Starbucks (SBUX, Financial) announced its second-quarter revenue at $8.76 billion, slightly falling short of the anticipated $8.83 billion. The company experienced a 1% decrease in global comparable store sales, mainly due to a 2% drop in transaction volume, although this was somewhat balanced by a 1% rise in the average ticket size.

In North America, comparable store sales fell by 1%, with a notable 4% decrease in transactions, partially countered by a 3% increase in average spending per ticket. Specifically in the U.S., the sales saw a 2% decline, following similar trends with a 4% dip in transactions, slightly mitigated by a 3% gain in the average ticket size.

Conversely, international sales reported a 2% growth in comparable store sales, attributed to a 3% increase in transactions, alongside a 1% reduction in average ticket size. In China, the sales results remained stable, as a 4% rise in transactions was offset by an equivalent 4% decline in average ticket size.

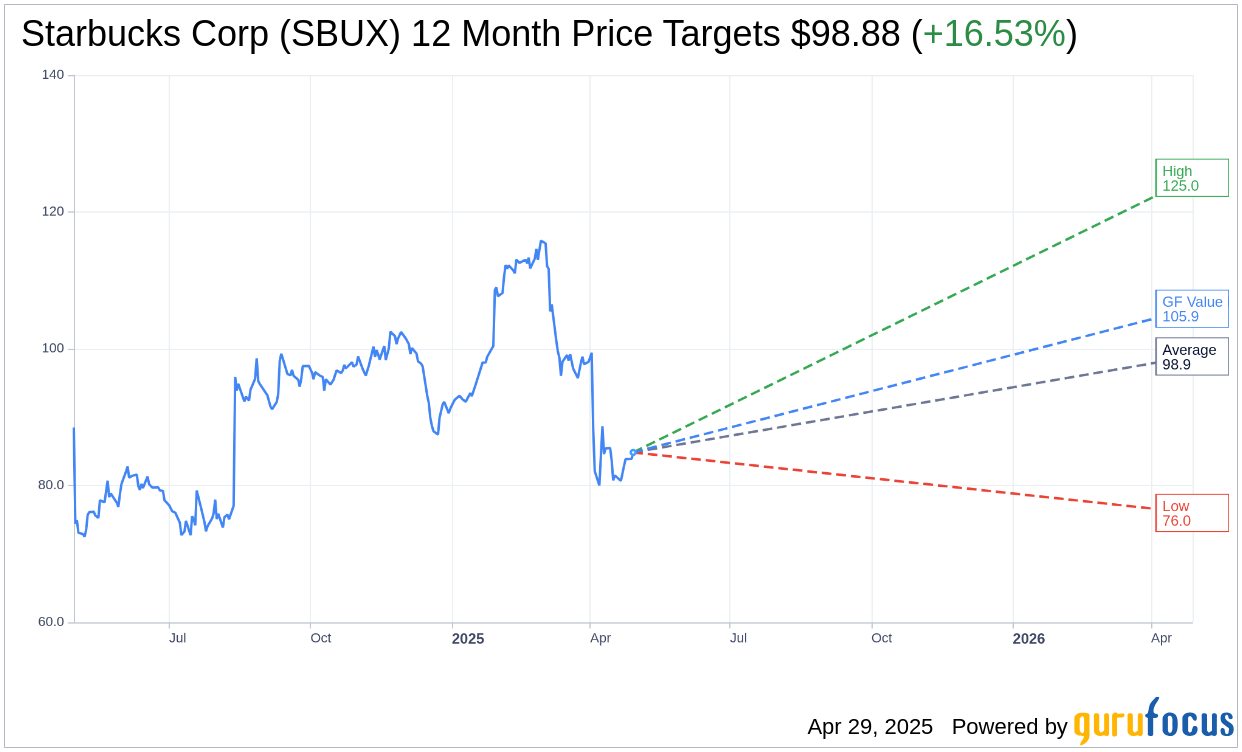

Wall Street Analysts Forecast

Based on the one-year price targets offered by 31 analysts, the average target price for Starbucks Corp (SBUX, Financial) is $98.88 with a high estimate of $125.00 and a low estimate of $76.00. The average target implies an upside of 16.53% from the current price of $84.85. More detailed estimate data can be found on the Starbucks Corp (SBUX) Forecast page.

Based on the consensus recommendation from 39 brokerage firms, Starbucks Corp's (SBUX, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Starbucks Corp (SBUX, Financial) in one year is $105.86, suggesting a upside of 24.76% from the current price of $84.85. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Starbucks Corp (SBUX) Summary page.

SBUX Key Business Developments

Release Date: January 28, 2025

- Revenue: $9.4 billion, flat compared to the prior year.

- Global Comparable Store Sales: Decline of 4%.

- US Comparable Store Sales: Decline of 4% with a 4% ticket growth.

- Operating Margin: 11.9%, a contraction of 380 basis points from the prior year.

- Earnings Per Share (EPS): $0.69, down 22% from the prior year.

- Net New Stores Opened: 377 globally in Q1.

- Store Growth: 7% net new company-operated store growth over the past 12 months.

- Investments Impact: 180 basis point margin pressure from labor investments and 60 basis points from removal of non-dairy milk customization charges.

- Efficiencies: In-store and supply chain efficiencies yielded savings of approximately 150 basis points.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Starbucks Corp (SBUX, Financial) reported a total company revenue of $9.4 billion for the first quarter of fiscal 2025, meeting their expectations.

- The company has seen a positive response to its 'Back to Starbucks' strategy, which focuses on reintroducing Starbucks as a premier coffeehouse.

- Starbucks Rewards membership and spend grew both quarter over quarter and year over year, indicating strong customer engagement.

- The company is investing in technology and staffing to improve efficiency and customer experience, including a new in-store prioritization algorithm.

- Starbucks Corp (SBUX) is planning to double its store count in the US, indicating confidence in market potential and growth opportunities.

Negative Points

- Global comparable store sales declined by 4%, with a similar decline in the US market, indicating challenges in driving same-store sales growth.

- The company's operating margin contracted by 380 basis points to 11.9%, primarily due to investments in labor and the removal of extra charges for non-dairy milk customizations.

- Starbucks Corp (SBUX) suspended its full fiscal year 2025 guidance, reflecting uncertainty in the business environment.

- The company is facing challenges with mobile order sequencing, which is causing bottlenecks and impacting customer experience.

- EPS for the first quarter was $0.69, down 22% from the prior year, reflecting deleverage and heightened investments.