- IBM has raised its quarterly dividend, offering an attractive forward yield for shareholders.

- Analysts predict a moderate price target for IBM, hinting at potential stock appreciation.

- The GF Value suggests a different perspective on IBM's fair valuation.

IBM (IBM, Financial) has announced a quarterly dividend increase to $1.68 per share, a slight rise from the previous $1.67. This adjustment brings the forward yield to 2.82%. The dividend is payable on June 10 to shareholders on record as of May 9, with an ex-dividend date of the same day.

Wall Street Analysts Forecast

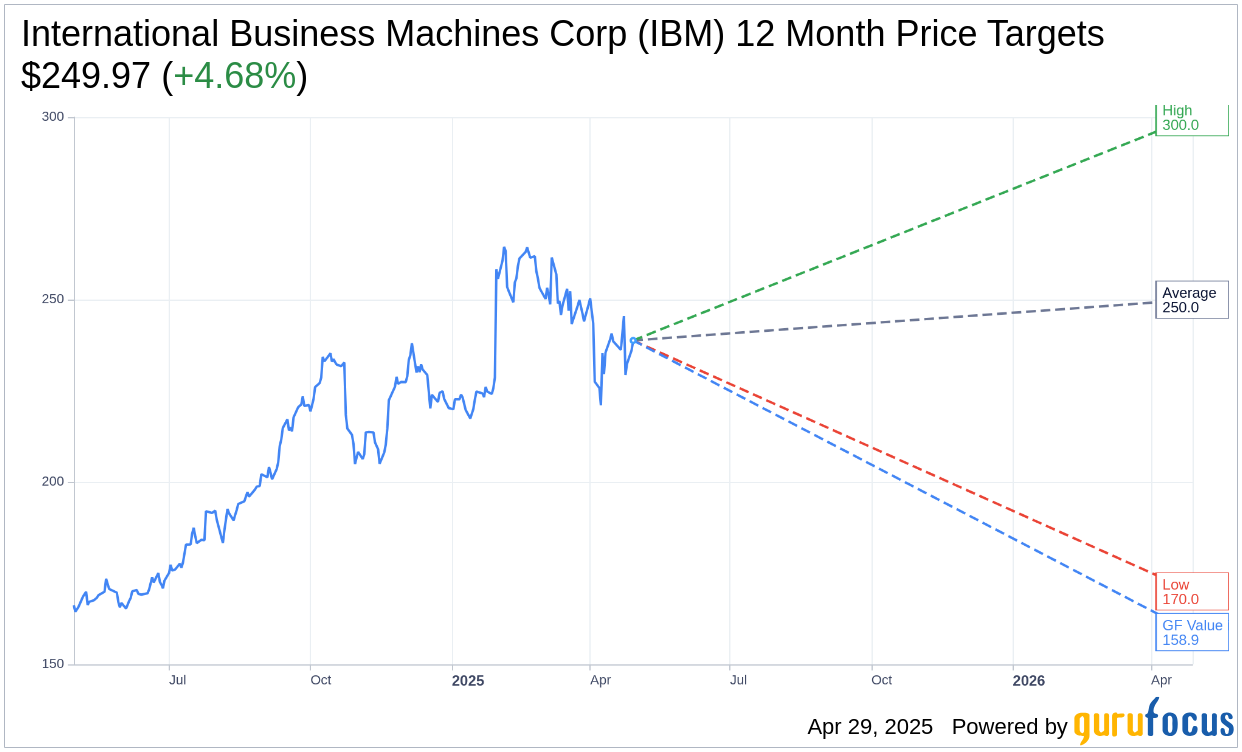

According to the one-year price targets offered by 18 analysts, the average target price for International Business Machines Corp (IBM, Financial) is set at $249.97. The high estimate reaches $300.00, while the low sits at $170.00. This average target suggests a potential upside of 4.68% from the current price of $238.80. For more detailed estimate data, please visit the International Business Machines Corp (IBM) Forecast page.

Moreover, based on the consensus recommendation from 23 brokerage firms, IBM's average brokerage recommendation currently stands at 2.4, which indicates an "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Evaluating the GF Value

According to GuruFocus estimates, the estimated GF Value for International Business Machines Corp (IBM, Financial) in one year is $158.86. This suggests a potential downside of 33.48% from the current price of $238.80. The GF Value is GuruFocus' projection of the fair value at which the stock should trade. It is calculated using the historical multiples at which the stock has traded previously, in combination with past business growth and future performance estimates. For more comprehensive data, explore the International Business Machines Corp (IBM) Summary page.