TD Securities has reduced its target price for Brookfield Asset Management (BAM, Financial) from $68 to $64 while maintaining a Buy rating. This adjustment comes as the firm prepares for its first-quarter analysis. Despite current challenges such as increased market volatility and broader macroeconomic uncertainties, Brookfield has outperformed its peers in the alternative asset management sector so far this year.

The revised outlook by TD Securities takes into account several factors, including a decrease in the market capitalization of Brookfield’s subsidiaries, reduced transaction fees, and the impact of a recent debt issuance. These adjustments reflect the ongoing pressures and shifting dynamics within the market environment, influencing the firm's projections for BAM.

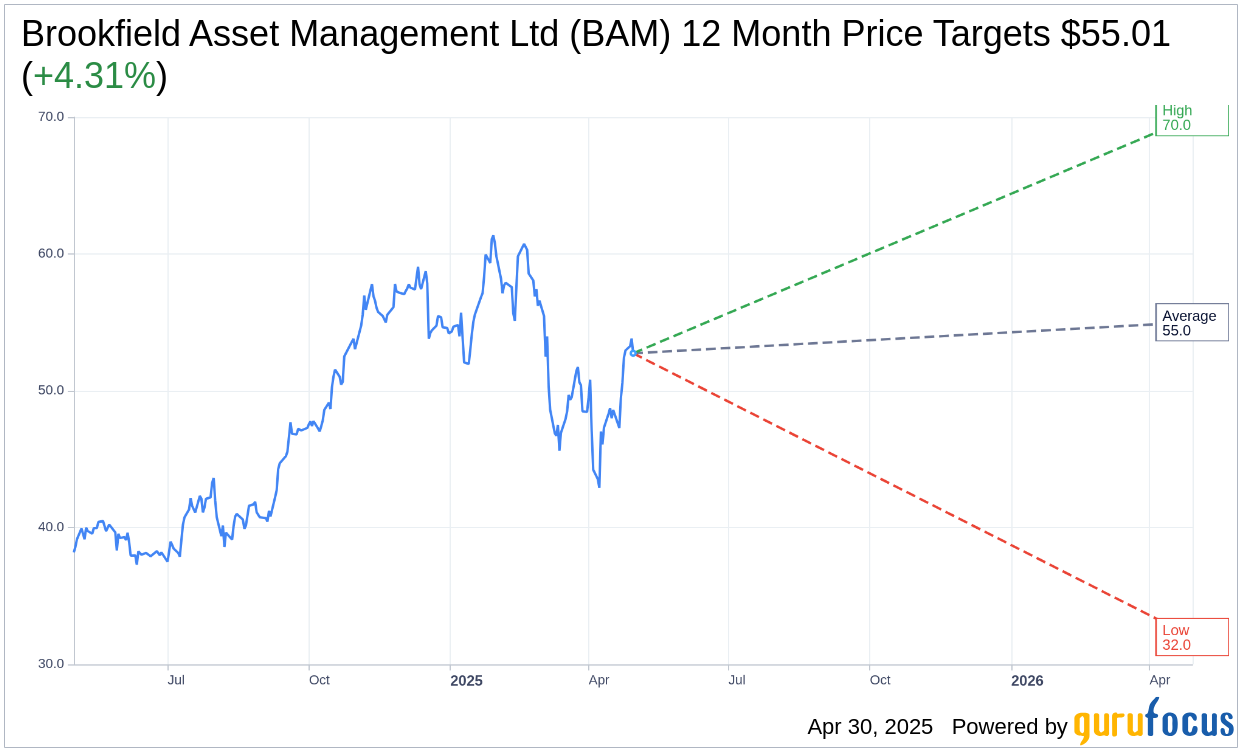

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for Brookfield Asset Management Ltd (BAM, Financial) is $55.01 with a high estimate of $70.00 and a low estimate of $32.00. The average target implies an upside of 4.31% from the current price of $52.74. More detailed estimate data can be found on the Brookfield Asset Management Ltd (BAM) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Brookfield Asset Management Ltd's (BAM, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

BAM Key Business Developments

Release Date: February 12, 2025

- Fee-Related Earnings (FRE): $677 million or $0.42 per share in Q4, up 17% year-over-year; $2.5 billion for the last 12 months.

- Distributable Earnings (DE): $649 million or $0.40 per share in Q4, up 11% year-over-year; $2.4 billion for the last 12 months.

- Fee-Bearing Capital (FBC): