Key Takeaways:

- Immunic (IMUX, Financial) shares fell significantly in premarket trading following Phase 2 trial results.

- The trial demonstrated a 20% reduction in disability worsening for multiple sclerosis but only a modest brain volume improvement.

- Analysts offer a substantial price target upside, with the stock rated as "Outperform."

Immunic's Phase 2 Trial Results Impact Stock Price

Immunic (IMUX) observed a substantial premarket drop of approximately 22% after unveiling results from their Phase 2 trial of vidofludimus calcium. This trial, focusing on the treatment of multiple sclerosis, highlighted a modest 5% enhancement in brain volume change, yet it successfully achieved a 20% reduction in the risk of disability worsening. Importantly, the drug's safety profiles remained consistent, a vital factor for its continued development and potential approval.

Wall Street Analysts' Price Projections

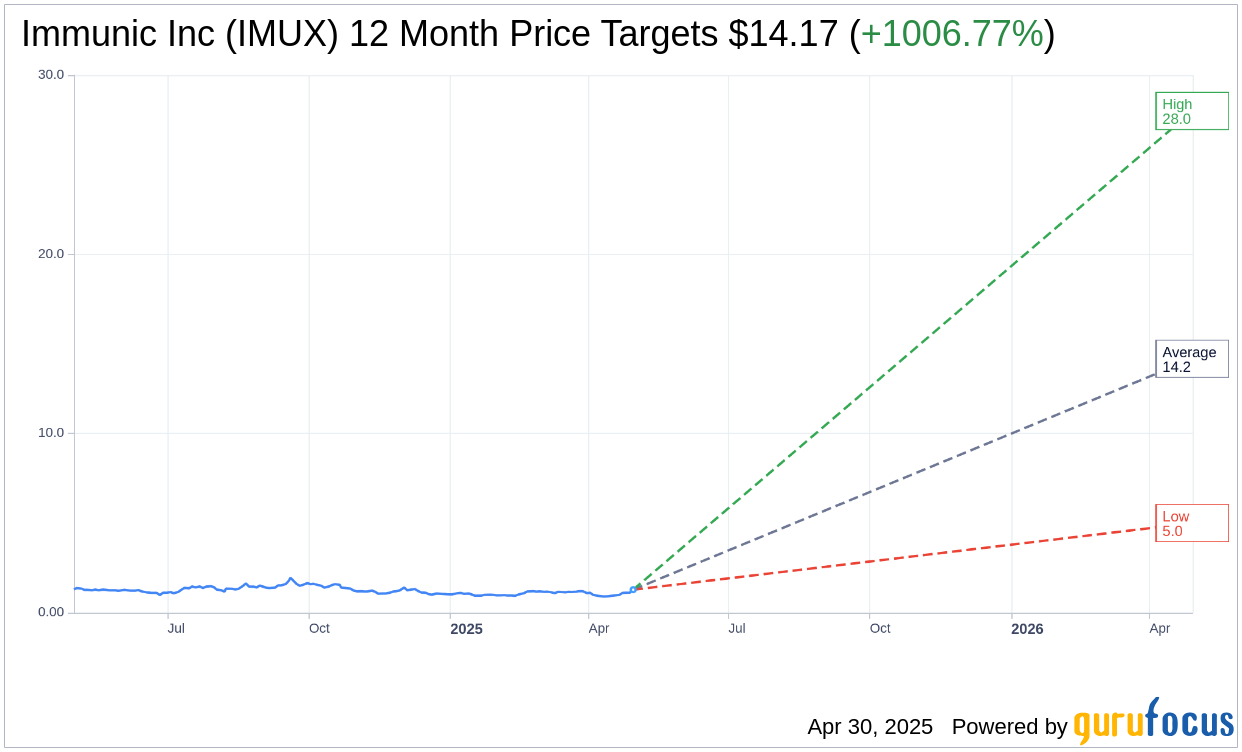

According to insights from six analysts projecting one-year price targets, the average target for Immunic Inc (IMUX, Financial) is $14.17. The high projection reaches $28.00, while the low estimate is set at $5.00. This average target price suggests an impressive potential upside of 1,006.77% from the current price of $1.28. For further detailed analyses and projections, visit the Immunic Inc (IMUX) Forecast page.

Brokerage Consensus and Recommendations

Drawing from the consensus recommendations of seven brokerage firms, Immunic Inc (IMUX, Financial) currently holds an average rating of 1.7, indicating it is "Outperform." This rating is part of a scale where 1 represents a "Strong Buy" and 5 stands for a "Sell." Such a favorable rating reflects confidence among analysts regarding the company's future performance and potential market growth.