Stephens has adjusted its price target for Builders FirstSource (BLDR, Financial), reducing it from $160 to $145, while maintaining an Overweight rating on the stock. The firm anticipates ongoing challenges in demand and margin pressures in the first quarter, extending through 2025. Analysts note that while the housing market activity may remain subdued, coupled with heightened pricing competition during this period, the company's margins are expected to stay above historical norms until demand stabilizes. This outlook was shared in a recent market preview, highlighting the firm's cautious optimism despite current market conditions.

Wall Street Analysts Forecast

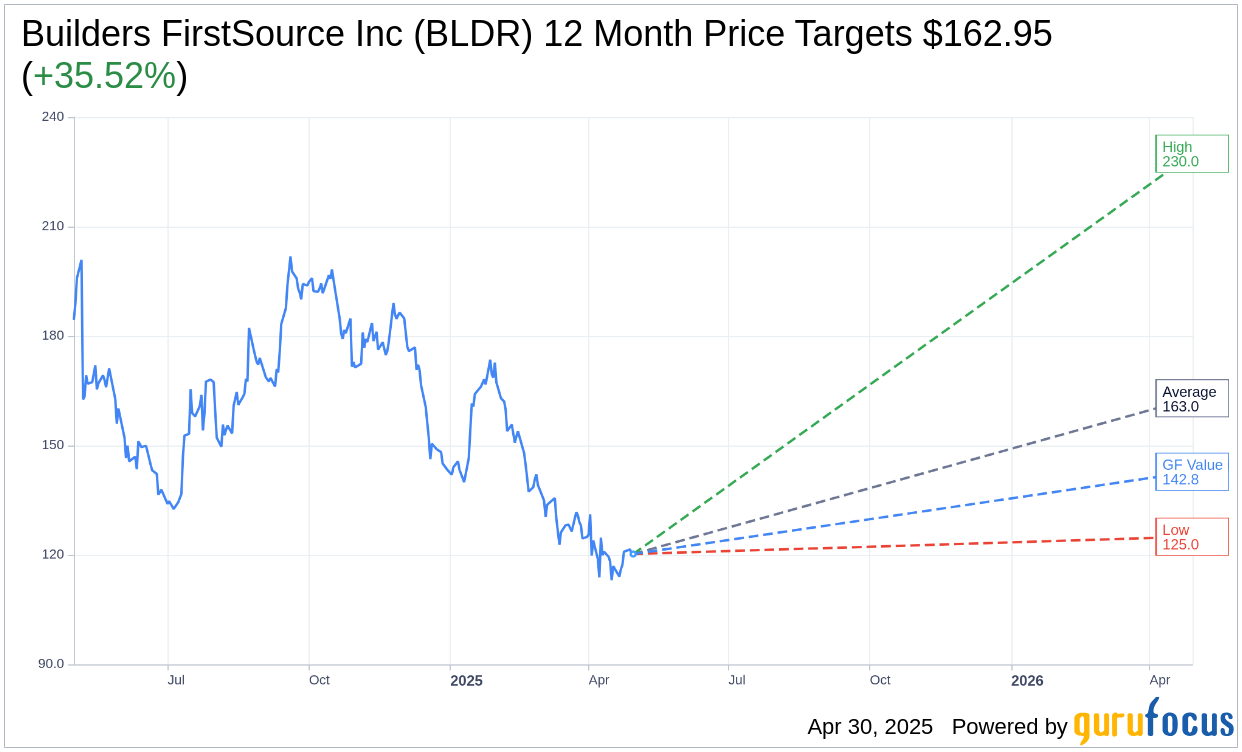

Based on the one-year price targets offered by 20 analysts, the average target price for Builders FirstSource Inc (BLDR, Financial) is $162.95 with a high estimate of $230.00 and a low estimate of $125.00. The average target implies an upside of 35.52% from the current price of $120.24. More detailed estimate data can be found on the Builders FirstSource Inc (BLDR) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Builders FirstSource Inc's (BLDR, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Builders FirstSource Inc (BLDR, Financial) in one year is $142.82, suggesting a upside of 18.78% from the current price of $120.24. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Builders FirstSource Inc (BLDR) Summary page.

BLDR Key Business Developments

Release Date: February 20, 2025

- Net Sales: Decreased 8% to $3.8 billion in Q4 2024.

- Gross Margin: 32.3% in Q4 2024, down 300 basis points year-over-year.

- Adjusted EBITDA: $494 million in Q4 2024, down 28% year-over-year.

- Adjusted EBITDA Margin: 12.9% in Q4 2024, down 360 basis points year-over-year.

- Adjusted EPS: $2.31 in Q4 2024, a decrease of 35% year-over-year.

- Operating Cash Flow: $1.9 billion for 2024, a decrease of approximately $400 million.

- Free Cash Flow: Approximately $1.5 billion for 2024.

- Capital Expenditures: $367 million for 2024.

- Acquisitions: 13 acquisitions in 2024 with prior year sales of roughly $420 million.

- Share Repurchases: $1.5 billion in 2024, removing roughly 7% of shares outstanding.

- 2025 Net Sales Guidance: $16.5 billion to $17.5 billion.

- 2025 Adjusted EBITDA Guidance: $1.9 billion to $2.3 billion.

- 2025 Free Cash Flow Guidance: $600 million to $1 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Builders FirstSource Inc (BLDR, Financial) demonstrated resilience with a mid-teens adjusted EBITDA margin and nearly 33% gross margin in 2024.

- The company invested over $75 million in value-added facilities, opening new truss manufacturing facilities and upgrading existing ones, which fueled strong organic growth.

- Digital sales saw an increase of $134 million in 2024, with expectations for an additional $200 million in 2025.

- Builders FirstSource Inc (BLDR) completed 13 acquisitions in 2024, expanding its footprint and enhancing value-added offerings.

- The company maintained a strong balance sheet with a net debt to adjusted EBITDA ratio of approximately 1.5 times and no long-term debt maturities until 2030.

Negative Points

- Net sales decreased by 8% in the fourth quarter due to lower core organic sales and commodity deflation.

- Multifamily sales declined by 29% amid muted activity levels, posing a headwind for 2025.

- Single-family starts pulled back due to affordability challenges and uncertainty around potential policy changes.

- The company faced competitive pressures on margins, particularly in the single-family segment.

- Extreme weather and California wildfires impacted sales, with an estimated $80 million loss in the first quarter of 2025.