RBBN has experienced a change in its stock forecast, with analyst Dave Kang from B. Riley adjusting the price target from $7.50 to $6, while maintaining a Buy rating. This adjustment follows the company's underperformance in the first quarter, attributed primarily to deferred federal and enterprise projects now expected in the second quarter. Despite this setback, the company saw strong orders. For RBBN to achieve a higher stock price, consistent improvement in management execution is deemed necessary by the analyst.

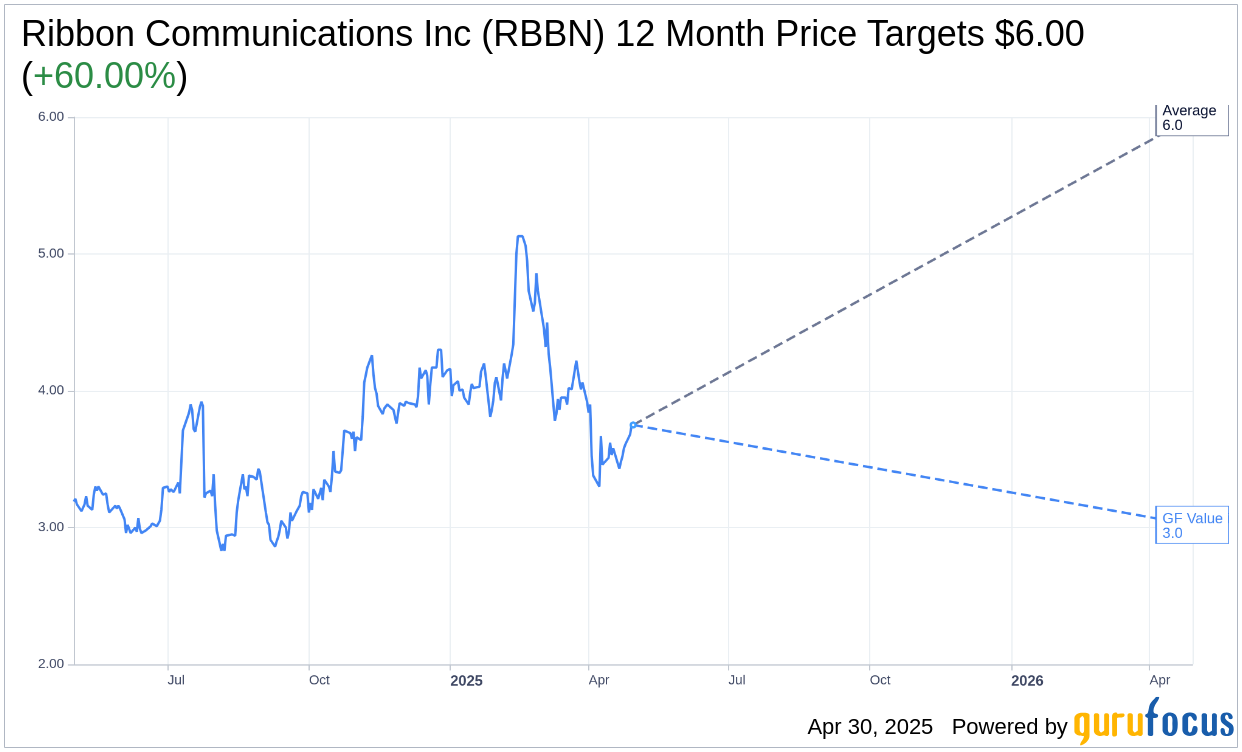

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Ribbon Communications Inc (RBBN, Financial) is $6.00 with a high estimate of $6.00 and a low estimate of $6.00. The average target implies an upside of 60.00% from the current price of $3.75. More detailed estimate data can be found on the Ribbon Communications Inc (RBBN) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Ribbon Communications Inc's (RBBN, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ribbon Communications Inc (RBBN, Financial) in one year is $3.02, suggesting a downside of 19.47% from the current price of $3.75. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ribbon Communications Inc (RBBN) Summary page.

RBBN Key Business Developments

Release Date: April 29, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ribbon Communications Inc (RBBN, Financial) reported a 35% increase in backlog from the same point last year, indicating strong demand.

- The company's cloud and edge business continues to be a growth engine, with sales growing approximately 6% year over year.

- Sales to global service providers were a primary driver of growth, with total cloud and edge revenue increasing approximately 20% year over year.

- Ribbon Communications Inc (RBBN) expects a strong second quarter with sales projected to grow more than 10% year over year.

- The company has a strong presence in Asia, with sales in India increasing 80% year over year, contributing to the highest level in the last five years.

Negative Points

- First quarter sales were flat year over year and lower than expected due to the timing of two enterprise projects.

- Margins in the first quarter were lower than projected, primarily due to the mix of shipments and lower sales volume.

- Cloud and edge sales to enterprise customers were down approximately 23% year over year.

- First quarter non-GAAP gross margin was 48.6%, lower than expected due to higher sales in India and higher cloud and edge hardware shipments.

- The IP optical segment recorded a 6% decrease in revenue year over year, impacted by the suspension of shipments to Eastern Europe.