Ensign Group (ENSG, Financial) announced its first-quarter revenue of $1.17 billion, aligning precisely with market predictions. The company attributes its continued success to the dedication and hard work of its local teams, achieving remarkable performance amidst challenging industry conditions. CEO Barry Port highlighted that the quarter set several operational records, driven by strong clinical results and the commitment of the company’s caregivers and frontline staff. This consistent performance underscores Ensign's resilience and strength in a fluctuating market.

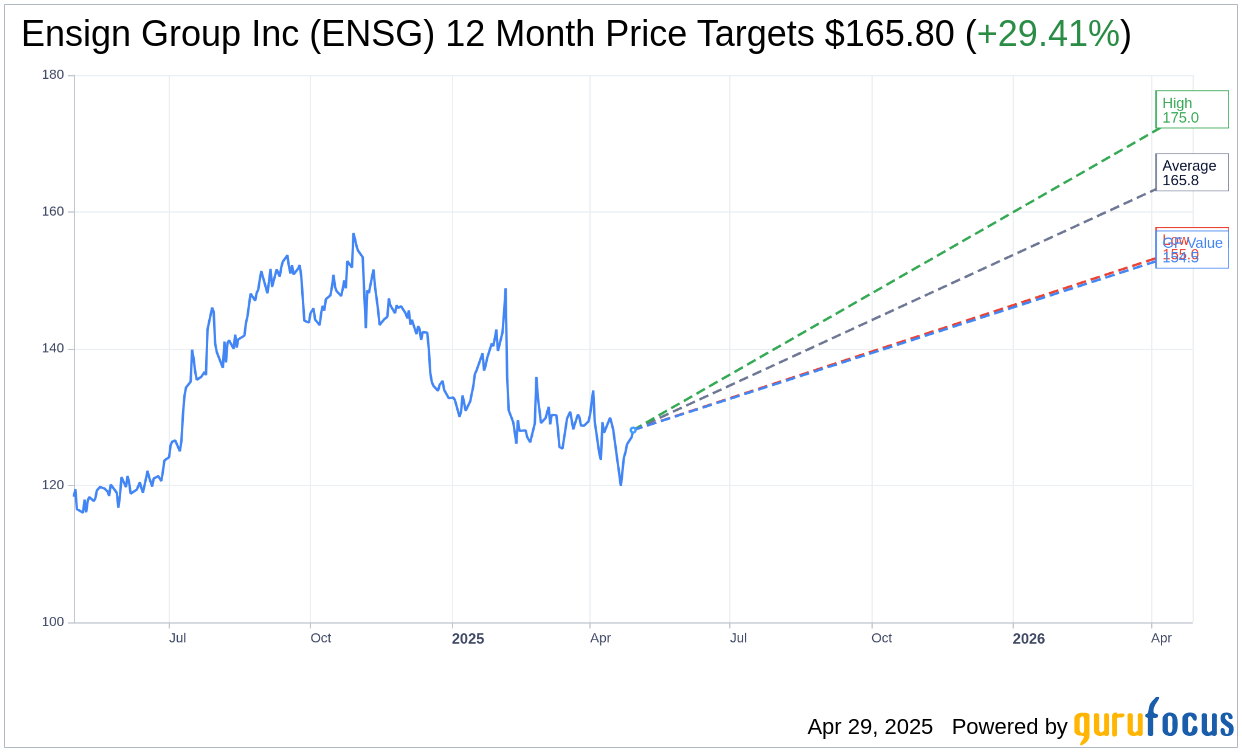

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Ensign Group Inc (ENSG, Financial) is $165.80 with a high estimate of $175.00 and a low estimate of $155.00. The average target implies an upside of 29.41% from the current price of $128.12. More detailed estimate data can be found on the Ensign Group Inc (ENSG) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Ensign Group Inc's (ENSG, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ensign Group Inc (ENSG, Financial) in one year is $154.51, suggesting a upside of 20.6% from the current price of $128.12. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ensign Group Inc (ENSG) Summary page.

ENSG Key Business Developments

Release Date: February 06, 2025

- Same-Store Occupancy Increase: 2.7% for the year, 2.3% over the prior-year quarter.

- Transitioning Occupancy Increase: 4.1% for the year, 4.7% over the prior-year quarter.

- Skilled Days Increase: 3.8% for same-store, 10.9% for transitioning operations over the prior-year quarter.

- Managed Care Census Growth: 6.6% for same-store, 27.7% for transitioning operations over the prior-year quarter.

- New Operations Added: 57 new operations in 2024.

- 2025 Earnings Guidance: $6.16 to $6.34 per diluted share.

- 2025 Revenue Guidance: $4.83 billion to $4.91 billion.

- 2024 GAAP Diluted EPS: $5.12, an increase of 40.3%.

- 2024 Adjusted Diluted EPS: $5.50, an increase of 15.3%.

- 2024 GAAP Revenue: $4.3 billion, an increase of 14.2%.

- 2024 GAAP Net Income: $298 million, an increase of 42.3%.

- 2024 Adjusted Net Income: $320.5 million, an increase of 17.2%.

- Q4 2024 GAAP Diluted EPS: $1.36, an increase of 257.9%.

- Q4 2024 Adjusted Diluted EPS: $1.49, an increase of 16.4%.

- Q4 2024 GAAP Revenue: $1.1 billion, an increase of 15.5%.

- Q4 2024 GAAP Net Income: $79.7 million, an increase of 267.4%.

- Q4 2024 Adjusted Net Income: $87.6 million, an increase of 18.9%.

- Cash and Cash Equivalents: $464.6 million as of December 31, 2024.

- Cash Flow from Operations: $347.2 million.

- Dividend Increase: 22nd consecutive year, $0.0625 per common share.

- Lease Adjusted Net Debt-to-EBITDA Ratio: 1.9 times.

- Available Credit Capacity: $572 million, over $1 billion in dry powder for future investments.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ensign Group Inc (ENSG, Financial) reported record clinical and financial results, with significant growth in occupancy and skilled mix.

- The company added 57 new operations across various markets, demonstrating strong expansion capabilities.

- Ensign Group Inc (ENSG) issued a 2025 earnings guidance with a midpoint increase of 13.8% over 2024 results.

- The company has a strong balance sheet with over $1 billion in available liquidity for future investments.

- Ensign Group Inc (ENSG) increased its dividend for the 22nd consecutive year, showcasing a commitment to returning value to shareholders.

Negative Points

- There are potential risks related to Medicaid reimbursement changes under the new administration.

- The company faces delays in licensing and Medicaid certifications, impacting cash flow in the short term.

- Ensign Group Inc (ENSG) operates in a highly competitive environment, particularly in regions like Costa Mesa, California.

- The acquisition process is experiencing slowdowns due to state-level bureaucratic delays.

- Labor costs remain a concern, although there is a gradual improvement in the labor market.