Banco Santander Chile (BSAC, Financial) demonstrated a remarkable financial performance as of March 31, 2025, with net income for shareholders reaching $278 billion. This marks a substantial 131% increase compared to the previous year. The return on average equity (ROAE) rose to 25.7%, a significant jump from 11.2% in the same quarter of 2024, driven primarily by improved revenue streams.

Operating income for the bank grew by 33.2% year-over-year, supported by enhanced net interest and readjustment income. When compared to the last quarter of 2024, the bank's net income for shareholders saw a marginal increase of 0.5%. Although the UF variation in the first quarter of 2025 was slightly less than the previous quarter, which affected quarterly readjustment gains, this was counterbalanced by increased fees, better financial transaction results, and improved cost management.

The first quarter of 2025 achieved a ROAE of 25.7%, marking the fourth successive quarter where ROAE exceeded the 20% benchmark. The Common Equity Tier 1 (CET1) ratio stood firm at 10.7%, and the overall Basel III ratio was at 16.9%. Furthermore, the bank's capital planning includes a dividend provision of 70% from 2024 earnings and 60% of 2025 earnings thus far.

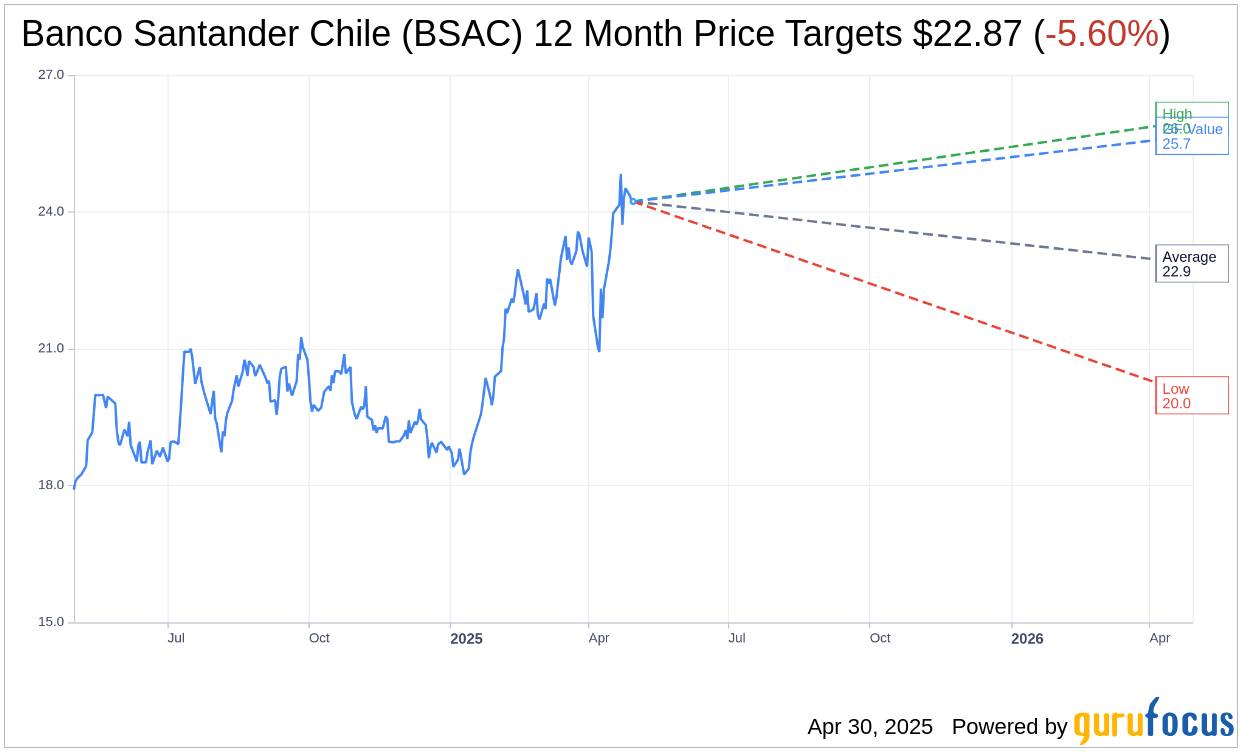

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Banco Santander Chile (BSAC, Financial) is $22.87 with a high estimate of $26.00 and a low estimate of $19.98. The average target implies an downside of 5.60% from the current price of $24.23. More detailed estimate data can be found on the Banco Santander Chile (BSAC) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Banco Santander Chile's (BSAC, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Banco Santander Chile (BSAC, Financial) in one year is $25.67, suggesting a upside of 5.94% from the current price of $24.23. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Banco Santander Chile (BSAC) Summary page.

BSAC Key Business Developments

Release Date: February 07, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Banco Santander Chile (BSAC, Financial) reported a net profit of 865 billion Pesos for 2024, a 73% increase compared to 2023.

- The bank's return on average equity improved to 20.2% for the year, with the fourth quarter reaching 26%.

- Total deposits increased by 5.9% in the fourth quarter, improving the loan to deposit ratio by over 10 percentage points in two years.

- The bank received significant recognition in 2024, being named Best Bank in Chile by Latin Finance and Euromoney.

- Banco Santander Chile (BSAC) successfully migrated its legacy system to the cloud, enhancing digital transformation and platform performance.

Negative Points

- Non-performing loans have been increasing over the year, particularly in mortgage and commercial loan books.

- The bank's cost of risk was 1.3%, with asset quality ratios affected by weaker loan growth.

- Fee income decreased by 5.2% quarter on quarter due to lower collection fees and insurance brokerage.

- The bank set aside provisions for restructuring its branch network and operational risks, impacting total operating expenses.

- The effective tax rate may increase as inflation realigns to the central bank's target.