CareDx (CDNA, Financial) has unveiled fresh scientific insights into the practical application of AlloSure Lung at the 45th Annual Meeting of the International Society for Heart and Lung Transplantation held in Boston. The company's research, conducted in collaboration with study partners, was showcased through eight abstracts, including two oral presentations.

Significant findings highlighted the efficacy of AlloSure Lung in detecting increases in dd-cfDNA levels, which could indicate the onset of acute cellular rejection, and a subsequent decrease in levels following treatment. The technology also proved beneficial in assessing the safety and graft functionality of Tacrolimus inhalation powder as an alternative to oral TAC among lung transplant patients with renal impairments.

Additionally, AlloSure Lung was critical in studying the effects of TAC drug levels on outcomes for DSA-positive lung transplant recipients over a year-long follow-up period. The AlloHome system was recognized for its role in real-time monitoring and management, easing the burden on transplant center staff. Furthermore, an interim analysis from the ALAMO study suggested that AlloSure Lung could predict Chronic Allograft Lung Dysfunction, a primary cause of post-transplant mortality. Early post-transplant elevated dd-cfDNA levels were linked to restrictive allograft syndrome, a severe form of CLAD.

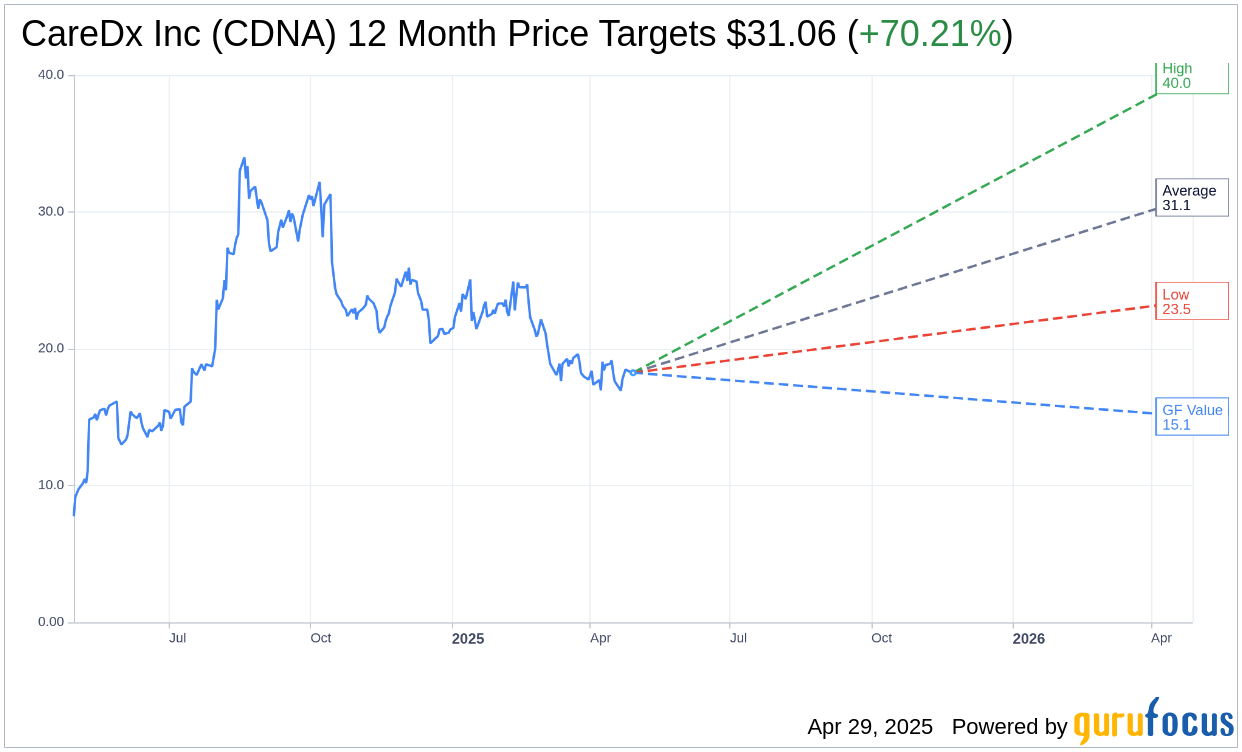

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for CareDx Inc (CDNA, Financial) is $31.06 with a high estimate of $40.00 and a low estimate of $23.50. The average target implies an upside of 70.21% from the current price of $18.25. More detailed estimate data can be found on the CareDx Inc (CDNA) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, CareDx Inc's (CDNA, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CareDx Inc (CDNA, Financial) in one year is $15.05, suggesting a downside of 17.53% from the current price of $18.25. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CareDx Inc (CDNA) Summary page.

CDNA Key Business Developments

Release Date: February 26, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- CareDx Inc (CDNA, Financial) reported a 32% year-over-year increase in quarterly revenue, reaching $86.6 million.

- The company achieved $9.8 million in adjusted EBITA in the fourth quarter and $27.8 million for the full year.

- CareDx Inc (CDNA) ended the year with a strong cash balance of $261 million and no debt.

- Testing services revenue grew by 37% year over year, with a 14% increase in test volumes.

- The company expanded payer coverage significantly, adding millions of new commercial covered lives for its products.

Negative Points

- The company anticipates some seasonality in testing volumes, with modest growth expected in the first quarter of 2025.

- CareDx Inc (CDNA) faces potential challenges in ASP growth, with a cautious outlook on ASP appreciation.

- The company is not including contributions from prior period collections in its 2025 guidance, which could impact revenue expectations.

- There is uncertainty regarding the impact of new product launches on gross margins, particularly for smaller indications.

- CareDx Inc (CDNA) anticipates potential appeals in ongoing IP litigation, which could affect future financials.