In the first quarter, ROCK reported revenue of $290.02 million, slightly under the expected $296.77 million. Despite this, the company saw an 18.8% rise in adjusted earnings per share, while adjusted net sales remained stable. A significant highlight was the backlog, which reached a record $434 million, marking a 30% increase. ROCK's strategy included effective execution of restructuring initiatives and successful integration of the Lane Supply acquisition. Additionally, the company expanded its footprint in the metal roofing market with two new acquisitions in its Residential segment, signifying robust growth and strategic positioning in the industry.

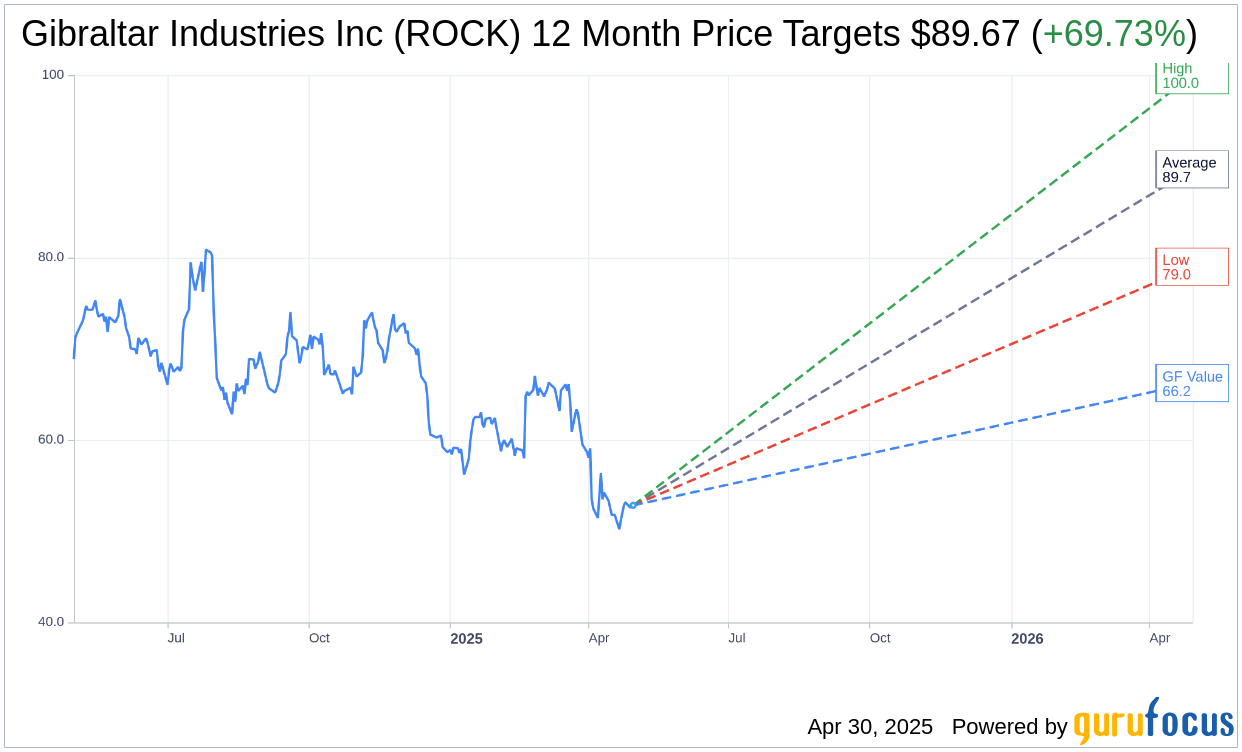

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Gibraltar Industries Inc (ROCK, Financial) is $89.67 with a high estimate of $100.00 and a low estimate of $79.00. The average target implies an upside of 69.73% from the current price of $52.83. More detailed estimate data can be found on the Gibraltar Industries Inc (ROCK) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Gibraltar Industries Inc's (ROCK, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Gibraltar Industries Inc (ROCK, Financial) in one year is $66.24, suggesting a upside of 25.38% from the current price of $52.83. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Gibraltar Industries Inc (ROCK) Summary page.

ROCK Key Business Developments

Release Date: February 19, 2025

- Net Sales (Q4 2024): Decreased 7.9% due to market issues in the renewables business.

- Operating Income (Q4 2024): Improved by 11% or 210 basis points.

- Adjusted EPS (Q4 2024): Increased by 17.4%.

- Adjusted EBITDA Margin (Q4 2024): Improved by 220 basis points.

- Net Sales (Full Year 2024): Decreased 3.9% to $1.31 billion.

- Operating Cash Flow (2024): Generated $174 million.

- Free Cash Flow (2024): $154 million, or 12% of net sales.

- Backlog (Year End 2024): Down 24%.

- Residential Segment Net Sales (Q4 2024): Decreased by $8.6 million or 4.8%.

- Renewables Adjusted Net Sales (Q4 2024): Decreased $16.3 million or 18.8%.

- AgTech Net Sales (Q4 2024): Increased by about 1%.

- Infrastructure Net Sales (Q4 2024): Decreased by $1.3 million.

- Cash on Hand (End of 2024): $270 million.

- Free Cash Flow (2024): 11.8% of sales.

- 2025 Net Sales Guidance: $1.4 billion to $1.45 billion, growth of 8% to 12%.

- 2025 Adjusted Operating Margin Guidance: 13.9% to 14.2%.

- 2025 Adjusted EPS Guidance: $4.80 to $5.05, growth of 13% to 19%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Gibraltar Industries Inc (ROCK, Financial) reported a 17.4% increase in adjusted EPS for the fourth quarter of 2024, demonstrating strong profitability despite a decline in net sales.

- The company achieved a 32% improvement in EBITDA and a 460 basis point increase in EBITDA margin in its residential, agtech, and infrastructure segments.

- Order activity has increased significantly in 2025, with renewables bookings up 33% and AgTech bookings up over 300% compared to the previous year.

- The acquisition of Lane Supply is expected to be accretive in 2025, adding $112 million in net sales and enhancing Gibraltar's AgTech structures business.

- Gibraltar Industries Inc (ROCK) maintains a strong balance sheet with $270 million in cash on hand and no debt, providing flexibility for future investments and share repurchases.

Negative Points

- Net sales for the fourth quarter of 2024 were down 7.9%, primarily due to ongoing challenges in the renewables business.

- The renewables segment experienced an 18.8% decrease in adjusted net sales and a 32% decline in backlog during the quarter.

- The company incurred a $5.3 million non-cash charge related to the discontinuation of legacy trade names in the renewables segment.

- Backlog at year-end was down 24%, with new bookings for renewables and AgTech moving into the first quarter of 2025.

- The residential segment faced a 4.8% decrease in net sales due to point of sale softness and delayed transition of new business.