Key Takeaways:

- Qualcomm's Q2 earnings report is anticipated to show significant EPS and revenue growth.

- Analysts maintain an optimistic price target, suggesting a considerable upside potential.

- The company's diverse sector strength supports its 'Outperform' rating.

As investors eagerly await Qualcomm's (NASDAQ: QCOM) second-quarter earnings, set for release on April 30 post-market, anticipation of a robust financial performance is growing. The semiconductor titan is poised for a 15% year-over-year increase in earnings per share (EPS), reaching $2.81, with revenues expected to rise by 13% to $10.65 billion. Despite the potential headwinds in global smartphone demand, Qualcomm's diverse operations in the handset, automotive, and Internet of Things (IoT) sectors showcase its resilience.

Wall Street Analysts Forecast

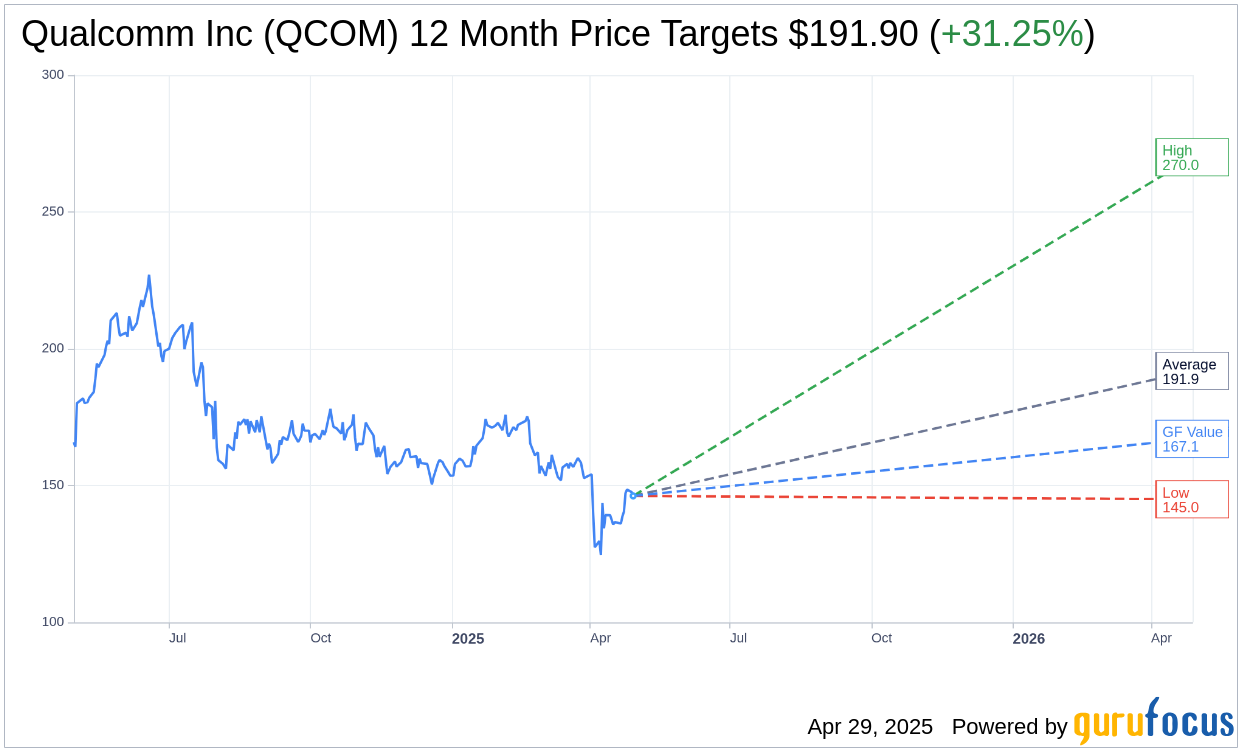

Analysts on Wall Street present a favorable outlook for Qualcomm Inc. (QCOM, Financial). The consensus one-year price target from 31 seasoned analysts stands at $191.90, with optimistic predictions ranging from a high of $270.00 to a lower boundary of $145.00. This average target suggests a promising upside potential of 31.25% from the current trading price of $146.21. For a deep dive into these estimates, explore the Qualcomm Inc (QCOM) Forecast page.

Qualcomm's robust performance is further underscored by its average brokerage recommendation of 2.4, denoting an "Outperform" status based on insights from 40 brokerage firms. This rating uses a scale where 1 represents a Strong Buy and 5 indicates a Sell, highlighting the market's confidence in Qualcomm's strategic direction.

According to GuruFocus estimates, Qualcomm Inc's (QCOM, Financial) one-year GF Value is projected at $167.08, pointing to a potential 14.27% upside from its current price of $146.21. The GF Value offers a perspective on a stock's fair trading value, derived from historical multiples, past business growth, and future performance forecasts. For further insights, visit the Qualcomm Inc (QCOM) Summary page.