Larimar Therapeutics (LRMR, Financial) is making significant strides in its clinical development program for nomlabofusp, aiming to deliver a groundbreaking treatment for Friedreich's Ataxia (FA). The company plans to submit a Biologics License Application (BLA) by the end of 2025, targeting accelerated FDA approval. This initiative is backed by comprehensive preclinical and clinical data, and ongoing positive feedback from the FDA aligns with Larimar's strategic approach.

Engagement with the FDA continues under the START pilot program, focusing on the required safety data for the BLA submission. Larimar anticipates launching a global Phase 3 study in mid-2025, following international regulatory consultations on the study protocol. The transition to a lyophilized formulation of nomlabofusp is also expected at that time.

In addition to these developments, Larimar has completed the dosing phase for adolescents in a pharmacokinetic study, with data expected in September 2025. This includes findings from participants receiving a daily 50 mg dose in an ongoing long-term open-label extension study. The company looks forward to these upcoming milestones as it advances nomlabofusp toward potential market registration.

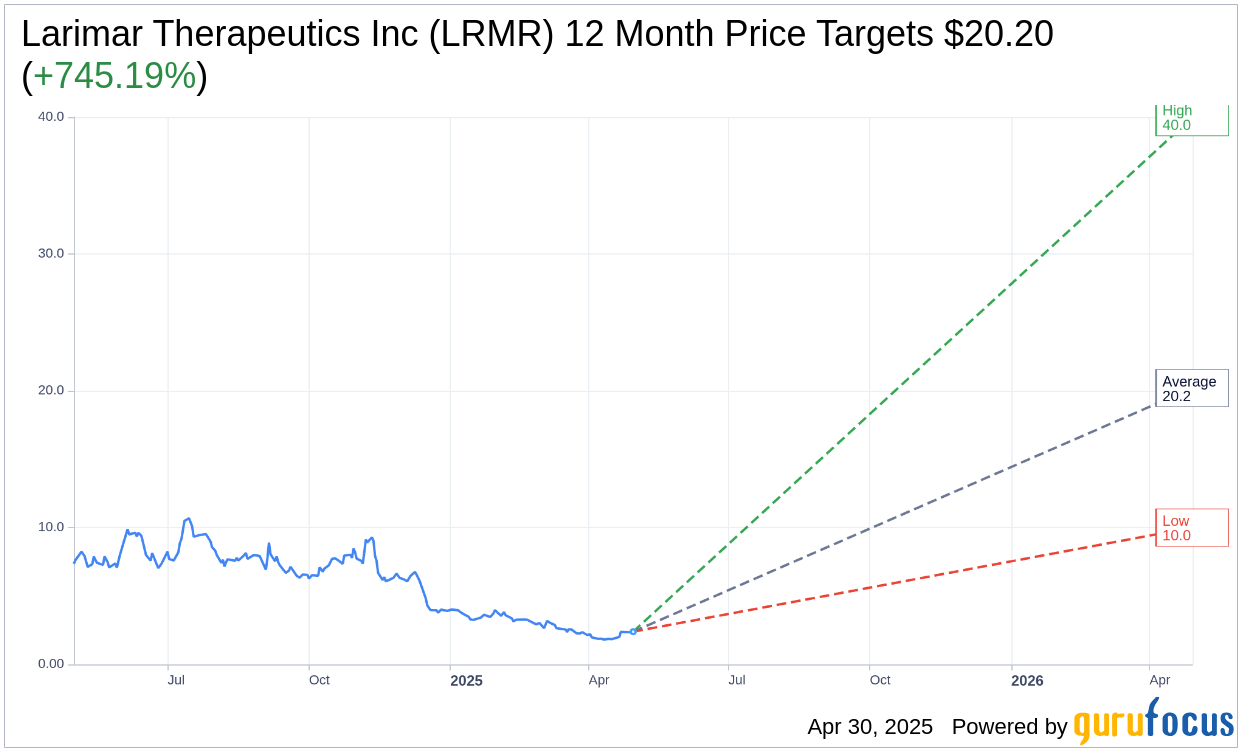

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Larimar Therapeutics Inc (LRMR, Financial) is $20.20 with a high estimate of $40.00 and a low estimate of $10.00. The average target implies an upside of 745.19% from the current price of $2.39. More detailed estimate data can be found on the Larimar Therapeutics Inc (LRMR) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Larimar Therapeutics Inc's (LRMR, Financial) average brokerage recommendation is currently 1.4, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.