Extreme Networks (EXTR, Financial) experienced robust financial results in the third quarter, with notable sequential revenue increases. This performance was driven by effective execution from the company's team, leading to substantial gains in earnings and positive cash flow. The company is observing rapid expansion in its opportunities and improved conversion rates, which bolster optimism for the upcoming fourth quarter. These developments are expected to contribute to year-over-year revenue growth for the fiscal year.

Looking ahead, EXTR anticipates continued growth in earnings and cash flow. This outlook is supported by the company's increased revenue projections and its strategic approach to managing expenses efficiently.

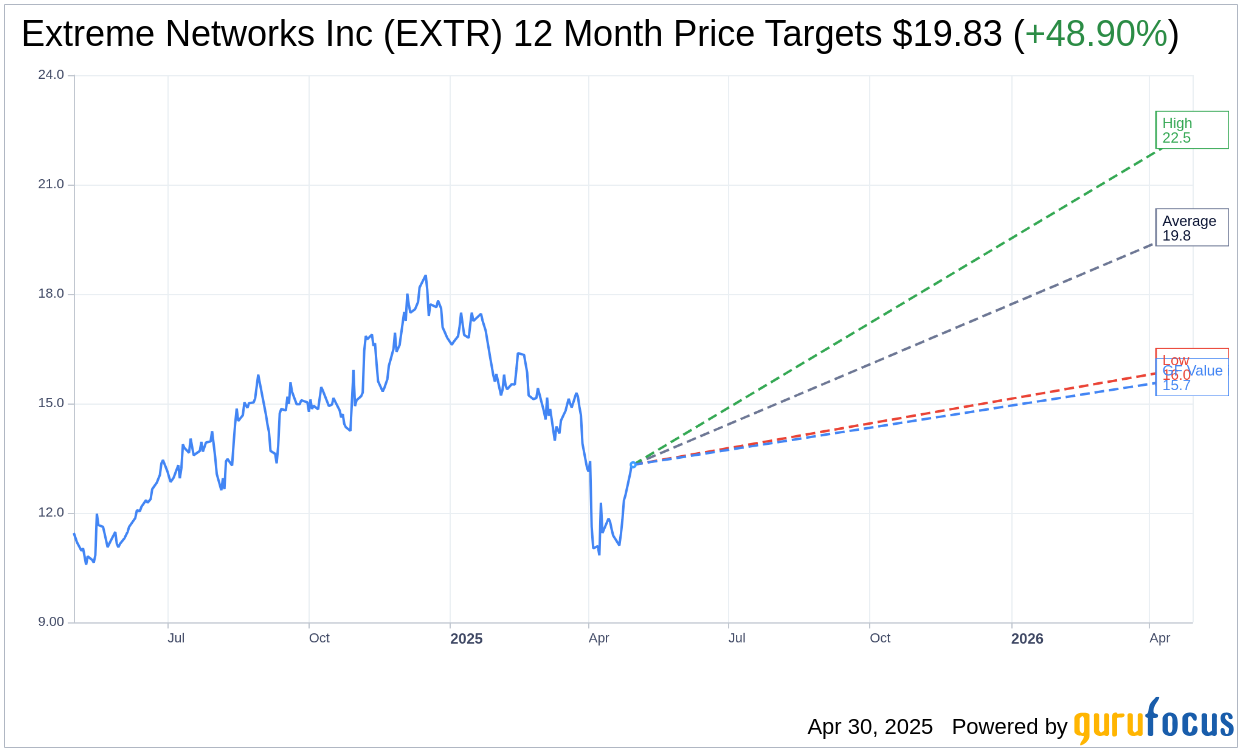

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Extreme Networks Inc (EXTR, Financial) is $19.83 with a high estimate of $22.50 and a low estimate of $16.00. The average target implies an upside of 48.90% from the current price of $13.32. More detailed estimate data can be found on the Extreme Networks Inc (EXTR) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Extreme Networks Inc's (EXTR, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Extreme Networks Inc (EXTR, Financial) in one year is $15.72, suggesting a upside of 18.02% from the current price of $13.32. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Extreme Networks Inc (EXTR) Summary page.

EXTR Key Business Developments

Release Date: January 29, 2025

- Revenue: $279.4 million, up 4% sequentially.

- Earnings Per Share (EPS): $0.21, up 24% from the previous quarter.

- Gross Margin: 63.4%, down 30 basis points sequentially, up 90 basis points year-over-year.

- Operating Expenses: $136 million, down $2 million sequentially and $5 million year-over-year.

- Operating Profit: $41.2 million, 14.7% margin.

- Cash and Net Debt: $170.3 million in cash, net debt of $15 million.

- Free Cash Flow: $16 million in the quarter.

- Subscription and Support Revenue: $107.1 million, consistent with the first quarter.

- Total Deferred Revenue: $589 million, up 7.5% year-over-year.

- Guidance for Q3 Revenue: $276 million to $284 million.

- Guidance for Q3 Gross Margin: 62% to 63%.

- Guidance for Q3 EPS: $0.16 to $0.20.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Extreme Networks Inc (EXTR, Financial) achieved its best quarter of product bookings in five quarters, indicating strong demand and market recovery.

- The company reported a sequential revenue growth for the third consecutive quarter, with a 4% increase driven by a 6% rise in product sales.

- Extreme Networks Inc (EXTR) saw significant growth in its EMEA business both sequentially and year-over-year, showcasing successful market penetration.

- The company is experiencing improved competitive win rates, particularly with larger enterprise customers, leading to meaningful share gains across various verticals.

- The introduction of Extreme Platform ONE, integrating networking and security solutions with AI capabilities, received positive feedback and is expected to drive productivity gains and market differentiation.

Negative Points

- Revenue in the Americas declined sequentially due to seasonality in the K-12 vertical and difficult comparisons with significant deals closed in the previous quarter.

- The company's gross margin slightly decreased by 30 basis points sequentially, attributed to product and subscription mix.

- Operating expenses are expected to increase in the second half of the year, potentially impacting profitability despite a positive revenue outlook.

- The company is still facing challenges in the German market due to a lack of government, affecting business in that region.

- Professional services revenue was down slightly year-over-year, indicating potential challenges in that segment.