Tetra Technologies (TTI, Financial) announced its first-quarter revenue, reaching $157 million, which fell slightly short of market expectations of $159.71 million. The company achieved a record Q1 Adjusted EBITDA of $32.3 million, marking a substantial 41% increase from the previous quarter and the same period last year. This growth was driven by the strong performance of their Completion Fluids and Products segment.

Additionally, the total revenue saw a rise of 17% over the prior quarter and a 4% increase from the previous year. A significant achievement during this period was the successful completion of the first TETRA CS Neptune well out of the three planned. Progress was also made on the second well, which was completed in April.

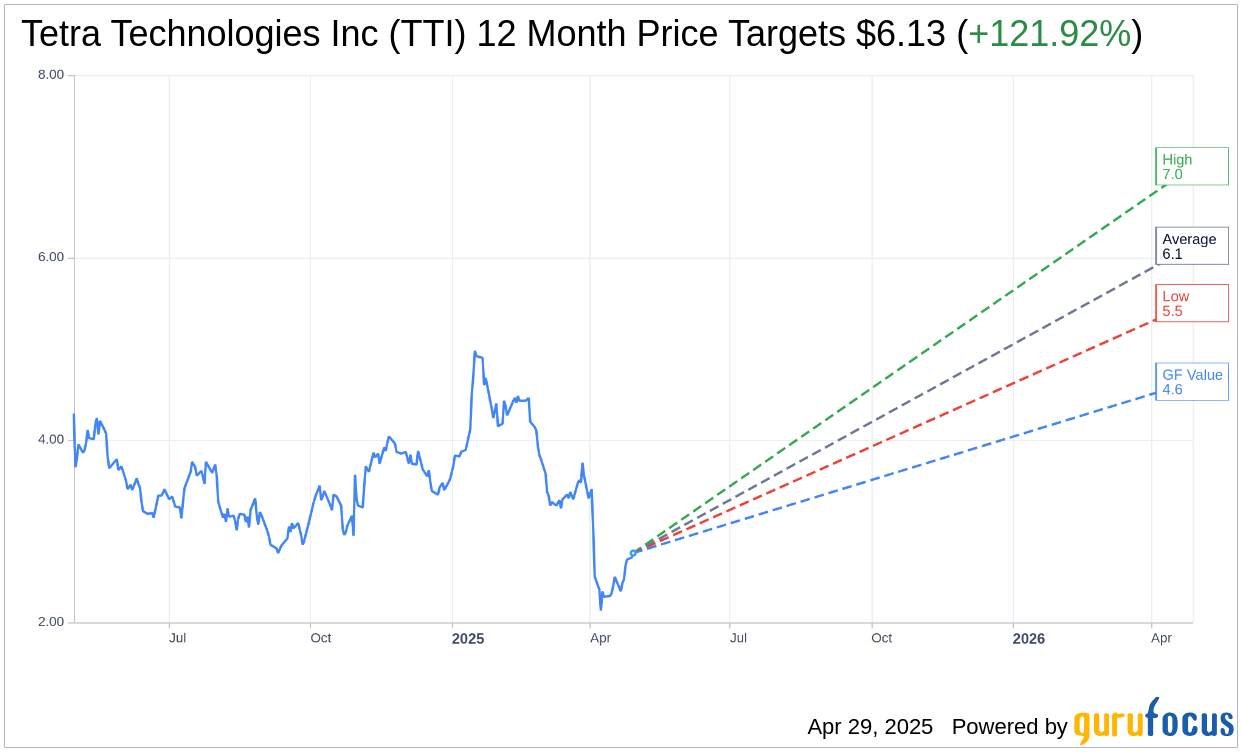

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Tetra Technologies Inc (TTI, Financial) is $6.13 with a high estimate of $7.00 and a low estimate of $5.50. The average target implies an upside of 121.92% from the current price of $2.76. More detailed estimate data can be found on the Tetra Technologies Inc (TTI) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Tetra Technologies Inc's (TTI, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Tetra Technologies Inc (TTI, Financial) in one year is $4.64, suggesting a upside of 68.12% from the current price of $2.76. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Tetra Technologies Inc (TTI) Summary page.

TTI Key Business Developments

Release Date: February 26, 2025

- Adjusted EBITDA Margin: 17% in Q4 2024, up from 16.6% in Q3 2024 and 15.8% in Q4 2023.

- Industrial Chemicals Revenue Growth: Over 9% increase in 2024 compared to 2023.

- Completion Fluids and Products Revenue: $311 million for 2024, second highest since 2015.

- Water and Flowback Segment Margin: 13.8% in Q4 2024.

- Produced Water Volume: Record 89 million barrels treated and recycled in Q4 2024.

- Projected Net Income Before Taxes (H1 2025): Between $19 million and $34 million.

- Projected Adjusted EBITDA (H1 2025): Between $55 million and $65 million.

- Net Operating Loss (NOL) Carryforward: Can offset approximately $345 million of US taxable income, saving about $97.5 million in cash taxes.

- Cash on Hand (End of December 2024): $37 million.

- Liquidity (As of February 2025): Almost $207 million.

- Interest Expense (2025 Projection): Approximately $20 million.

- Capital Expenditures (2025 Projection): Between $30 million and $35 million.

- Cash Taxes (2025 Projection): Approximately $6 million to $7 million.

- Free Cash Flow (2025 Projection): Potential to generate over $50 million from the base business.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Tetra Technologies Inc (TTI, Financial) reported strong offshore and industrial chemicals performance, which offset a weaker US land operations performance.

- The company achieved a record volume of 89 million barrels of treated and recycled produced water for frac reuse in the fourth quarter.

- Tetra's industrial chemicals business achieved its highest revenue and adjusted EBITDA in the company's history, with a 9% revenue growth over 2023.

- The company is projecting a significant year-over-year increase in both revenue and EBITDA in the first half of 2025, with net income before taxes between $19 million and $34 million.

- Tetra Technologies Inc (TTI) has secured power for its Arkansas project and completed the front-end engineering design, preparing for the next phase of construction.

Negative Points

- The US land operations experienced a weaker than expected year-end slowdown, impacting overall performance.

- The water and flowback segment faced challenges due to operator consolidation and low natural gas prices, leading to a decline in rig count and frac fleet.

- The company anticipates potential regulatory restrictions on water disposal, which could impact operations.

- Tetra Technologies Inc (TTI) experienced a year-on-year working capital increase of $21 million due to inventory ramp-up for projects.

- The company expects revenue from the water and flowback services segment to remain flat in 2025, despite efforts to enhance operational efficiencies.