- PayPal's Q1 earnings exceeded expectations with a non-GAAP EPS of $1.33.

- Analysts predict a potential 31.07% upside for PayPal stock from its current price.

- PayPal maintains an "Outperform" rating from brokerages, with future growth anticipated.

PayPal Holdings (NASDAQ: PYPL) demonstrated resilience in the first quarter by surpassing earnings expectations. The company reported a non-GAAP EPS of $1.33, outperforming analysts' forecasts of $1.16. However, while the earnings shone, the company's revenue of $7.79 billion did not meet expectations. Despite this revenue miss, PayPal is optimistic about its future, projecting Q2 non-GAAP EPS to be between $1.29 and $1.31, signaling robust future earnings potential.

Wall Street Analysts Outlook

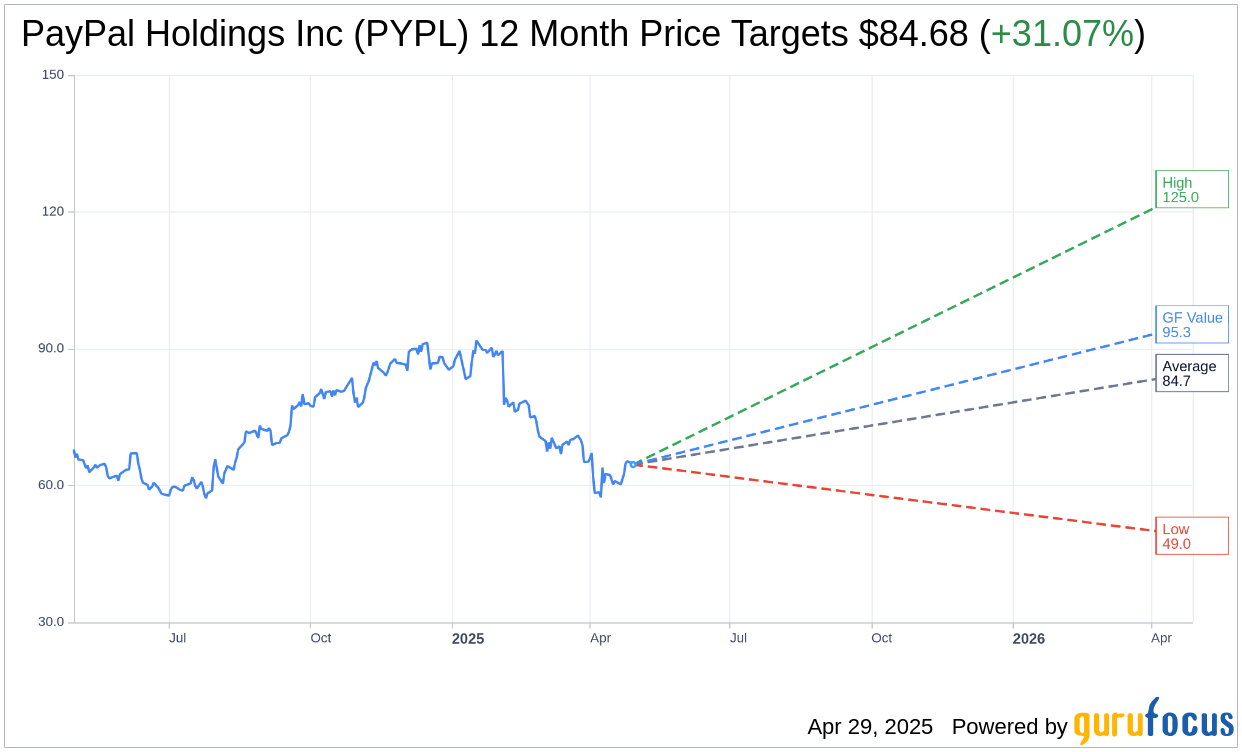

Analyzing projections from 38 Wall Street analysts, PayPal Holdings Inc (PYPL, Financial) has an encouraging average target price of $84.68. While the highest estimate reaches $125.00, the lowest stands at $49.00. This average target suggests a promising upside of 31.07% from the current stock price of $64.61. For a deeper dive into these estimates, visit the PayPal Holdings Inc (PYPL) Forecast page.

Brokerage Firm Recommendations

A consensus from 47 brokerage firms places PayPal Holdings Inc (PYPL, Financial) in an "Outperform" category, with an average recommendation score of 2.4. This rating is on a scale from 1 to 5, where 1 signals a Strong Buy and 5 indicates Sell. The "Outperform" rating underscores analysts' confidence in PayPal's future market performance.

GF Value Estimation

According to GuruFocus estimates, the projected GF Value for PayPal Holdings Inc (PYPL, Financial) in the next year is pegged at $95.34. This forecasted value suggests a substantial upside of 47.56% from the current trading price of $64.61. The GF Value represents GuruFocus's assessment of the stock's fair value, derived from historical trading multiples, past business growth, and future performance projections. For a comprehensive analysis, explore the PayPal Holdings Inc (PYPL) Summary page.