Visa (V, Financial) has made a strategic financial move by placing $375 million into its litigation escrow account on March 27, 2025. This account, part of the company's U.S. retrospective responsibility plan, is designed to protect both Visa and its class A shareholders from potential liabilities arising from ongoing legal cases.

This contribution to the escrow account effectively mirrors a share buyback. It diminishes the share count of class B-1 and class B-2 common stock, based on a volume-weighted average price of $346.79. This action is intended to have a similar positive impact on earnings per share as would be experienced with a direct repurchase of class A common stocks.

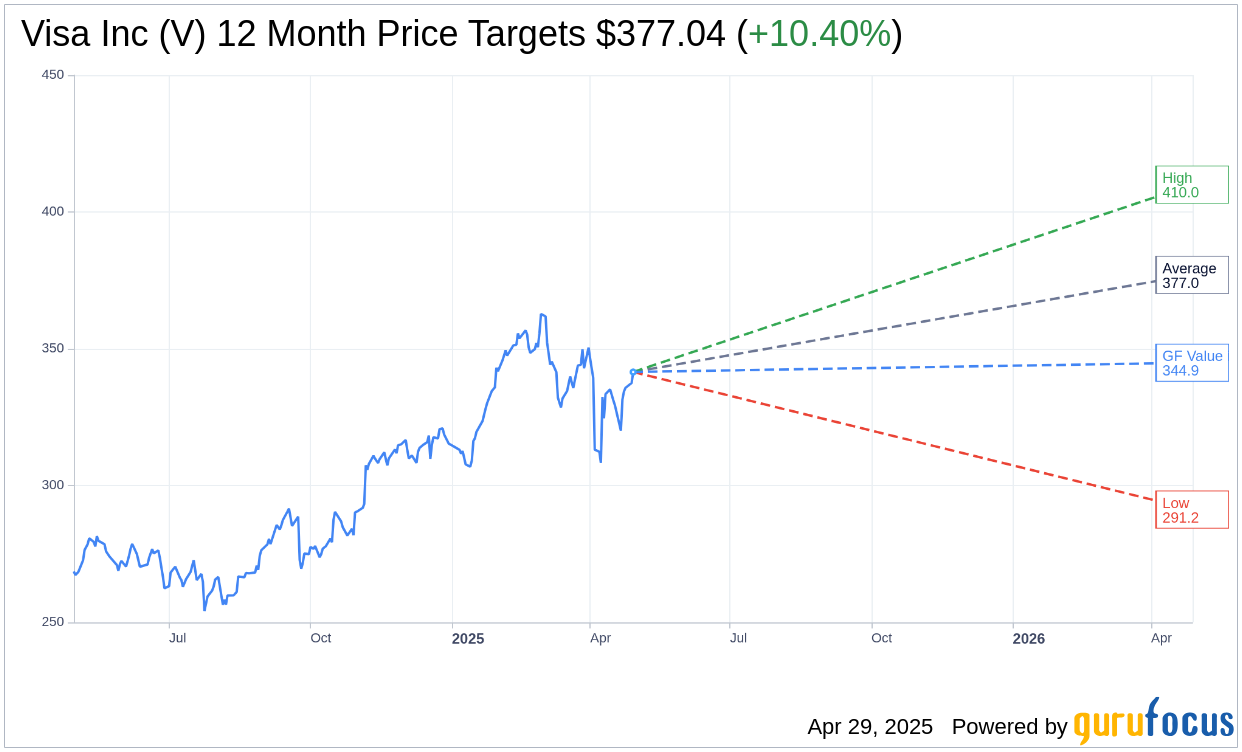

Wall Street Analysts Forecast

Based on the one-year price targets offered by 38 analysts, the average target price for Visa Inc (V, Financial) is $377.04 with a high estimate of $410.00 and a low estimate of $291.22. The average target implies an upside of 10.40% from the current price of $341.52. More detailed estimate data can be found on the Visa Inc (V) Forecast page.

Based on the consensus recommendation from 43 brokerage firms, Visa Inc's (V, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Visa Inc (V, Financial) in one year is $344.90, suggesting a upside of 0.99% from the current price of $341.52. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Visa Inc (V) Summary page.

V Key Business Developments

Release Date: January 30, 2025

- Net Revenue: $9.5 billion, up 10% year over year.

- EPS: Up 14% year over year.

- Payments Volume: Overall growth of 9% in constant dollars; US payments volume grew 7%, international payments volume grew 11%.

- Cross-Border Volume: Excluding intra-Europe, up 16% in constant dollars.

- Process Transactions: Grew 11% year over year.

- Credentials: 4.7 billion, up 7% year over year.

- Tokens: 12.6 billion, up 44% year over year.

- New Flows Revenue: Grew 19% year over year in constant dollars.

- Visa Direct Transactions: Grew 34% year over year.

- Value-Added Services Revenue: Grew 18% in constant dollars.

- Operating Expenses: Grew 11% year over year.

- Tax Rate: 17.7%.

- Stock Buyback: Approximately $3.9 billion in Q1.

- Dividends: $1.2 billion distributed to stockholders.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Visa Inc (V, Financial) reported a strong start to the fiscal year with $9.5 billion in net revenue, up 10% year over year, and EPS up 14%.

- Cross-border volume excluding intra-Europe rose 16% in constant dollars, indicating robust international growth.

- Visa Direct transactions grew 34% year-over-year, highlighting significant expansion in new payment flows.

- Value-added services revenue grew 18% in constant dollars, driven by strong growth in consulting, marketing services, and risk solutions.

- Visa Inc (V) successfully renewed and expanded several key partnerships globally, including with ICBC in China and ICICI Bank in India, strengthening its international presence.

Negative Points

- Asia Pacific payments volume growth remained muted, reflecting a challenging macroeconomic environment in the region.

- Operating expenses grew 11%, driven by increases in personnel and general and administrative expenses, which could impact profitability.

- The restructuring charge of $213 million related to workforce changes indicates ongoing adjustments and potential disruptions.

- Visa Inc (V) faces potential challenges from a strong US dollar, which could affect cross-border travel and spending patterns.

- The regulatory environment in the US remains uncertain, which could impact Visa Inc (V)'s operations and growth strategies.