Canaccord has revised its price target for Tenable (TENB, Financial), adjusting it downwards from $53 to $45, while maintaining a Buy rating on the stock. The adjustment follows Tenable's robust performance in the first quarter, where the company exceeded all projected metrics despite a challenging macroeconomic environment.

However, the first quarter also revealed that revenue from federal sources was weaker than anticipated. This outcome aligned with previous management cautions about this segment. Despite this soft spot, the overall quarterly results were considered strong.

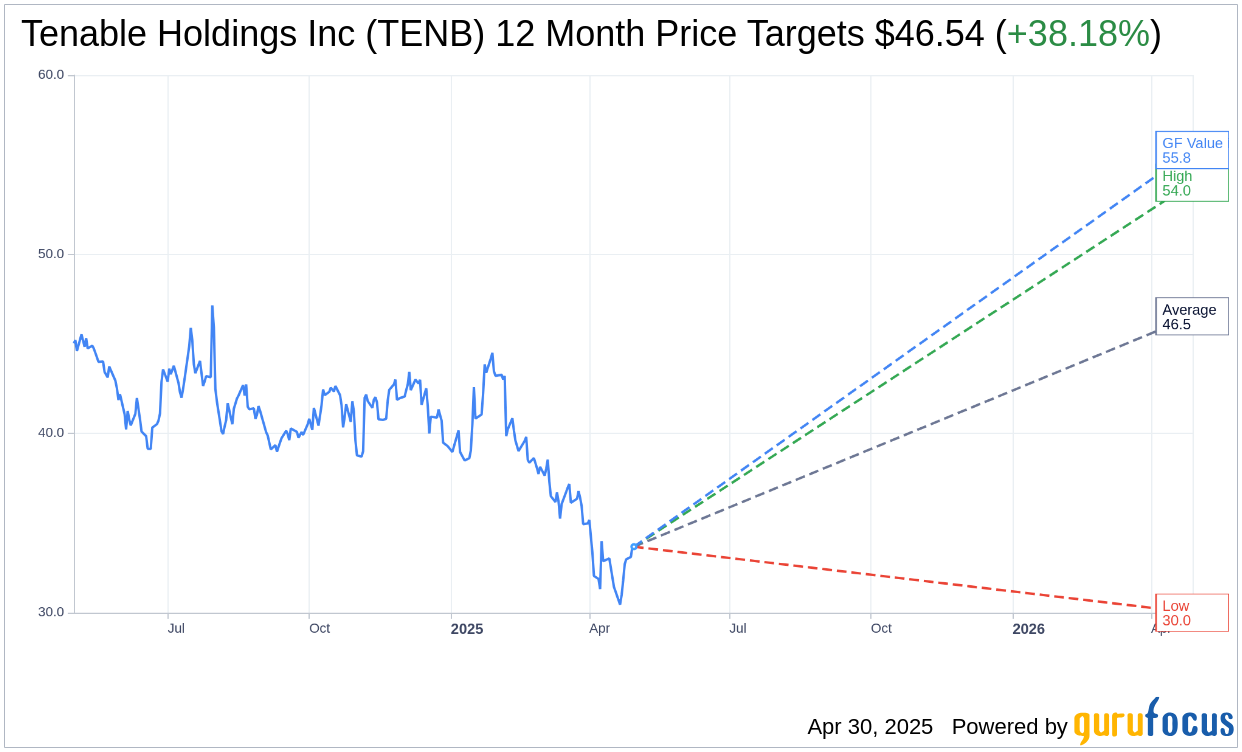

Wall Street Analysts Forecast

Based on the one-year price targets offered by 20 analysts, the average target price for Tenable Holdings Inc (TENB, Financial) is $40.79 with a high estimate of $54.00 and a low estimate of $28.00. The average target implies an upside of 21.10% from the current price of $33.68. More detailed estimate data can be found on the Tenable Holdings Inc (TENB) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, Tenable Holdings Inc's (TENB, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Tenable Holdings Inc (TENB, Financial) in one year is $55.82, suggesting a upside of 65.74% from the current price of $33.68. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Tenable Holdings Inc (TENB) Summary page.

TENB Key Business Developments

Release Date: April 29, 2025

- Revenue: $239.1 million, representing 11% year-over-year growth.

- Gross Margin: 82%, consistent with the previous quarter.

- Operating Margin: 20%, approximately 300 basis points better than the midpoint of the guided range.

- EPS: $0.36 per share, $0.095 better than the midpoint of the guided range.

- Unlevered Free Cash Flow: $87 million, a record for the quarter.

- Calculated Current Billings: $215.4 million, 9% year-over-year growth.

- Current RPO Growth: 13% year-over-year.

- Net Dollar Expansion Rate: 108%.

- Sales and Marketing Expense: $85.5 million, 36% of revenue.

- R&D Expense: $39 million, 16% of revenue.

- G&A Expense: $22.7 million, 9% of revenue.

- Cash and Short-term Investments: $460 million.

- Deferred Revenue: $808 million, with $633 million current deferred revenue.

- Share Repurchase: 1.6 million shares for $60 million during the quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Tenable Holdings Inc (TENB, Financial) reported 11% year-over-year revenue growth, exceeding their guided range by $5.1 million.

- The company achieved a 36% unlevered free cash flow margin, reflecting strong operating leverage.

- Tenable One platform drove significant sales acceleration, with the best quarter ever for seven-figure wins.

- The company is making progress in expanding integrations with third-party tools and data sources, enhancing their platform's capabilities.

- Tenable Holdings Inc (TENB) is seeing strong momentum in cloud security and exposure management, with a notable increase in AI-related application detections.

Negative Points

- The company expressed caution due to macroeconomic uncertainties, particularly in the US public sector, impacting their guidance.

- Sales and marketing expenses increased, partly due to the annual sales kickoff conference, affecting operating margins.

- R&D expenses rose due to increased personnel costs from the Vulcan acquisition, impacting short-term profitability.

- Tenable Holdings Inc (TENB) faces potential challenges from geopolitical events and policy actions that could lengthen sales cycles.

- The company acknowledged disruptions in the US public sector, particularly on the civilian side, affecting visibility and deal closure timelines.