Reinvent Technology Partners (AUR, Financial) is witnessing notable bullish activity in the options market with 7,781 call contracts changing hands, which is four times the usual amount. This surge in activity has pushed the implied volatility up by over two points to 115.74%. The most active options are the 5/2 weekly 7.5 calls and 5/2 weekly 8 calls, with approximately 4,300 contracts traded between these two strike prices. Currently, the Put/Call Ratio stands at a low 0.03, indicating a prevailing bullish sentiment. Investors are anticipating the company's earnings announcement scheduled for May 8th.

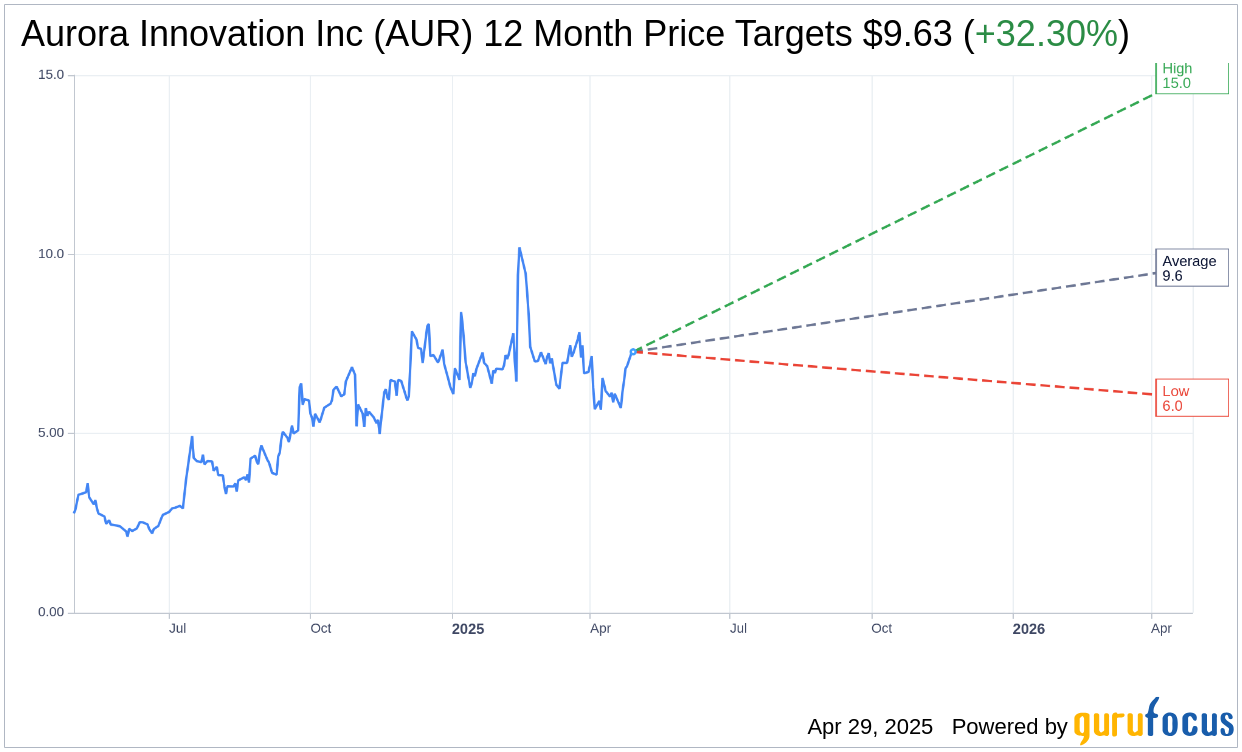

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Aurora Innovation Inc (AUR, Financial) is $9.63 with a high estimate of $15.00 and a low estimate of $6.00. The average target implies an upside of 32.30% from the current price of $7.28. More detailed estimate data can be found on the Aurora Innovation Inc (AUR) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Aurora Innovation Inc's (AUR, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

AUR Key Business Developments

Release Date: February 12, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Aurora Innovation Inc (AUR, Financial) is nearing the commercial launch of its autonomous trucking service, planned for April 2025, marking a significant milestone in its development.

- The company has demonstrated strong financial discipline, managing cash use under budget and ending the year with over $1.2 billion in cash and short-term investments.

- Aurora Innovation Inc (AUR) has formed a strategic partnership with Nvidia and Continental, enhancing its ability to scale operations and integrate advanced technology.

- The company has achieved a 99% completion rate in its safety case for the Dallas to Houston launch lane, showcasing its commitment to safety and readiness for commercial deployment.

- Aurora Innovation Inc (AUR) has successfully conducted pilot operations with major partners like DHL, FedEx, and Uber Freight, demonstrating the reliability and efficiency of its autonomous trucks.

Negative Points

- The company anticipates only modest revenue in the mid-single-digit millions for 2025, indicating that significant financial returns from its autonomous trucking operations may take time to materialize.

- Aurora Innovation Inc (AUR) faces regulatory challenges, as seen with the FMCSA's rejection of its petition for flashing lights on stopped trucks, which could impact operational efficiency.

- The company acknowledges that certain situations will always require on-site support, which could increase operational costs and affect profitability.

- Aurora Innovation Inc (AUR) is still in the early stages of scaling its operations, with plans to operate only up to 10 trucks commercially by the end of 2025.

- The transition to driverless operations is expected to be gradual, with significant scaling and profitability not anticipated until 2026, which may concern investors looking for quicker returns.