Key Takeaways:

- Spotify's stock (SPOT, Financial) has been downgraded despite strong strategic execution.

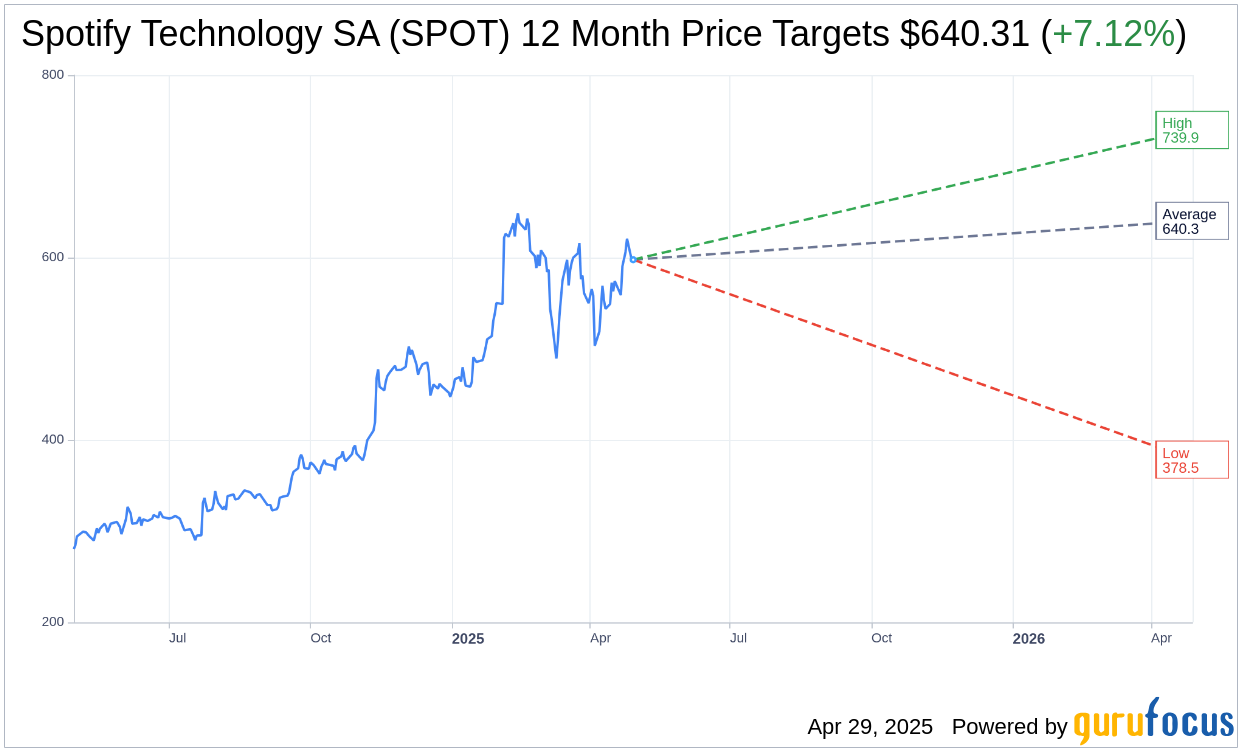

- Wall Street analysts forecast an average price target offering a modest upside potential.

- GuruFocus estimates suggest a significant downside, indicating potential overvaluation.

Spotify's Strategic Performance and Stock Downgrade

Spotify (SPOT) has been making notable strides in its strategic execution, aiming for heightened profitability by 2027. Despite these impressive operational achievements, the stock has recently faced a downgrade and is no longer marked as a buy. Investors should note that upcoming market developments may exclude U.S. price hikes, potentially influencing future earnings.

Insights from Wall Street Analysts

According to 36 analysts, the average one-year price target for Spotify Technology SA (SPOT, Financial) is estimated at $640.31. Price estimates range from a low of $378.48 to a high of $739.93. This spectrum suggests a modest upside potential of 7.12% from the current trading price of $597.73. For more comprehensive data, visit the Spotify Technology SA (SPOT) Forecast page.

The average brokerage recommendation, based on consensus from 39 firms, currently stands at 2.2, which indicates an "Outperform" status on a scale where 1 is a Strong Buy and 5 is a Sell. This reflects a generally positive outlook from the brokerage community, although caution is warranted given the downgrade.

Evaluating GuruFocus Metrics

GuruFocus provides a contrasting view with its estimated GF Value for Spotify Technology SA (SPOT, Financial) at $249.93 in one year's time. This estimate points to a substantial downside risk of 58.19% from the current price of $597.73. The GF Value is calculated based on historical trading multiples, previous growth trajectories, and anticipated future business performance. Detailed metrics are available on the Spotify Technology SA (SPOT) Summary page.

In conclusion, while Spotify exhibits operational strengths, investors should weigh Wall Street's optimism against GuruFocus' cautionary metrics to make informed investment decisions.