On March 31, 2025, JPMorgan Chase & Co. executed a significant transaction involving Seagate Technology Holdings PLC. The firm added 2,138,139 shares of Seagate Technology, increasing its position by 12.76% at a trade price of $84.95 per share. This move reflects JPMorgan Chase & Co.'s strategic interest in the data storage sector, as Seagate Technology is a prominent player in this field. The transaction highlights the firm's ongoing efforts to optimize its investment portfolio by focusing on key industry sectors.

JPMorgan Chase & Co.: A Financial Powerhouse

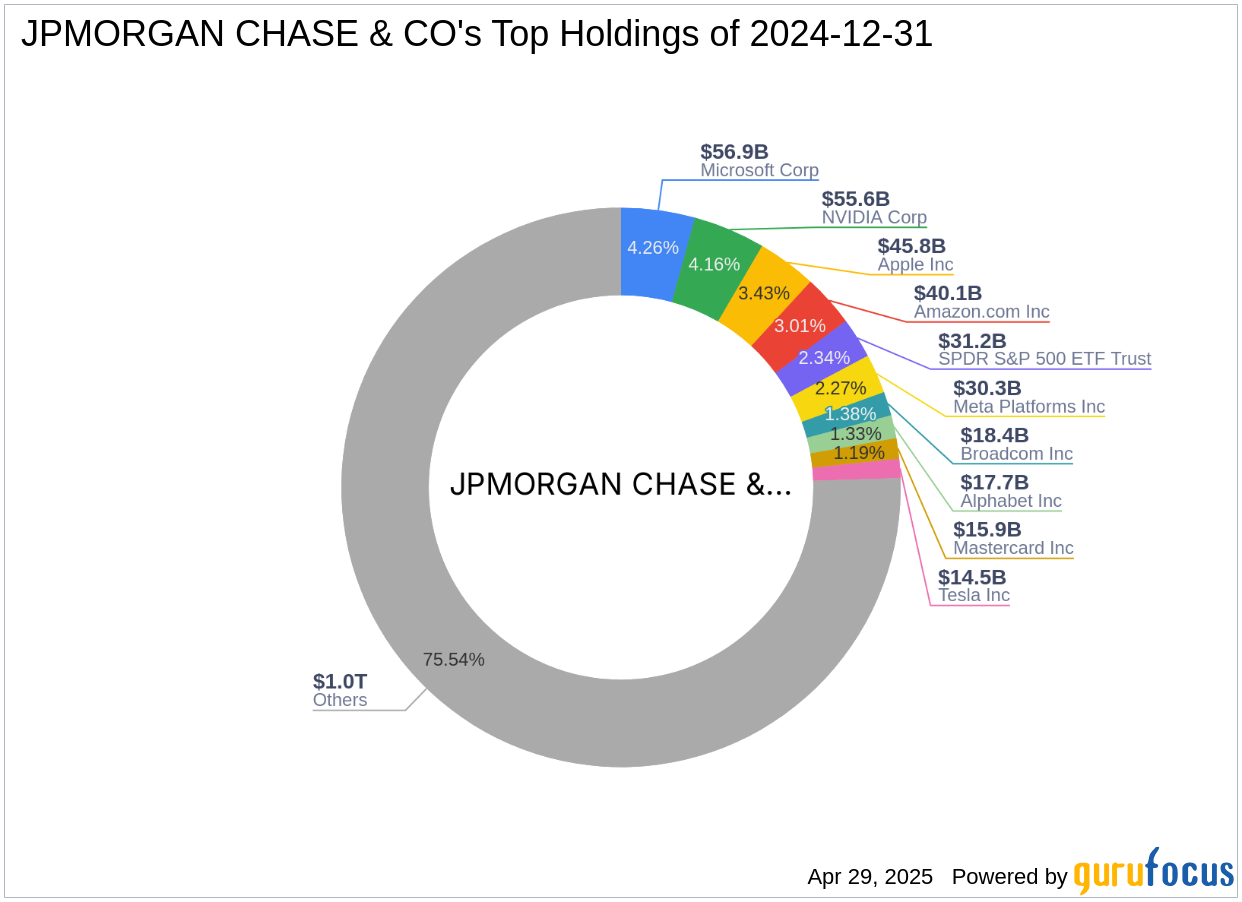

JPMorgan Chase & Co. is one of the world's oldest and largest financial institutions, with a history dating back to 1799. The firm operates in over 60 countries and focuses on six major business areas, including investment banking and asset management. With a robust presence in the financial sector, JPMorgan Chase & Co. serves millions of clients globally, managing $2.6 trillion in total assets. The firm's top holdings include SPDR S&P 500 ETF Trust (SPY, Financial), Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial).

Seagate Technology Holdings PLC: A Leader in Data Storage

Seagate Technology, headquartered in Singapore, is a leading supplier of hard disk drives for data storage. The company operates in a duopoly with Western Digital and is involved in the manufacture and distribution of storage solutions. Seagate Technology has a market capitalization of $17.28 billion and a current stock price of $81.6. Despite being modestly overvalued with a GF Value of $73.02 and a Price to GF Value ratio of 1.12, the company remains a key player in the hardware industry.

Impact of the Transaction on JPMorgan Chase & Co.'s Portfolio

The transaction had a minimal impact on JPMorgan Chase & Co.'s portfolio, with a trade impact of 0.01. The current position of Seagate Technology in the firm's portfolio is 0.12, while the stock represents 8.90% of the firm's holdings. This indicates that while the transaction is significant, it does not drastically alter the overall composition of the firm's investment portfolio. The addition of Seagate Technology shares aligns with JPMorgan Chase & Co.'s strategy to maintain a diversified portfolio with a focus on technology and financial services.

