Key Highlights:

- LifeMD, Inc. expands its virtual care by collaborating with NovoCare Pharmacy for easier access to Wegovy.

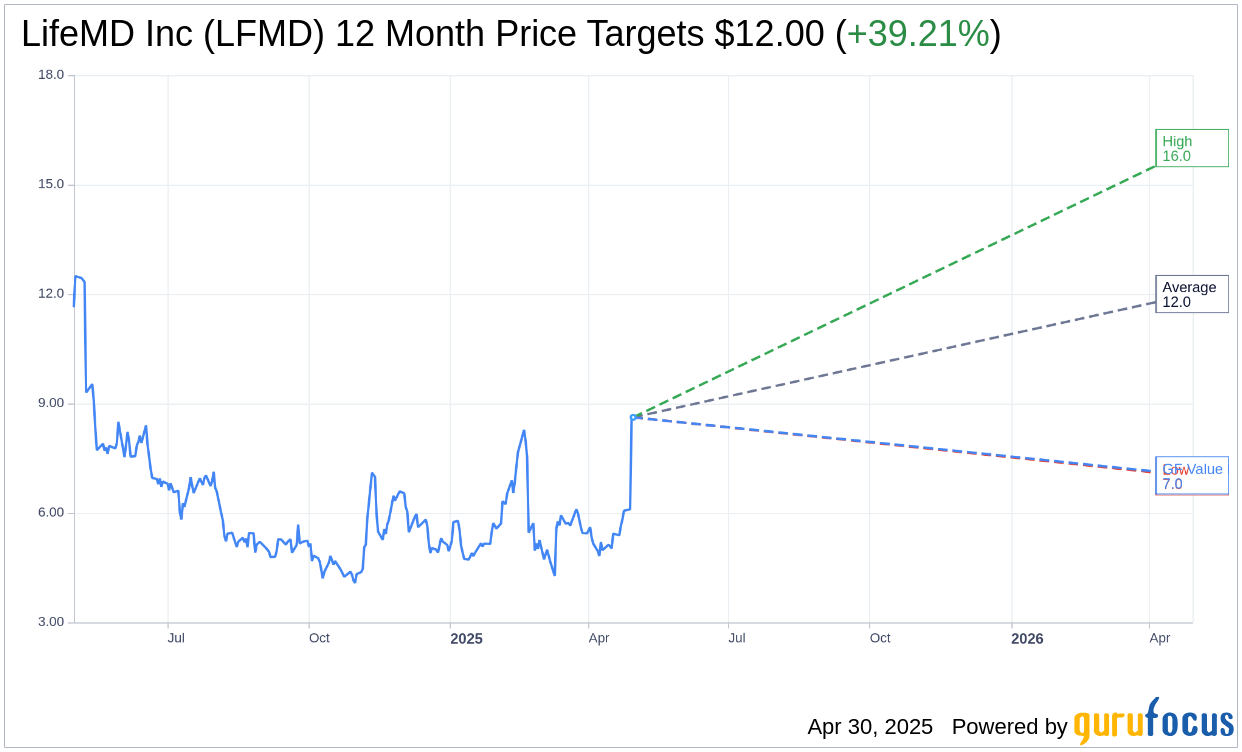

- Analysts project a 39.21% upside potential for LifeMD Inc (LFMD, Financial) with an average target price of $12.00.

- LifeMD currently holds an "Outperform" status with a brokerage recommendation of 2.0.

LifeMD, Inc. (LFMD) is making notable strides in the healthcare sector by broadening its virtual primary care services. Through a strategic collaboration with NovoCare Pharmacy, LifeMD is facilitating more accessible and affordable access to Wegovy, a highly sought-after anti-obesity drug. This integration is designed to streamline the patient experience by offering Wegovy at competitive rates directly from LifeMD's platform.

Wall Street Analysts Forecast

According to one-year price targets from 9 analysts, the average target price set for LifeMD Inc (LFMD, Financial) is $12.00. This suggests a potential upside of 39.21% from the stock's current trading price of $8.62. The highest price target stands at $16.00, while the lowest is $7.00. For more detailed insights into these estimates, visit the LifeMD Inc (LFMD) Forecast page.

LifeMD's stock enjoys a favorable "Outperform" status based on the consensus recommendation from 9 brokerage firms. On a rating scale from 1 to 5, where 1 denotes Strong Buy and 5 indicates Sell, LifeMD scores an average recommendation of 2.0, suggesting positive market sentiment towards its growth prospects.

Despite this optimistic outlook, GuruFocus estimates suggest caution. The estimated GF Value for LifeMD Inc (LFMD, Financial) in one year is $7.03, indicating a potential downside of 18.45% from the current price. The GF Value reflects GuruFocus' assessment of the stock's fair trading value, derived from historical trading multiples and projections of the company's future performance. To explore these calculations further, please visit the LifeMD Inc (LFMD) Summary page.