TD Cowen has revised its price target for Werner (WERN, Financial), reducing it from $33 to $30 while maintaining a Buy rating on the company's shares. This decision follows an operating loss reported by Werner in the first quarter, which significantly deviated from both the firm's projections and general market expectations.

The company's Truckload Transportation Services (TTS) margins further declined during this period, reaching approximately break-even levels. The anticipated decrease in volume hasn't yet been fully realized, indicating challenging conditions ahead for Werner as it navigates an unpredictable spring season.

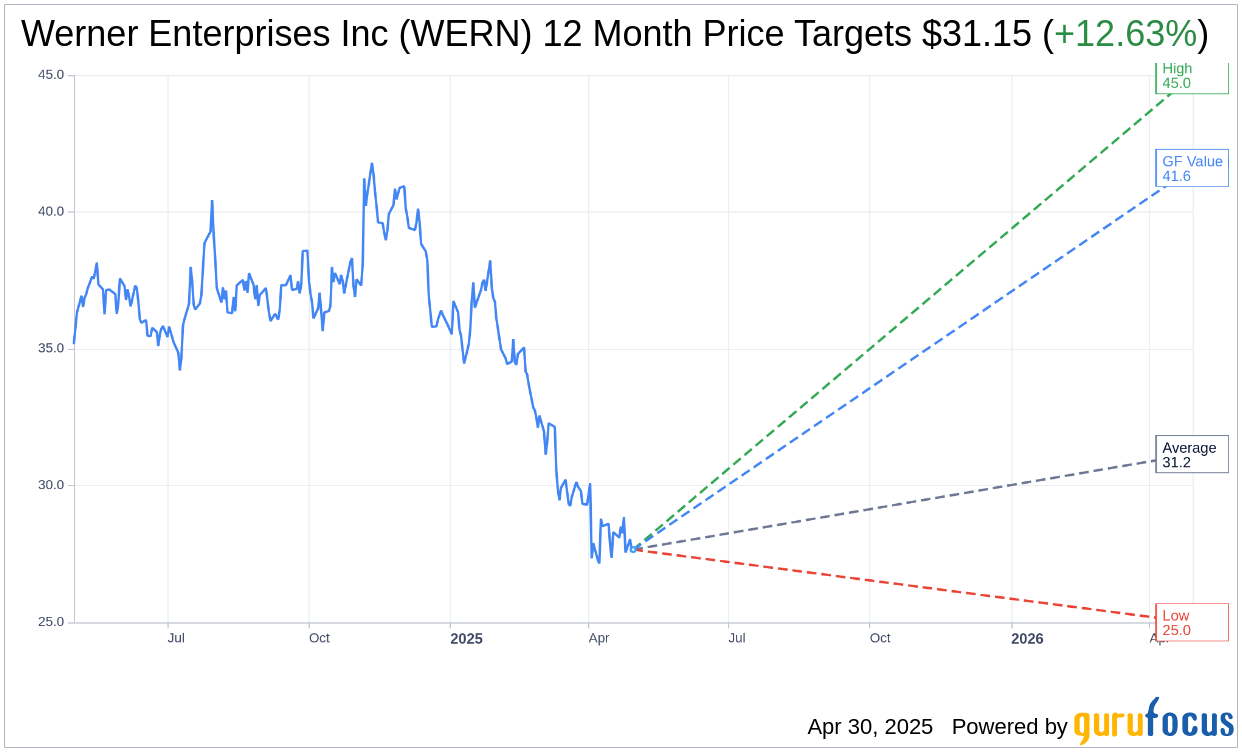

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Werner Enterprises Inc (WERN, Financial) is $31.15 with a high estimate of $45.00 and a low estimate of $25.00. The average target implies an upside of 12.63% from the current price of $27.66. More detailed estimate data can be found on the Werner Enterprises Inc (WERN) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Werner Enterprises Inc's (WERN, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Werner Enterprises Inc (WERN, Financial) in one year is $41.61, suggesting a upside of 50.43% from the current price of $27.66. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Werner Enterprises Inc (WERN) Summary page.

WERN Key Business Developments

Release Date: April 29, 2025

- Revenue: Down 7% year-over-year.

- Adjusted EPS: Negative $0.12, down $0.25 year-over-year.

- Adjusted Operating Margin: 0.3%.

- Adjusted TTS Operating Margin: 0.4% net of fuel surcharges.

- Truckload Transportation Services Revenue: $502 million, down 9%.

- Logistics Revenue: $196 million, down 3% year-over-year.

- Operating Cash Flow: $29 million, 4% of total revenue.

- Free Cash Flow: $37 million, 5% of total revenue.

- Total Liquidity: $777 million at quarter end.

- Debt: $640 million, down $10 million sequentially.

- Net Debt to EBITDA: 1.7 times as of March 31.

- Dedicated Revenue: $279 million, down 7% net of fuel.

- One-Way Truckload Revenue: $154 million, down 9% net of fuel.

- Intermodal Revenue: Increased 14% year-over-year.

- Final Mile Revenue: Decreased 12% year-over-year.

- Equipment Gains: $2.8 million for the quarter.

- Net CapEx: Cash flow positive $8 million.

- Fleet Metrics: TTS average trucks declined to 7,415.

- Cost Savings: $8 million achieved towards a $40 million target for 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Werner Enterprises Inc (WERN, Financial) secured several new dedicated fleet contracts, representing over 200 trucks, which are expected to be implemented in late Q2 and early Q3.

- The company has seen a positive trend in one-way truckload revenue per total mile, marking the third consecutive quarter of improvement.

- Werner Enterprises Inc (WERN) has been recognized as a 2025 TCA elite fleet, highlighting its commitment to providing a top-tier workplace for professional drivers.

- The company has increased its cost savings target for 2025 from $25 million to $40 million, with $8 million already achieved in the first quarter.

- Werner Enterprises Inc (WERN) has a strong liquidity position, with a new $300 million credit facility, allowing for potential share repurchase and M&A opportunities.

Negative Points

- First quarter revenues were down 7% year-over-year, with an adjusted EPS of negative $0.12.

- The company faced elevated insurance costs and claims, impacting adjusted EPS by $0.09, with one significant verdict related to a 2019 incident.

- Extreme weather conditions negatively affected operations, contributing to a $0.04 impact on first quarter EPS.

- Increased IT spending to advance technology strategy and transformation added financial pressure.

- The company experienced isolated operating inefficiencies and lower utilization due to select customer decisions and tariff-induced uncertainty.