- Public Service Enterprise Group (PEG, Financial) exceeds revenue expectations, reporting $3.22 billion.

- Analysts provide an average price target of $87.97, indicating potential upside.

- GF Value suggests a potential downside, estimating fair value at $72.02.

Public Service Enterprise Group (PEG) made headlines with its impressive first-quarter revenue of $3.22 billion, surpassing market expectations by $80 million. The company has also maintained its EPS guidance for 2025, reflecting its strategic confidence. Investors will be pleased to know that a quarterly dividend of $0.63 per share has been declared, marking a notable 5% increase.

Wall Street Analysts Forecast

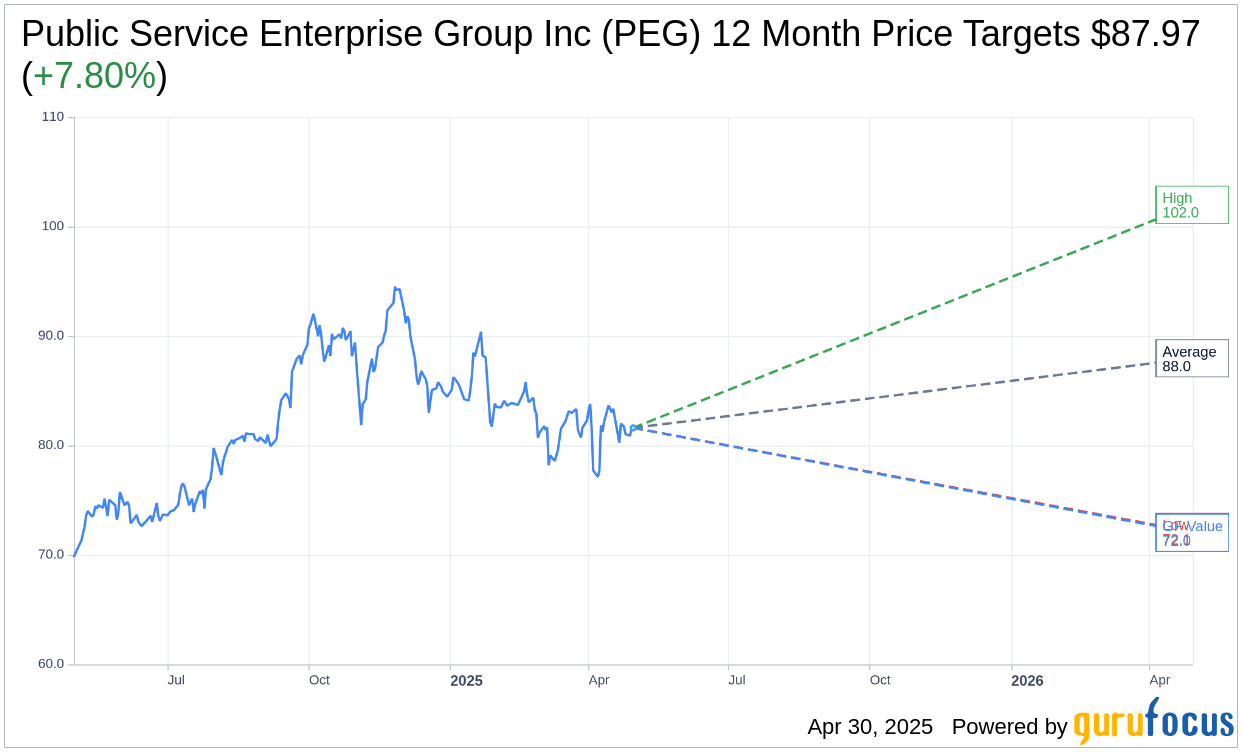

According to projections from 15 Wall Street analysts, Public Service Enterprise Group Inc (PEG, Financial) has an average price target of $87.97. These estimates range from a high of $102.00 to a low of $72.11. This average target price suggests a potential upside of 7.80% from the current trading price of $81.61. For further insights into these estimates, explore the detailed data on the Public Service Enterprise Group Inc (PEG) Forecast page.

Brokerage Recommendations

Public Service Enterprise Group Inc (PEG, Financial) holds an average brokerage recommendation of 2.5, according to assessments from 21 brokerage firms. This rating indicates an "Outperform" status, on a scale where 1 represents a Strong Buy and 5 signifies a Sell.

GuruFocus Analysis

The GF Value for Public Service Enterprise Group Inc (PEG, Financial) is estimated to be $72.02 over the next year. This suggests a potential downside of 11.75% from the current price of $81.61. The GF Value represents GuruFocus' estimation of the stock's fair trading value, calculated based on historical trading multiples, past business growth, and future performance projections. For a more comprehensive analysis of these metrics, visit the Public Service Enterprise Group Inc (PEG) Summary page.