- Stellantis reports a 14% drop in Q1 net revenues due to decreased shipments and unfavorable pricing.

- Analysts project a potential 35.71% upside for Stellantis stock with a one-year target price of $13.01.

- GuruFocus estimates a significant 92.6% upside based on the GF Value metric for Stellantis.

Stellantis (STLA, Financial) recently announced its first-quarter performance, revealing a 14% decline in net revenues, amounting to €35.8 billion. This downturn is attributed mainly to reduced shipments and less favorable pricing conditions. Notably, the company reported shipments of 1,217,000 units, marking a 9% reduction, significantly influenced by diminished production in North America. Amid growing uncertainties surrounding tariffs, Stellantis has opted to pause its 2025 financial outlook.

Wall Street Analysts Forecast

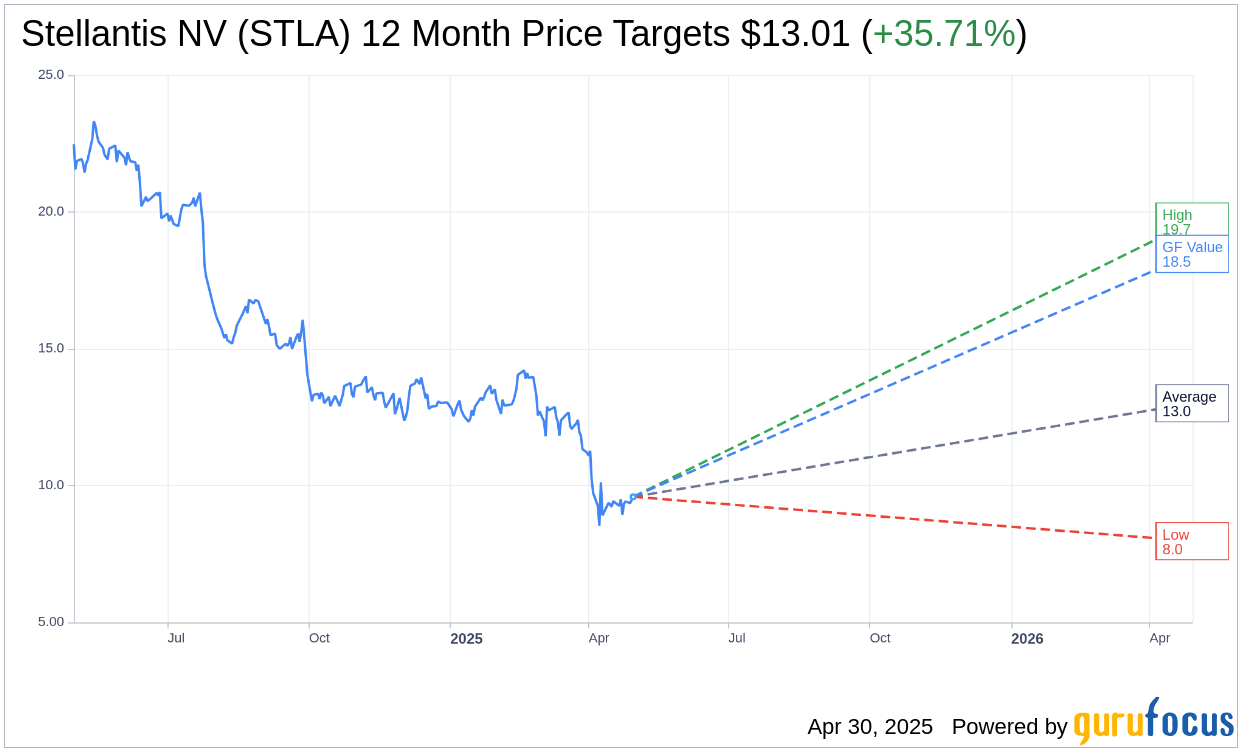

Turning to market projections, 9 analysts have set their one-year price targets for Stellantis NV (STLA, Financial), with the average target price set at $13.01. This includes a high estimate of $19.65 and a low of $7.97. Such projections suggest a potential 35.71% upside from the current trading price of $9.59. For more comprehensive estimation data, please visit the Stellantis NV (STLA) Forecast page.

In terms of brokerage recommendations, the consensus among 11 firms positions Stellantis NV (STLA, Financial) with an average recommendation score of 2.8, signaling a "Hold" status. This rating is derived from a scale where 1 represents a Strong Buy and 5 denotes a Sell.

Delving into GuruFocus metrics, the GF Value for Stellantis NV (STLA, Financial) projects an estimated value of $18.47 in one year, indicating an impressive potential 92.6% upside based on the current price point of $9.59. The GF Value metric is GuruFocus's assessment of a stock's fair market value, calculated through historical multiples and projected business performance. For further insights and data, please explore the Stellantis NV (STLA) Summary page.