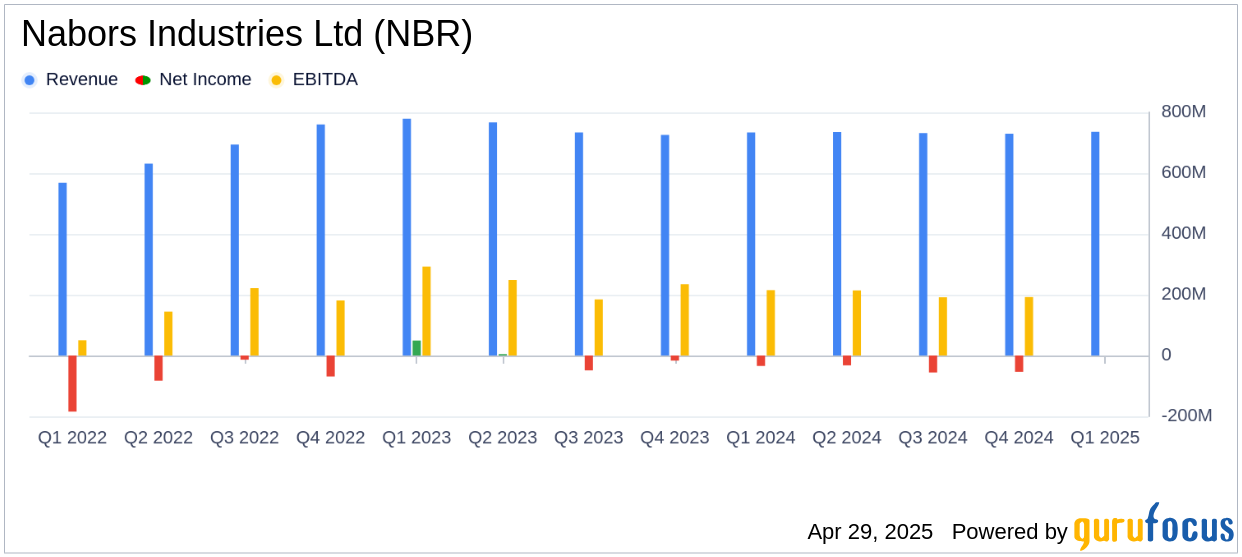

Nabors Industries Ltd (NBR, Financial) released its 8-K filing on April 29, 2025, announcing its first-quarter results. The company reported operating revenues of $736 million, exceeding the analyst estimate of $719.45 million. The net income attributable to Nabors shareholders was $33 million, translating to earnings per diluted share of $2.18, a significant improvement from the previous quarter's net loss of $54 million or a loss per diluted share of $6.67.

Company Overview

Nabors Industries Ltd owns and operates land-based drilling rig fleets and provides offshore platform rigs in the United States and international markets. The company also offers performance tools, directional drilling services, tubular running services, and technologies. Its operations are divided into four segments: U.S. Drilling, International Drilling, Drilling Solutions, and Rig Technologies, with the key revenue generated from International Drilling.

Performance and Challenges

The first quarter of 2025 saw Nabors Industries Ltd navigating through a mix of achievements and challenges. The company completed the acquisition of Parker Wellbore, which is expected to enhance its portfolio and improve cash flow. However, the U.S. market faced rig churn, affecting rig utilization and operating expenses. Despite these challenges, the company managed to increase its rig count in the Lower 48 states after a dip in February.

Financial Achievements

The acquisition of Parker Wellbore is a notable achievement, adding significant value to Nabors' Drilling Solutions business. This acquisition is anticipated to be immediately accretive to the company's free cash flow for 2025. Additionally, the SANAD joint venture with Saudi Aramco deployed its tenth newbuild rig, contributing to the company's international growth strategy.

Key Financial Metrics

In the first quarter, Nabors reported an adjusted EBITDA of $206 million, a decrease from $221 million in the previous quarter. The International Drilling segment's adjusted EBITDA was $115.5 million, reflecting improved performance in several geographies. The U.S. Drilling segment reported an adjusted EBITDA of $92.7 million, impacted by reduced rig count and higher operational expenses.

| Segment | Q1 2025 Adjusted EBITDA | Q4 2024 Adjusted EBITDA |

|---|---|---|

| International Drilling | $115.5 million | $112.0 million |

| U.S. Drilling | $92.7 million | $105.8 million |

| Drilling Solutions | $40.9 million | Not specified |

| Rig Technologies | $5.6 million | Not specified |

Commentary and Analysis

Anthony G. Petrello, Nabors Chairman, CEO and President, commented, “With the acquisition of Parker completed, we are already realizing the benefits we anticipated. Parker’s operations contributed to our first quarter. We commenced our well-planned integration, and the early achievements are encouraging.”

The company's strategic moves, such as the Parker acquisition and the SANAD joint venture, are expected to drive future growth and profitability. However, challenges in the U.S. market, particularly rig churn, remain a concern. The company's ability to navigate these challenges while capitalizing on international opportunities will be crucial for sustained performance.

Conclusion

Nabors Industries Ltd's first-quarter results demonstrate resilience and strategic growth, with revenue surpassing estimates and a return to profitability. The company's focus on international expansion and technological advancements positions it well for future success, despite ongoing challenges in the U.S. market.

Explore the complete 8-K earnings release (here) from Nabors Industries Ltd for further details.