- DuPont (DD, Financial) maintains a stable dividend yield of 2.49%, with a quarterly dividend of $0.41 per share.

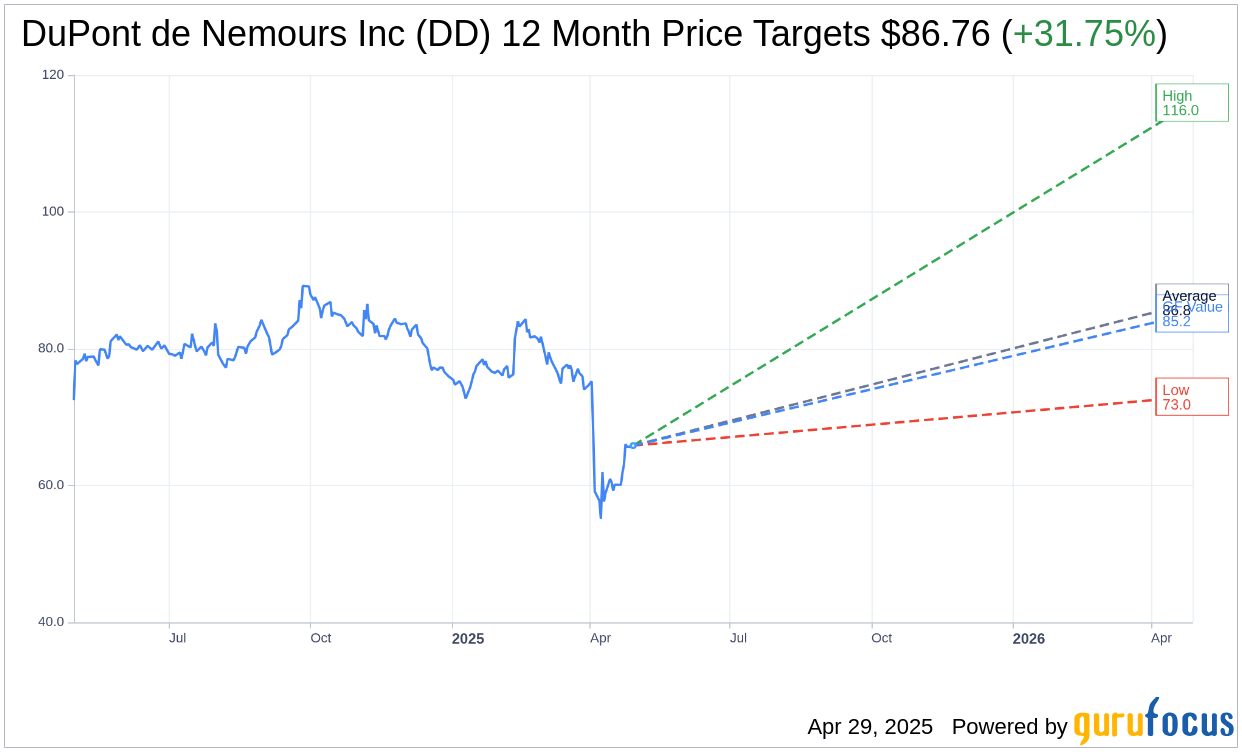

- Analysts project a 31.75% upside for DuPont, with a target price averaging $86.76.

- The stock holds an "Outperform" rating with a GF Value estimate indicating a 29.32% potential increase.

DuPont (NYSE: DD) remains a solid income-generating option for investors, as the company has announced a consistent quarterly dividend payment of $0.41 per share. This reflects a dividend yield of 2.49%, a draw for yield-seeking investors. The payment date is set for June 16, with the record date on May 30, which also serves as the ex-dividend date.

Wall Street's Perspective on DuPont

According to insights from 15 seasoned analysts, DuPont de Nemours Inc. (DD, Financial) is anticipated to reach an average price target of $86.76 within the next year. Forecasts range with a high of $116.00 and a low of $73.00, presenting an optimistic potential upside of 31.75% from its current trading price of $65.85. For further detailed projections, visit the DuPont de Nemours Inc (DD) Forecast page.

Brokerage Recommendations

Among 19 brokerage firms, DuPont de Nemours Inc (DD, Financial) garners an average recommendation rating of 2.1. This rating corresponds to an "Outperform" status on a scale where 1 implies a Strong Buy and 5 indicates a Sell. This consensus underscores the positive sentiment from analysts towards the stock's performance.

GuruFocus Valuation Metrics

GuruFocus provides an estimated GF Value for DuPont de Nemours Inc (DD, Financial) at $85.16 for the coming year, suggesting a substantial upside of 29.32% from its current price of $65.85. The GF Value estimate is derived from a blend of historical stock pricing multiples, past business growth, and projections of future performance. For comprehensive data, access the DuPont de Nemours Inc (DD) Summary page.

Also check out: (Free Trial)