Financial Metrics and Valuation of Seagate Technology

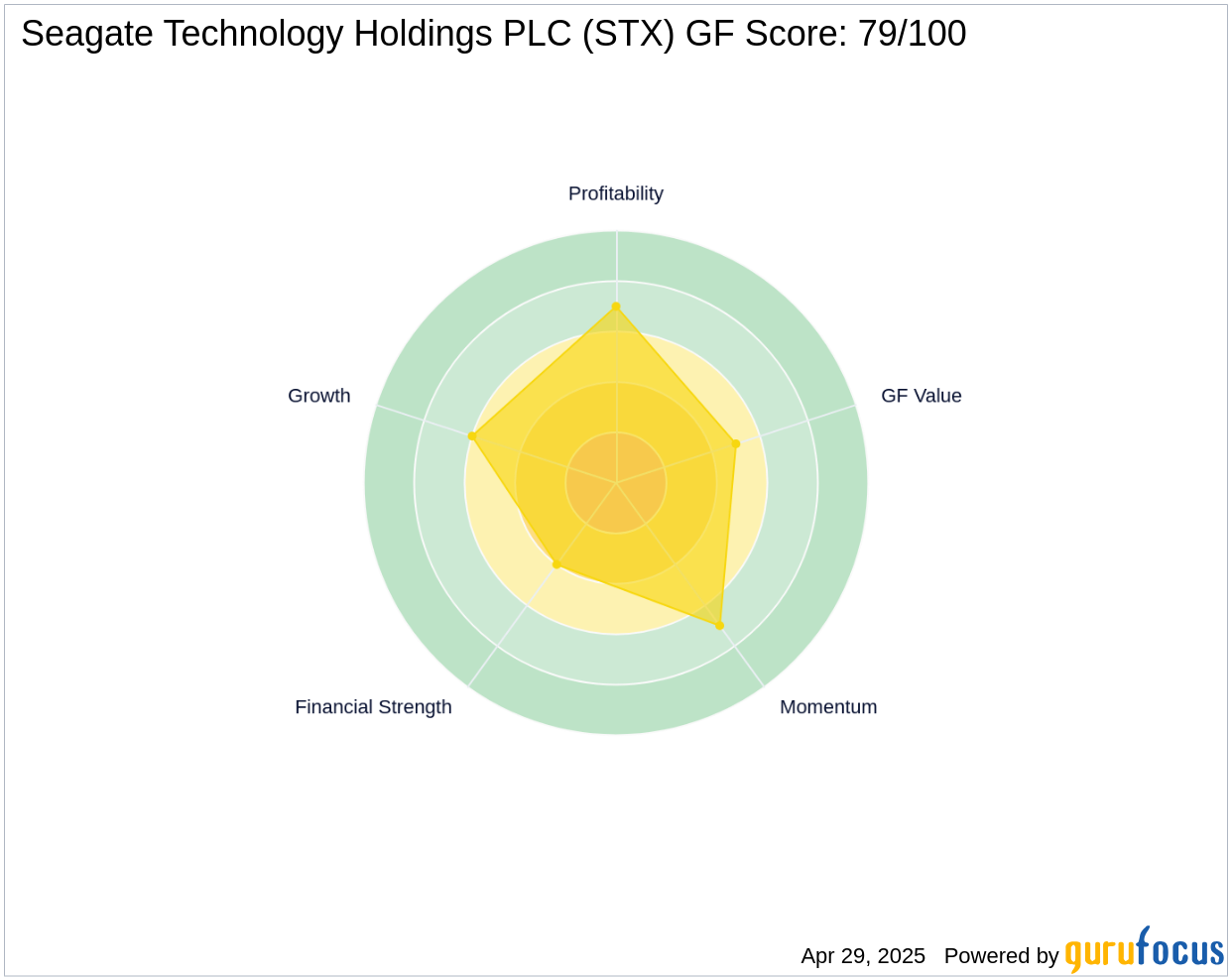

Seagate Technology's financial metrics reveal a mixed performance. The company's [GF Score](https://www.gurufocus.com/term/gf-score/STX) is 79/100, indicating likely average performance. Over the past three years, Seagate Technology has experienced negative growth in revenue, EBITDA, and earnings, with a revenue growth rate of -10.80%. The company's [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/STX) is 7/10, and its [Growth Rank](https://www.gurufocus.com/term/rank-growth/STX) is 6/10, reflecting challenges in maintaining growth momentum.

Other Notable Holders of Seagate Technology

Gotham Asset Management, LLC is the largest holder of Seagate Technology shares, indicating strong institutional interest in the company. Other firms, such as Jefferies Group (Trades, Portfolio), also hold positions in Seagate Technology, further underscoring the stock's appeal among institutional investors. This widespread interest suggests confidence in Seagate Technology's long-term potential despite recent performance challenges.

Conclusion

JPMorgan Chase & Co.'s acquisition of additional shares in Seagate Technology Holdings PLC reflects a strategic move to strengthen its position in the data storage sector. While the transaction's impact on the firm's portfolio is minimal, it aligns with JPMorgan Chase & Co.'s broader investment strategy. Seagate Technology's current valuation and financial metrics present both opportunities and challenges, making it a stock to watch for value investors. As the company navigates its growth trajectory, its performance will be closely monitored by institutional investors and market analysts alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: