On April 29, 2025, Expand Energy Corp (EXE, Financial), a leading independent natural gas producer in the United States, released its 8-K filing detailing its financial performance for the first quarter of 2025. Despite a robust revenue increase, the company reported a net loss, falling short of analyst earnings expectations.

Company Overview

Expand Energy Corp (EXE, Financial) is committed to fueling a more affordable, reliable, and lower-carbon future by developing abundant natural gas, oil, and gas liquids. The company focuses on expanding energy access across the United States.

Performance and Challenges

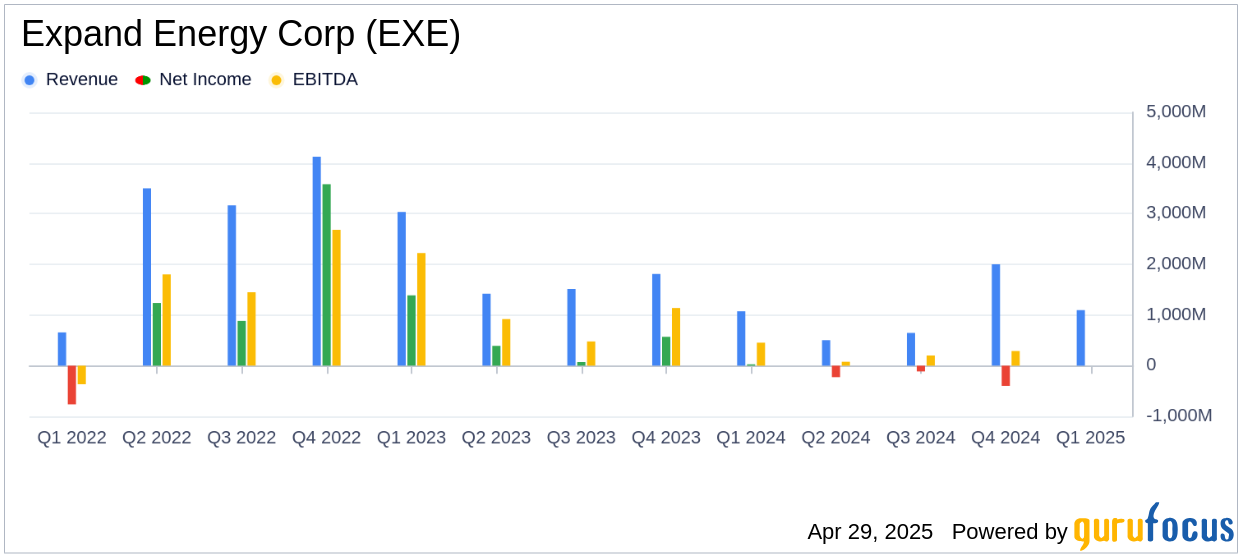

Expand Energy Corp (EXE, Financial) reported a net loss of $249 million, or $1.06 per fully diluted share, for the first quarter of 2025. This result is below the analyst estimate of $1.29 earnings per share. However, the company achieved an adjusted net income of $487 million, or $2.02 per share, indicating strong operational performance despite market challenges.

The company's revenue for the quarter was $2,196 million, slightly below the estimated $2,219 million. This shortfall highlights the volatility in the natural gas market and the challenges in meeting revenue expectations.

Financial Achievements

Despite the net loss, Expand Energy Corp (EXE, Financial) achieved several significant milestones. The company was added to the S&P 500 index and received an upgraded Investment Grade credit rating from Moody's. These achievements underscore the company's financial stability and growth potential in the oil and gas industry.

Key Financial Metrics

Expand Energy Corp (EXE, Financial) reported net cash provided by operating activities of $1,096 million and an Adjusted EBITDAX of $1,395 million. These metrics are crucial as they reflect the company's ability to generate cash flow and maintain operational efficiency.

The company produced approximately 6.79 Bcfe/d net, with 92% being natural gas, demonstrating its strong production capabilities.

Income Statement and Balance Sheet Highlights

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Total Revenues | $2,196 million | $1,081 million |

| Net Income (Loss) | $(249) million | $26 million |

| Adjusted EBITDAX | $1,395 million | Not Provided |

From the balance sheet, total assets stood at $27,934 million, with total liabilities at $10,743 million, reflecting a strong asset base and manageable liabilities.

Analysis and Outlook

Expand Energy Corp (EXE, Financial)'s performance in Q1 2025 highlights the challenges of market volatility and the impact on earnings. However, the company's strategic initiatives, such as increasing rig operations and capturing synergies, position it well for future growth. The company's commitment to reducing net debt and enhancing shareholder returns through dividends and share repurchases further strengthens its financial outlook.

“Overcoming market volatility requires a resilient financial foundation, a deep market-connected portfolio, and low cost, efficient operations, all hallmarks of our strategy," said Nick Dell'Osso, Expand Energy's President and Chief Executive Officer.

For more detailed financial information and future guidance, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Expand Energy Corp for further details.