Key Highlights:

- Seagate Technology reports a notable earnings beat with a 6.2% share price boost.

- Analyst projections suggest a 31.30% potential upside for STX.

- Seagate is rated as "Outperform," indicating positive sentiment from brokerage firms.

Seagate Technology (STX, Financial) has delivered a strong performance for its fiscal third quarter, presenting investors with compelling results. The technology giant announced a GAAP earnings per share of $1.90, which surpassed expectations by $0.47. Revenue also impressed, reaching $2.16 billion—an increase of 30.1% year-over-year and surpassing projections by $30 million. Following this announcement, Seagate's shares experienced a significant rise of 6.2%.

Wall Street Analysts Forecast

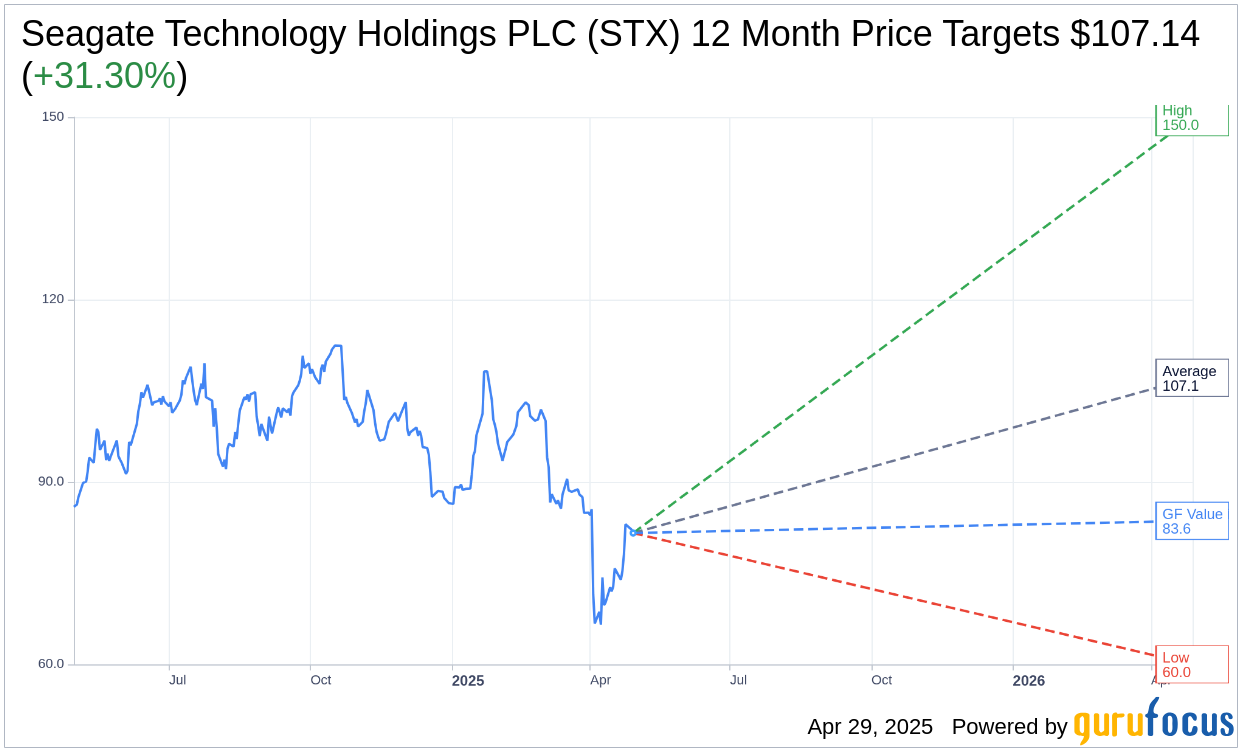

In the eyes of 19 analysts, the average one-year price target for Seagate Technology Holdings PLC (STX, Financial) stands at $107.14. The projections range from a high of $150.00 to a low of $60.00. This average target price suggests a potential upside of 31.30% from the current trading price of $81.60. For a more comprehensive look at these estimates, visit the Seagate Technology Holdings PLC (STX) Forecast page.

The sentiment among 24 brokerage firms is optimistic, with an average brokerage recommendation of 2.2, which denotes an "Outperform" rating for Seagate Technology Holdings PLC (STX, Financial). This rating is derived from a scale where 1 indicates a Strong Buy, ascending to 5 for a Sell recommendation.

According to GuruFocus estimates, the projected GF Value for Seagate Technology Holdings PLC (STX, Financial) within a year is calculated at $83.61. This implies a modest upside of 2.46% from its current price of $81.60. The GF Value is a measure of the fair valuation based on the stock's historical trading multiples, past growth, and forecasted business performance. For more in-depth data, please refer to the Seagate Technology Holdings PLC (STX) Summary page.