Truist has revised its price target for Biogen (BIIB, Financial), decreasing it from $210 to $199 while maintaining a Buy rating. The update comes as the firm adjusts its model in light of recent collaborative efforts aimed at developing and commercializing Zorevunersen, intended for Dravet Syndrome, a rare form of genetic epilepsy. Additionally, Truist has recalibrated its expectations for the rollout of Skyclarys, taking into account management's comments and anticipating a slower growth trajectory in the U.S. market.

Wall Street Analysts Forecast

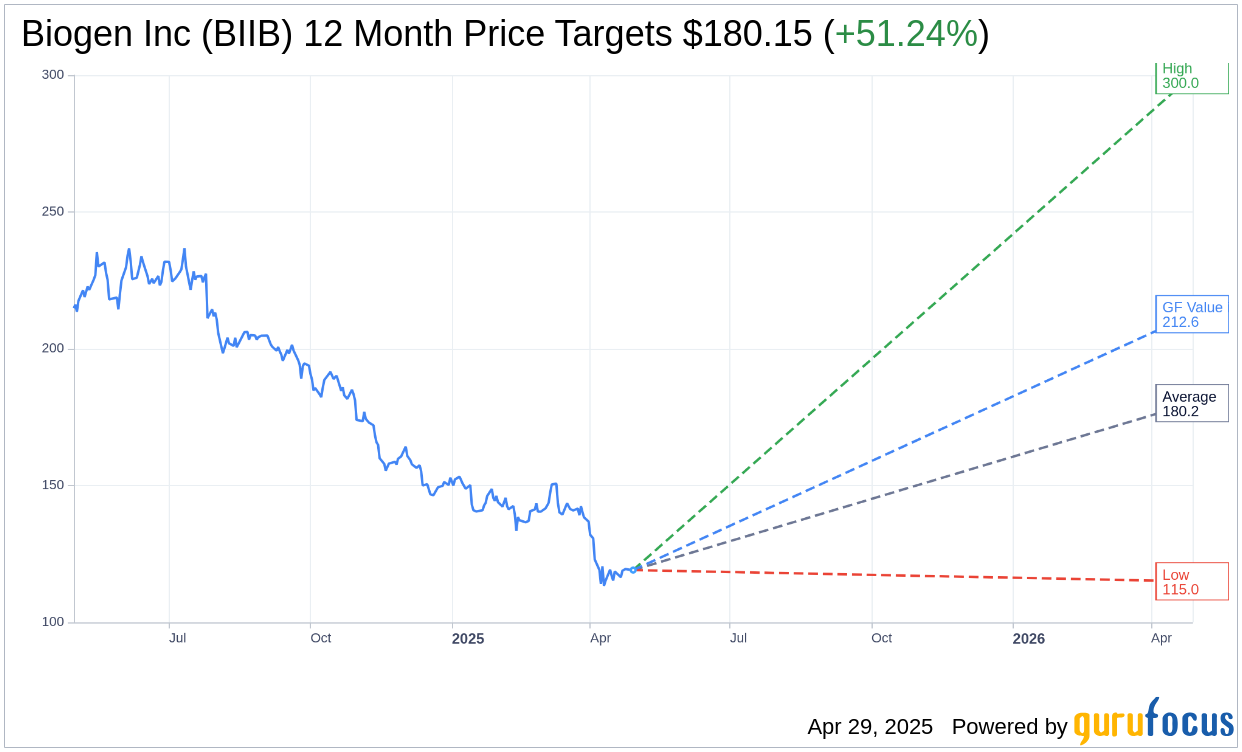

Based on the one-year price targets offered by 29 analysts, the average target price for Biogen Inc (BIIB, Financial) is $180.15 with a high estimate of $300.00 and a low estimate of $115.00. The average target implies an upside of 51.24% from the current price of $119.12. More detailed estimate data can be found on the Biogen Inc (BIIB) Forecast page.

Based on the consensus recommendation from 37 brokerage firms, Biogen Inc's (BIIB, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Biogen Inc (BIIB, Financial) in one year is $212.63, suggesting a upside of 78.5% from the current price of $119.12. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Biogen Inc (BIIB) Summary page.

BIIB Key Business Developments

Release Date: February 12, 2025

- Total Revenue (Q4 2024): $2.5 billion, 3% growth from Q4 2023.

- Total Revenue (Full Year 2024): $9.7 billion, 2% decline from 2023.

- Non-GAAP Diluted EPS (Q4 2024): $3.44, 17% higher than Q4 2023.

- Non-GAAP Diluted EPS (Full Year 2024): $16.47, 12% higher than 2023.

- Free Cash Flow (Q4 2024): $722 million.

- Free Cash Flow (Full Year 2024): $2.7 billion, up from $1.3 billion in 2023.

- MS Product Revenue Decline (Q4 2024): Roughly 8% at actual currency, 9% at constant currency.

- Rare Disease Revenue (Q4 2024): $535 million, 13% growth at actual currency, 15% at constant currency.

- Global SKYCLARYS Revenue (Q4 2024): $102 million, 83% increase from Q4 2023.

- Global SPINRAZA Revenue (Q4 2024): $421 million, 2% growth year over year.

- ZURZUVAE Revenue (Q4 2024): Approximately $23 million.

- LEQEMBI Global In-Market Sales (Q4 2024): Approximately $87 million, 30% sequential growth.

- Non-GAAP Cost of Sales Improvement (Q4 2024): Improved by 300 basis points compared to Q4 2023.

- Non-GAAP Core Operating Expense Increase (Q4 2024): 4% year over year.

- Cash and Net Debt (End of 2024): $2.4 billion cash, $3.9 billion net debt.

- 2025 Revenue Guidance: Expected to decline by a mid-single-digit percentage.

- 2025 Non-GAAP Diluted EPS Guidance: Between $15.25 and $16.25.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Biogen Inc (BIIB, Financial) launched four first-in-class, disease-modifying products in Alzheimer's, Friedreich's ataxia, depression, and ALS, showcasing their innovation capabilities.

- The company has reprioritized its pipeline, focusing on key projects expected to yield significant developments starting in 2026.

- Biogen Inc (BIIB) has successfully reduced operating expenses, freeing up resources for growth investments, resulting in improved cash flow.

- Revenue from new product launches in 2024 more than offset the decline in multiple sclerosis product revenue, marking the first core pharma business growth in four years.

- The company is leveraging advanced technologies like AI and genetic testing to identify patients for rare disease treatments, enhancing their market reach.

Negative Points

- Biogen Inc (BIIB) faces increased competition in the multiple sclerosis market, impacting revenue from this segment.

- The company's total revenue declined by $160 million in 2024, with a significant drop in contract manufacturing revenue.

- Challenges in patient identification and reimbursement, particularly in rare diseases, pose hurdles to revenue growth.

- The potential entry of TYSABRI biosimilars in the US and TECFIDERA generics in Europe could further pressure the MS business.

- Biogen Inc (BIIB) anticipates a mid-single-digit percentage decline in total revenue for 2025, driven by increased competition and potential biosimilar and generic entries.