LSB Industries (LXU, Financial) reported first-quarter revenue of $143.4 million, surpassing market expectations set at $138.13 million. The company noted a 4% rise in total sales volumes compared to the previous year, attributed to increased production of upgraded ammonia products and higher sales volumes of UAN and AN due to improved reliability and operations.

Despite facing elevated natural gas prices, which impacted their cost structure, the firm experienced robust ammonia selling prices during the period. LSB Industries anticipates benefiting from the recent stabilization in natural gas prices in the upcoming quarter, notwithstanding ongoing global economic uncertainties.

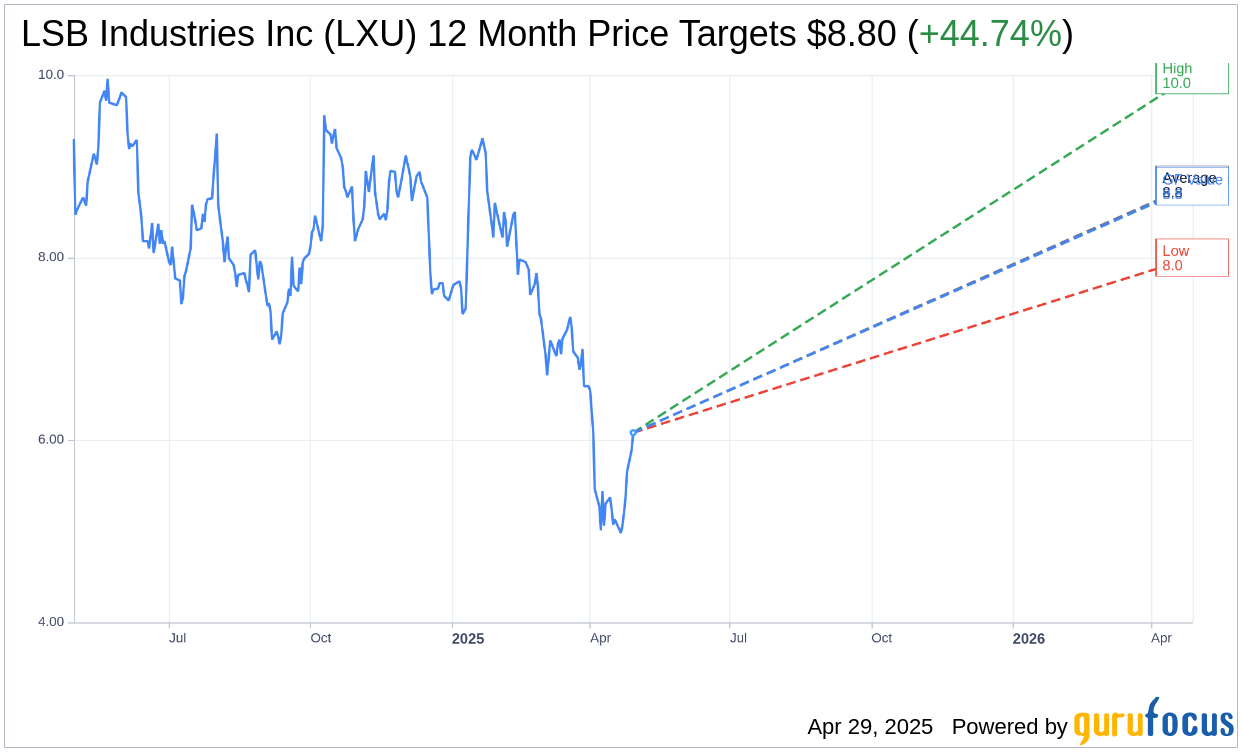

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for LSB Industries Inc (LXU, Financial) is $8.80 with a high estimate of $10.00 and a low estimate of $8.00. The average target implies an upside of 44.74% from the current price of $6.08. More detailed estimate data can be found on the LSB Industries Inc (LXU) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, LSB Industries Inc's (LXU, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for LSB Industries Inc (LXU, Financial) in one year is $8.78, suggesting a upside of 44.41% from the current price of $6.08. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the LSB Industries Inc (LXU) Summary page.

LXU Key Business Developments

Release Date: February 27, 2025

- Adjusted EBITDA: $38 million for Q4 2024, up from $25 million in Q4 2023.

- Impact of Turnaround: Estimated $7 million impact from the planned turnaround at Cherokee facilities.

- Estimated Adjusted EBITDA without Turnaround Impact: Approximately $45 million for Q4 2024.

- CapEx for 2024: $92 million, with $25 million for growth and the remainder for sustaining operations.

- Senior Secured Notes Repurchase: Approximately $222 million in principal amount repurchased over two years.

- Stock Repurchase: Approximately 4.6 million shares repurchased over two years.

- 2025 CapEx Expectation: $80 million to $90 million, with $60 million to $65 million for EH&S and reliability, and $20 million to $25 million for growth investments.

- Natural Gas Cost: Average of $3.85 per MMBTU for the first two months of 2025.

- Effective Tax Rate for 2025: Approximately 25%, with no material cash taxes expected due to NOLs.

- Incremental Annual EBITDA from CCS Project: Expected $15 million to $20 million once completed.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- LSB Industries Inc (LXU, Financial) reported a significant year-over-year increase in adjusted EBITDA, despite a planned turnaround at the Cherokee facility.

- The company achieved record-high daily production rates for urea and UAN, with the Cherokee site finishing 2024 with zero recordable injuries.

- LSB Industries Inc (LXU) successfully increased production volumes to meet healthy demand from primary industrial end markets.

- The company completed two margin enhancement projects in 2024, expected to yield full-year incremental EBITDA benefits in 2025.

- LSB Industries Inc (LXU) has a strong cash flow balance and a year-end leverage ratio below the target level for a mid-cycle pricing environment.

Negative Points

- The planned turnaround at the Cherokee facility had an estimated $7 million negative impact on the fourth quarter adjusted EBITDA.

- LSB Industries Inc (LXU) faces potential impacts from tariffs on US nitrogen imports from Canada, which could affect pricing in ag and industrial markets.

- The company expects higher natural gas prices in 2025, which could impact production costs.

- Ammonia sales volumes are expected to decline in 2025 as more production is upgraded to higher margin downstream products.

- The timeline for the El Dorado CCS project is dependent on the EPA's approval of the Class 6 permit application, which remains uncertain.