An analyst at B. Riley, Ryan Pfingst, has revised the price target for Enovix (ENVX, Financial), dropping it from $17 to $12, while maintaining a Buy recommendation for the stock. This adjustment comes in anticipation of the company's upcoming report on April 30, with the aim of aligning expectations with progress at their Fab2 facility. The analyst also highlighted challenges within the renewable energy sector, particularly for renewable natural gas producers, who are facing hurdles due to the EPA's proposal to partially waive supply mandates for 2024.

Wall Street Analysts Forecast

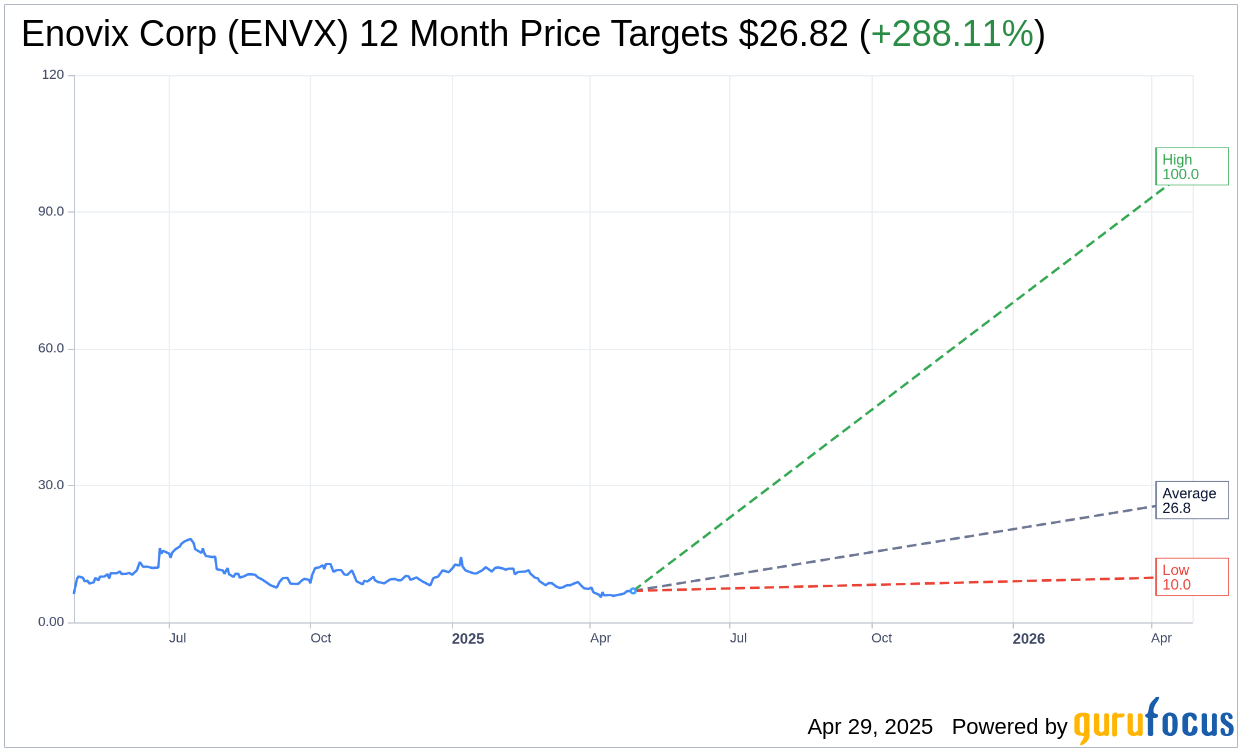

Based on the one-year price targets offered by 11 analysts, the average target price for Enovix Corp (ENVX, Financial) is $26.82 with a high estimate of $100.00 and a low estimate of $10.00. The average target implies an upside of 288.11% from the current price of $6.91. More detailed estimate data can be found on the Enovix Corp (ENVX) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Enovix Corp's (ENVX, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Enovix Corp (ENVX, Financial) in one year is $36.53, suggesting a upside of 428.65% from the current price of $6.91. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Enovix Corp (ENVX) Summary page.

ENVX Key Business Developments

Release Date: February 19, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Enovix Corp (ENVX, Financial) reported Q4 2024 revenues of $9.6 million, near the high end of their guidance range.

- The company completed site acceptance testing of their high-volume manufacturing line and shipped their first samples of EX2M to customers.

- Enovix Corp (ENVX) secured a purchase order from a second marquee smart eyewear customer, indicating strong demand in this segment.

- The ramp-up of Fab 2 in Malaysia was completed in just one year, showcasing operational efficiency.

- The company ended the quarter with a strong balance sheet, holding approximately $273 million in cash and cash equivalents.

Negative Points

- Enovix Corp (ENVX) reported a non-GAAP EBITDA loss of $11.7 million for Q4 2024.

- The company forecasts a revenue decline for Q1 2025, with guidance set between $3.5 million to $5.5 million.

- There is uncertainty regarding the exact volumes and timelines for the commercialization of new battery models like EX2M and EX3M.

- The competitive landscape remains intense, with significant capital being invested in alternative battery technologies.

- The company faces challenges in scaling production to meet demand, particularly in the defense and smart eyewear markets.