Key Takeaways:

- Enterprise Products Partners (EPD, Financial) reported strong Q1 2025 results with notable financial achievements.

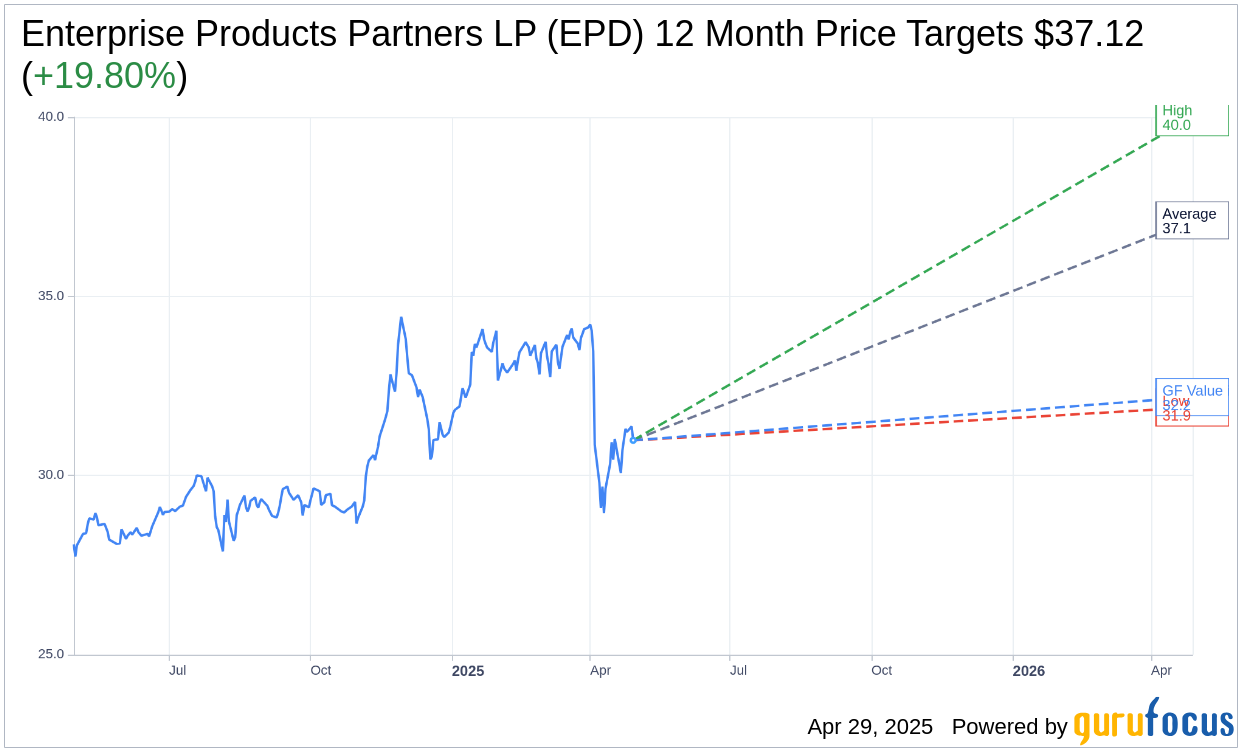

- Wall Street consensus suggests a potential price upside up to 19.80% based on analyst forecasts.

- GuruFocus estimates indicate a moderate growth potential with a 3.89% upside in GF Value.

Enterprise Products Partners (EPD) recently released its Q1 2025 financial results, revealing an impressive adjusted EBITDA of $2.4 billion and a net income of $1.4 billion. The company continues to focus on executing significant projects, which supports its consistent growth trajectory and meets the strong global demand for U.S. hydrocarbons.

Wall Street Analysts' Predictions

The financial outlook for Enterprise Products Partners LP (EPD, Financial) remains promising according to 16 analysts' one-year price targets. The average target price is $37.12, indicating a potential upside of 19.80% from the current price of $30.99. Estimates vary, with a high of $40.00 and a low of $31.90, providing investors with a comprehensive range of projections. For further insights, view detailed estimates on the Enterprise Products Partners LP (EPD) Forecast page.

Brokerage Recommendations

The prevailing sentiment from 20 brokerage firms ranks Enterprise Products Partners LP (EPD, Financial) at an average recommendation of 1.9, suggesting an "Outperform" status. This rating falls within a scale from 1 to 5, where 1 is a Strong Buy and 5 signifies a Sell recommendation. This characterization highlights the positive perspective held by analysts regarding EPD's market position.

GuruFocus Valuation Metrics

According to GuruFocus estimates, the projected GF Value for Enterprise Products Partners LP (EPD, Financial) in the upcoming year is $32.19. This indicates a modest upside potential of 3.89% from the current market price of $30.985. The GF Value is a proprietary measure that determines a stock's fair value based on its historical trading multiples, previous business growth, and future performance projections. For a detailed analysis, visit the Enterprise Products Partners LP (EPD) Summary page.