First quarter results for 2025 demonstrated solid performance for Eagle Bancorp Montana (EBMT, Financial), highlighted by an increase in deposits and a decrease in operating costs. The company also achieved an improvement in net interest margins, showcasing its resilience in a fluctuating financial environment. President and CEO Laura Clark emphasized the progress made in strengthening their community bank presence throughout Montana, supported by a stable core deposit base and a diversified loan portfolio.

As one of the few publicly traded financial institutions in Montana, EBMT is navigating market uncertainties and interest rate fluctuations while maintaining a favorable position for continued growth within its regional markets.

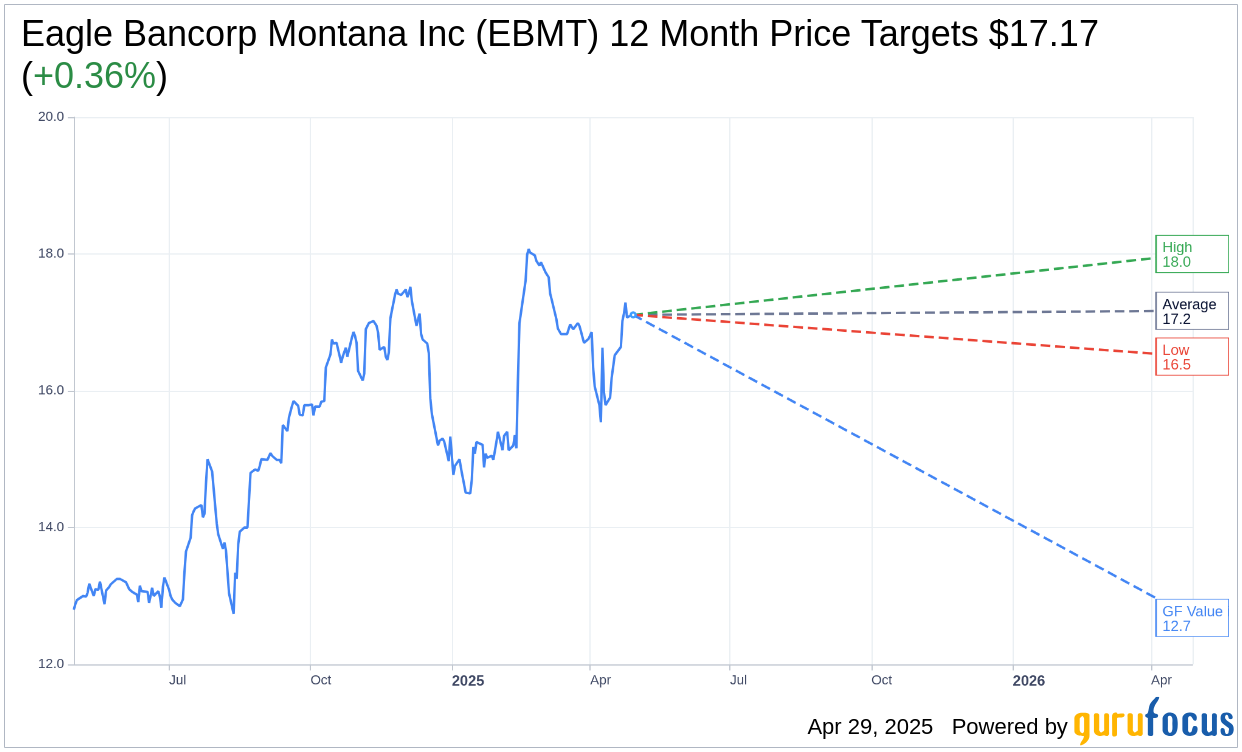

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Eagle Bancorp Montana Inc (EBMT, Financial) is $17.17 with a high estimate of $18.00 and a low estimate of $16.50. The average target implies an upside of 0.36% from the current price of $17.11. More detailed estimate data can be found on the Eagle Bancorp Montana Inc (EBMT) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Eagle Bancorp Montana Inc's (EBMT, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Eagle Bancorp Montana Inc (EBMT, Financial) in one year is $12.68, suggesting a downside of 25.87% from the current price of $17.105. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Eagle Bancorp Montana Inc (EBMT) Summary page.