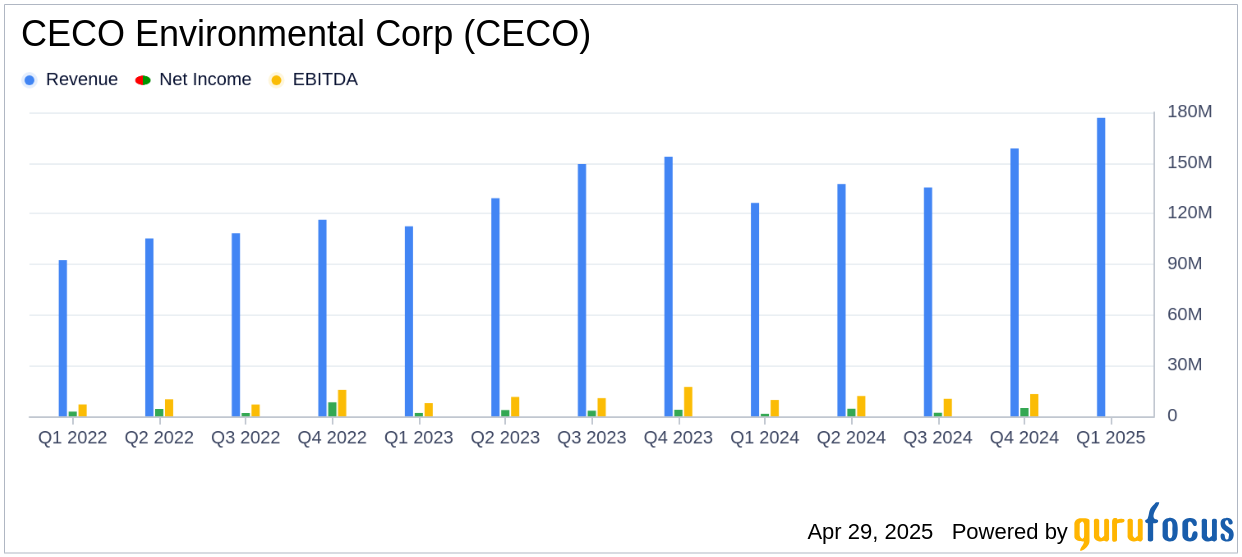

CECO Environmental Corp reported a remarkable 40% increase in revenue, reaching $176.7 million, which exceeded the analyst estimate of $151.53 million. This growth was driven by a 57% increase in orders, totaling $227.9 million, and a 55% rise in backlog, reaching $602.0 million. However, the company faced challenges with a decrease in free cash flow, which fell by $13.2 million to $(15.1) million, highlighting potential cash management issues.

Financial Achievements

CECO's gross profit margin stood at 35.2%, with a gross profit of $68.0 million, up 28% from the previous year. The company's GAAP diluted earnings per share (EPS) was $0.98, significantly surpassing the estimated EPS of $0.01. However, the non-GAAP EPS was $0.10, which is still above the estimate. These achievements underscore CECO's strong market positioning and operational efficiency in the industrial products sector.

Key Financial Metrics

CECO's operating income surged to $61.9 million, a substantial increase from $7.7 million in the first quarter of 2024. On a non-GAAP basis, operating income was $8.6 million, down from $10.2 million in the previous year. The adjusted EBITDA was $14.0 million, reflecting a 6% increase. These metrics are crucial as they indicate the company's ability to generate profit from its core operations.

Balance Sheet and Cash Flow

The balance sheet showed total assets of $957.1 million, up from $759.7 million at the end of 2024. Cash and cash equivalents increased significantly to $146.5 million from $37.8 million. However, the company reported a negative free cash flow of $(15.1) million, highlighting the need for improved cash management strategies.

Analysis and Outlook

CECO Environmental Corp's strong start to 2025, with record orders and backlog, positions the company well for continued growth. The strategic price actions and operational adjustments made in Q1 are expected to support future performance. Despite the challenges in cash flow, the company's robust revenue growth and market positioning provide a positive outlook for the remainder of the year.

Todd Gleason, CECO's Chief Executive Officer, commented, “We started 2025 with outstanding first quarter record orders of $228 million, which helped drive new record levels of backlog and revenue for the Company. This is a powerful statement on the strength of our well-positioned portfolio, which is closely aligned to key long-term growth themes of industrial manufacturing reshoring, electrification, power generation, natural gas infrastructure, and industrial water investments.”

For more detailed insights and analysis, visit the full earnings report on the SEC website.

Explore the complete 8-K earnings release (here) from CECO Environmental Corp for further details.