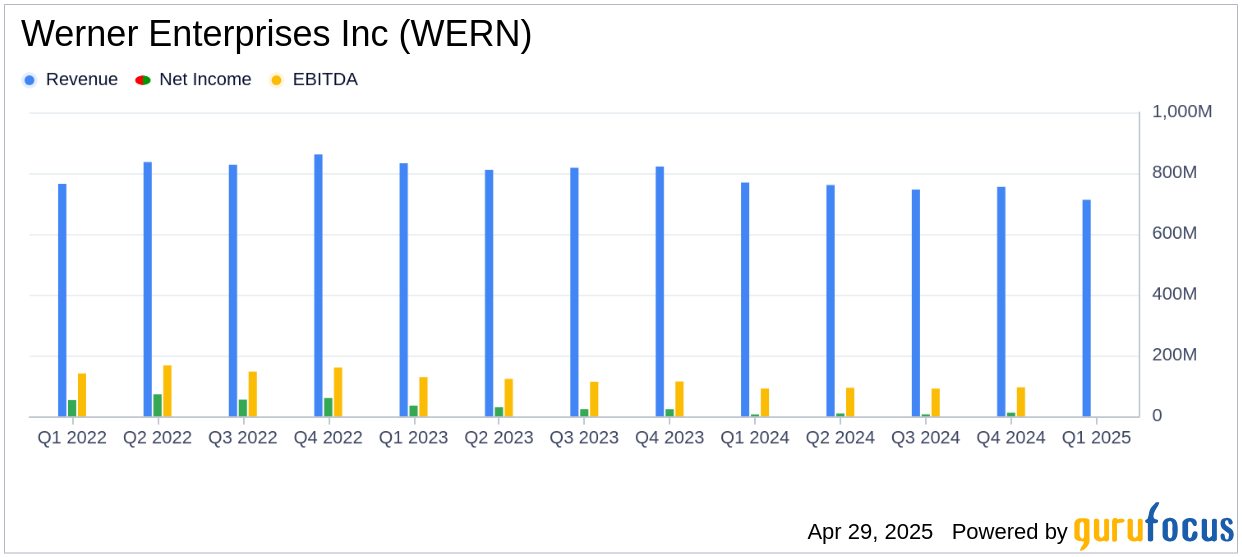

Werner Enterprises Inc (WERN, Financial) released its 8-K filing on April 29, 2025, detailing its financial performance for the first quarter of 2025. The transportation and logistics company, which operates primarily in the United States, reported a challenging quarter with total revenues of $712.1 million, falling short of the analyst estimate of $738.62 million. The company also reported a diluted loss per share of $0.16, significantly below the estimated earnings per share of $0.12.

Company Overview

Werner Enterprises Inc is a leading transportation and logistics company with two main segments: Truckload Transportation Services (TTS) and Werner Logistics. The company primarily generates revenue from full-truckload transportation services, with the majority of its operations based in the United States.

Performance and Challenges

The first quarter of 2025 presented several challenges for Werner Enterprises Inc. Total revenues decreased by $57.0 million, or 7%, compared to the same period in 2024. The company reported an operating loss of $5.8 million, a significant decline from the $15.6 million operating income reported in the previous year. The operating margin also decreased by 280 basis points to (0.8)%. These results were impacted by elevated insurance costs, extreme weather conditions, a smaller fleet, and changes in customer activity due to tariff-induced uncertainty.

“First quarter results were below our expectations due to elevated insurance costs, extreme weather, a smaller fleet and changes in customer activity stemming from tariff-induced uncertainty. Despite these challenges, we are seeing strength in Dedicated with a streak of wins in new fleet contracts to be implemented in the coming quarters,” said Derek Leathers, Chairman and CEO.

Financial Achievements and Industry Importance

Despite the challenges, Werner Enterprises Inc reported some positive developments. The company saw modest growth in One-Way Truckload revenue per total mile for the third consecutive quarter. Additionally, the Logistics segment improved its operating income and margin through a focus on cost management. These achievements are crucial for maintaining competitiveness in the transportation industry, where efficiency and cost management are key to success.

Key Financial Metrics

| Metric | Q1 2025 | Q1 2024 | Change |

|---|---|---|---|

| Total Revenues | $712.1 million | $769.1 million | (7)% |

| Operating Income (Loss) | $(5.8) million | $15.6 million | (137)% |

| Net Income (Loss) Attributable to Werner | $(10.1) million | $6.3 million | (260)% |

| Diluted Earnings (Loss) Per Share | $(0.16) | $0.10 | (264)% |

Segment Performance

The Truckload Transportation Services segment reported a revenue decline of 9% to $501.9 million, with an operating loss of $0.9 million. The segment faced increased insurance and claims expenses, a smaller fleet size, and lower gains on the sale of property and equipment. The Werner Logistics segment saw a 3% decrease in revenues to $195.6 million, but improved its operating loss by $1.9 million, achieving a non-GAAP adjusted operating income of $0.7 million.

Cash Flow and Capital Allocation

Cash flow from operations decreased by 67% to $29.4 million in the first quarter of 2025. The company continues to prioritize reinvestment in safe and modern equipment, technology, and talent. As of March 31, 2025, Werner Enterprises Inc had $52 million in cash and cash equivalents and $1.4 billion in stockholders’ equity.

Analysis and Outlook

Werner Enterprises Inc's first-quarter performance highlights the challenges faced by the transportation industry, including cost pressures and external uncertainties. However, the company's focus on cost management and strategic investments in its fleet and technology may position it for future growth. The upcoming implementation of new fleet contracts in the Dedicated segment could provide a boost in the coming quarters.

Explore the complete 8-K earnings release (here) from Werner Enterprises Inc for further details.