Trane Technologies (TT, Financial) reported an impressive first-quarter revenue of $4.69 billion, surpassing the anticipated $4.46 billion. The company attributes this success to its purpose-driven strategy, which has consistently delivered positive results. Despite challenging macroeconomic conditions, Trane's effective business operations have ensured continued strong demand for their innovative solutions.

The company experienced significant order growth during the first quarter, achieving a record-breaking level of bookings in its Americas commercial HVAC sector. This surge further bolsters their backlog, affirming the company's robust financial standing and market position.

With these achievements, Trane Technologies remains confident in meeting its full-year financial targets, aiming for performance at the higher end of its forecasted range. The firm anticipates delivering exceptional value to shareholders over the long term, supported by its innovation leadership and strategic backlog management.

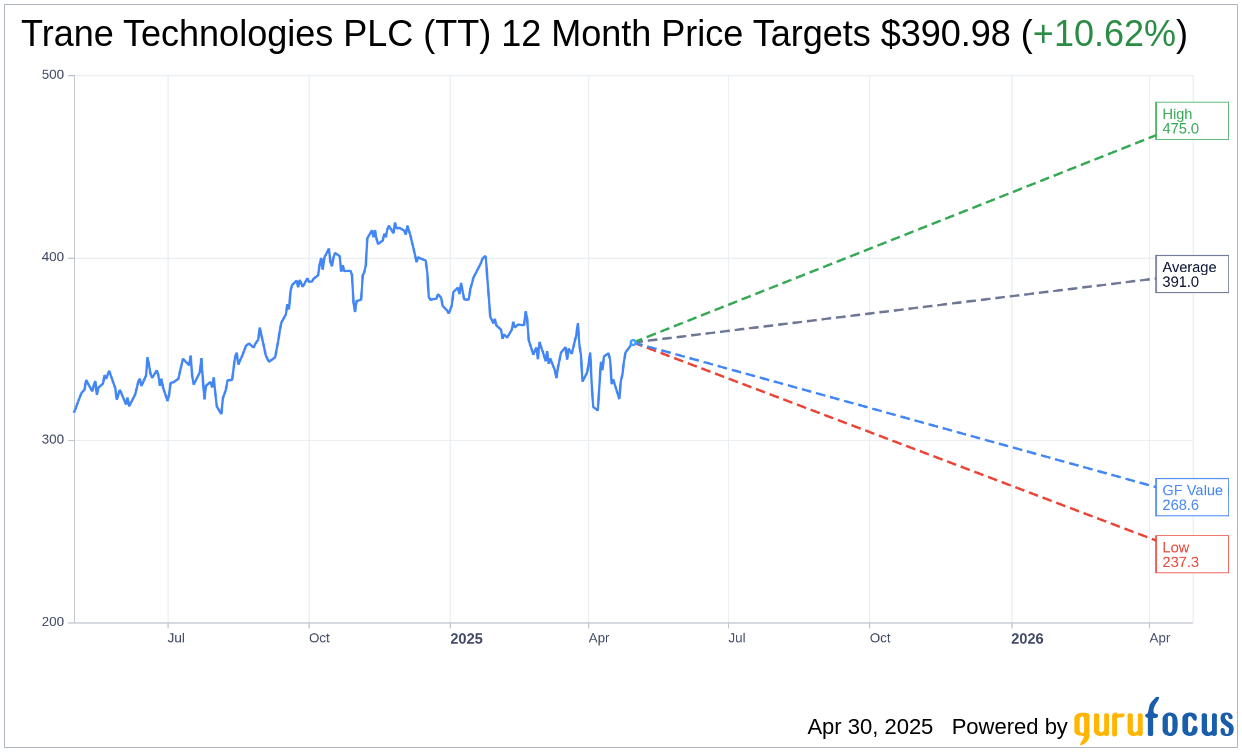

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Trane Technologies PLC (TT, Financial) is $390.98 with a high estimate of $475.00 and a low estimate of $237.34. The average target implies an upside of 10.62% from the current price of $353.44. More detailed estimate data can be found on the Trane Technologies PLC (TT) Forecast page.

Based on the consensus recommendation from 26 brokerage firms, Trane Technologies PLC's (TT, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Trane Technologies PLC (TT, Financial) in one year is $268.64, suggesting a downside of 23.99% from the current price of $353.44. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Trane Technologies PLC (TT) Summary page.

TT Key Business Developments

Release Date: January 30, 2025

- Organic Revenue Growth: 10% in Q4 2024.

- Adjusted EBITDA Margin Expansion: 110 basis points in Q4 2024.

- Adjusted EPS Growth: 20% in Q4 2024.

- Free Cash Flow: $2.8 billion for 2024, with 109% free cash flow conversion.

- Organic Revenue Growth (Full Year 2024): 12%.

- Adjusted EPS Growth (Full Year 2024): 24%.

- Organic Bookings Growth (Full Year 2024): 11%.

- Backlog: $6.75 billion entering 2025.

- Commercial HVAC Bookings (Americas & EMEA): Up more than 30% on a three-year stack in Q4 2024.

- Commercial HVAC Revenue (Americas): Up mid-50% on a three-year stack in Q4 2024.

- Commercial HVAC Revenue (EMEA): Up more than 60% on a three-year stack in Q4 2024.

- Applied Systems Revenue Growth (Americas): Up over 120% on a three-year stack.

- Applied Systems Revenue Growth (EMEA): Up over 90% on a three-year stack.

- Transport Refrigeration Revenue (Americas): Down low teens in Q4 2024.

- Transport Refrigeration Bookings (Americas): Down high 20s in Q4 2024.

- Organic Revenue Growth (Asia Pacific): Up 1% in Q4 2024.

- 2025 Guidance - Organic Revenue Growth: 7% to 8%.

- 2025 Guidance - Adjusted EPS: $12.70 to $12.90, representing 13% to 15% growth.

- 2025 Guidance - Free Cash Flow Conversion: 100% or greater.

- Q1 2025 Guidance - Organic Revenue Growth: 6% to 7%.

- Q1 2025 Guidance - Adjusted EPS: $2.15 to $2.20.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Trane Technologies PLC (TT, Financial) reported a strong financial performance for the fourth quarter of 2024, with 10% organic revenue growth and a 20% increase in adjusted EPS.

- The company achieved a high free cash flow conversion rate of 109%, enabling strategic M&A investments and significant cash returns to shareholders through dividends and share repurchases.

- Trane Technologies PLC (TT) experienced robust growth in its Commercial HVAC segment, with bookings in the Americas and EMEA up more than 30% on a three-year stack.

- The company is well-positioned for future growth with a highly elevated backlog of $6.75 billion entering 2025, providing strong visibility into the upcoming year.

- Trane Technologies PLC (TT) continues to invest in innovation and sustainability, enhancing its competitive advantage and driving strong demand for its solutions.

Negative Points

- Transport refrigeration bookings were down significantly, reflecting the inherent lumpiness associated with the timing of large customer orders in this business.

- The company faced challenges in the Asia Pacific region, particularly in China, where bookings and revenues declined due to tightened credit policies.

- Trane Technologies PLC (TT) anticipates a flat to slightly down residential market in the first quarter of 2025 due to the impact of a prebuy in late 2024.

- The company expects transport markets to remain flat or slightly down in 2025, with a recovery not anticipated until the second half of the year.

- Currency fluctuations and normalization of transport businesses contributed to a $0.5 billion adjustment in the company's backlog.