Industrial Logistics Properties Trust (ILPT, Financial) showcased a solid first quarter with notable advancements in its financial metrics compared to the previous year and the preceding quarter. The company achieved significant leasing activity, completing agreements for over 2.3 million square feet. This included rent adjustments that resulted in a 18.9% increase in average rental rates compared to previous rates.

A significant portion, 75%, of the leasing activity was attributed to renewals, highlighting the ongoing demand for ILPT's high-quality assets. This demand and strategic activity have allowed the company to enhance its cash flow organically, while preserving stability across its portfolio. This performance underscores the company's proficient management and its capacity to maintain robust operational fundamentals.

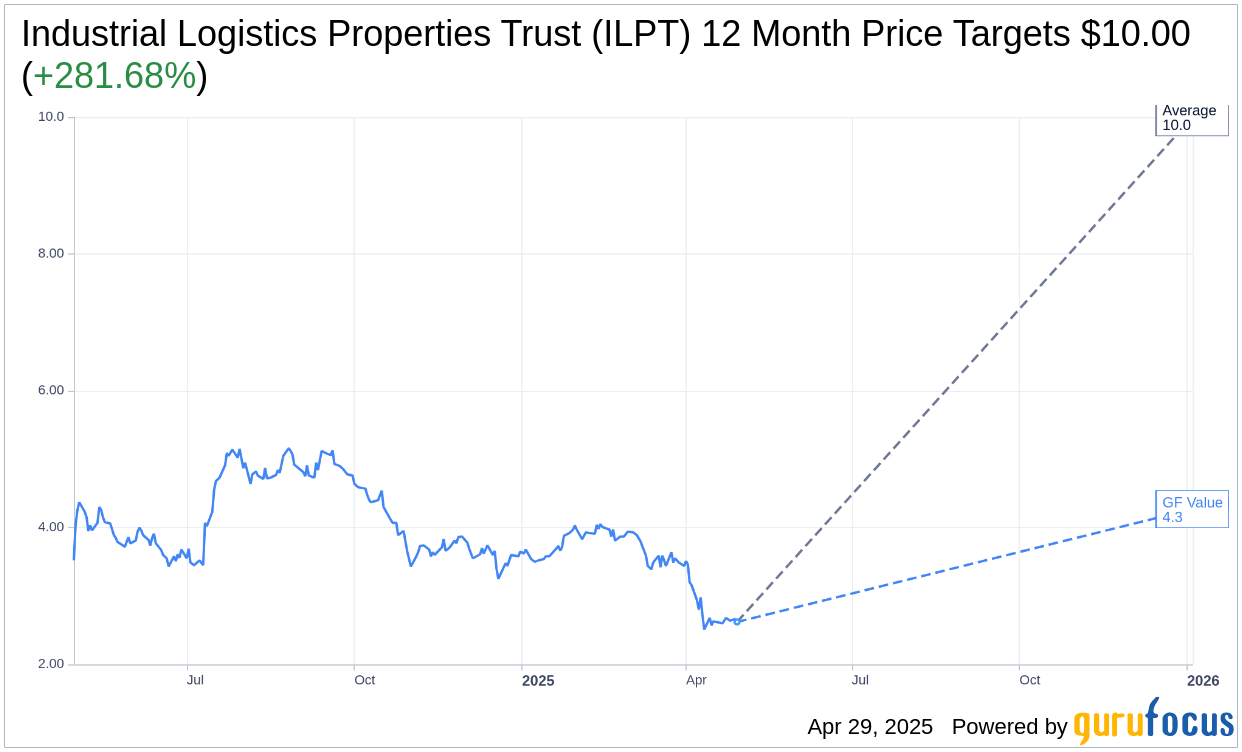

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Industrial Logistics Properties Trust (ILPT, Financial) is $10.00 with a high estimate of $10.00 and a low estimate of $10.00. The average target implies an upside of 281.68% from the current price of $2.62. More detailed estimate data can be found on the Industrial Logistics Properties Trust (ILPT) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Industrial Logistics Properties Trust's (ILPT, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Industrial Logistics Properties Trust (ILPT, Financial) in one year is $4.27, suggesting a upside of 62.98% from the current price of $2.62. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Industrial Logistics Properties Trust (ILPT) Summary page.

ILPT Key Business Developments

Release Date: February 19, 2025

- Portfolio Size: 411 properties across 39 states, totaling approximately 60 million square feet.

- Hawaii Footprint: 226 properties totaling more than 16.7 million square feet.

- Occupancy Rate: 94.4% as of December 31, 2024.

- Lease Term: Weighted average lease term of 7 years.

- Top 10 Tenants: Account for 48% of total annualized rental revenues.

- New and Renewal Leases (2024): 58 leases totaling 6.1 million square feet with rental rates 18.2% higher than prior rates.

- Fourth Quarter Leasing: 731,000 square feet at rental rates 39.3% higher than prior rents.

- Normalized FFO (2024): $35.4 million or $0.54 per share, a 12.1% increase from 2023.

- NOI (2024): Increased by 0.6% to $341.2 million.

- Cash Basis NOI (2024): Increased by 1.5% to $329.2 million.

- Adjusted EBITDAre (2024): Increased by 2.2% to $335.6 million.

- Fourth Quarter Normalized FFO: $8.9 million or $0.13 per share, a 10% increase from the prior year.

- Fourth Quarter NOI: Decreased by 0.8% to $84.2 million.

- Fourth Quarter Adjusted EBITDAre: Decreased by 1.1% to $82.2 million.

- Interest Expense (Q4 2024): Declined by $2.2 million to $71.7 million.

- Cash on Hand (Dec 31, 2024): Over $130 million.

- Net Debt to Total Assets Ratio: 68.6%.

- Net Debt Coverage Ratio: 12.4 times.

- Expected Normalized FFO (Q1 2025): Between $0.16 and $0.18 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ILPT's portfolio consists of 411 distribution and logistics properties across 39 states, totaling approximately 60 million square feet, showcasing a strategically diversified portfolio.

- The company achieved a consolidated occupancy rate of 94.4% at year-end, consistent with the previous quarter, indicating stable occupancy levels.

- ILPT's leasing activity in 2024 resulted in 58 new and renewal leases, with rental rates 18.2% higher than prior rates, contributing to an $8.2 million increase in annualized rental revenue.

- The Hawaii portfolio demonstrated strong performance, with new leasing rates 43% higher than prior rents and a weighted average lease term of 21.3 years.

- ILPT reported a 12.1% increase in normalized FFO for the year, reaching $35.4 million or $0.54 per share, reflecting strong financial performance.

Negative Points

- Vacancies in Hawaii and Indianapolis negatively impacted earnings in the second half of the year, reducing occupancy by 4.6% and resulting in a $1.8 million loss in quarterly rental revenues.

- The company faces significant competition in the Indianapolis market as new buildings come online, posing challenges for leasing efforts.

- Fourth quarter NOI decreased by 0.8% compared to the same quarter in 2023, indicating a slight decline in net operating income.

- Interest expense remains a concern, although it declined by $2.2 million in the fourth quarter, it still represents a significant cost at $71.7 million.

- The company's net debt to total assets ratio is relatively high at 68.6%, which could pose financial risks if not managed carefully.