Key Takeaways:

- American Tower Corporation (AMT, Financial) outperforms expectations with strong Q1 2025 results driven by increased mobile data demand and 5G upgrades.

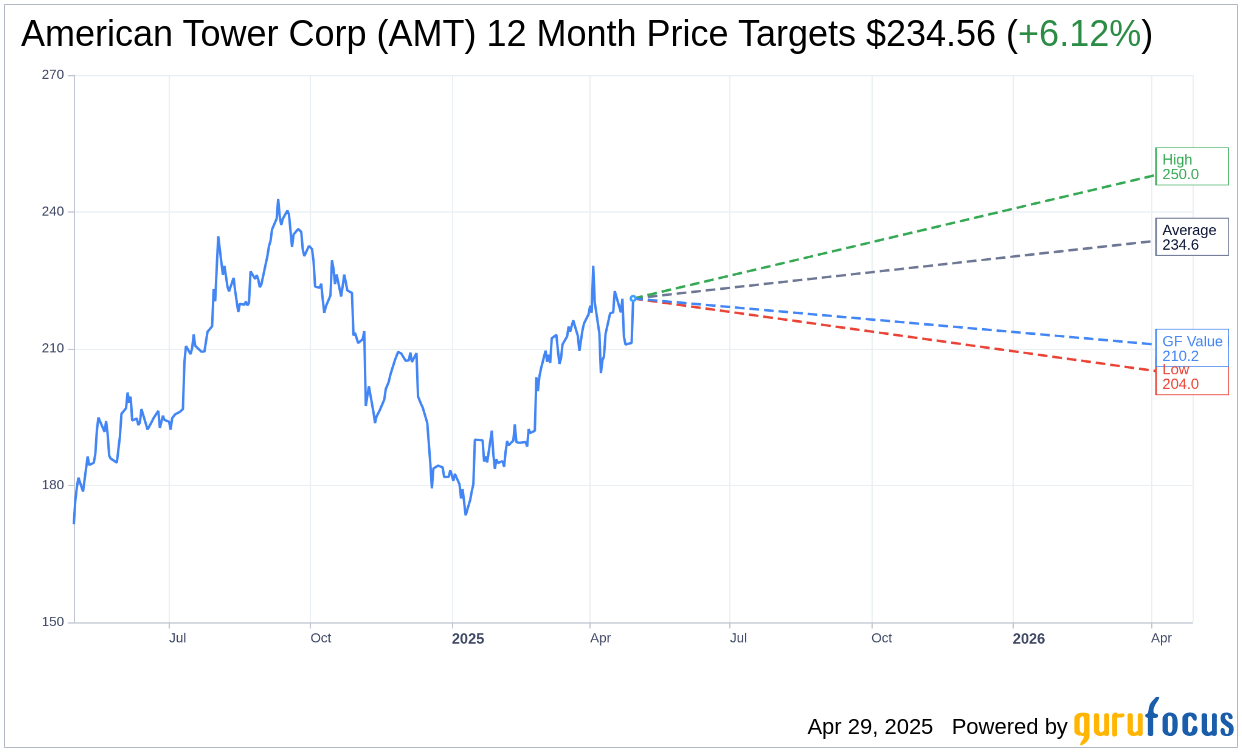

- Analysts forecast a potential upside of 6.12% in AMT's stock price over the next year.

- AMT's average brokerage recommendation indicates an "Outperform" status.

American Tower Corporation (AMT) recently announced impressive Q1 2025 financial results, solidifying its position as a leader in the telecommunications infrastructure sector. With heightened mobile data usage and significant investments in 5G technologies, the company has exceeded initial projections for property revenue, adjusted EBITDA, and AFFO per share. International markets, particularly in Nigeria and Brazil, have shown encouraging growth trends, bolstering AMT's global footprint. Additionally, the expansion of the CoreSite segment with new capacity further underscores the company's strategic growth initiatives.

Wall Street Analysts Forecast

Wall Street analysts have provided a one-year price target spectrum for American Tower Corp (AMT, Financial), with the average target set at $234.56. Estimates range from a high of $250.00 to a low of $204.00. This average target suggests a potential upside of 6.12% from the current trading price of $221.03. For more in-depth analysis and data, visit the American Tower Corp (AMT) Forecast page.

With insights drawn from 24 brokerage firms, American Tower Corp's (AMT, Financial) average brokerage recommendation currently stands at 1.9, signaling an "Outperform" status. The established rating scale ranges from 1, representing a Strong Buy, to 5, indicating a Sell recommendation.

According to GuruFocus estimates, the projected GF Value of American Tower Corp (AMT, Financial) over the next year is estimated at $210.22. This estimate implies a potential downside of 4.89% compared to the current price of $221.03. The GF Value is a proprietary estimate that reflects the fair market value of a stock, calculated using historical multiples, past business growth, and future performance predictions. To explore more detailed information, visit the American Tower Corp (AMT) Summary page.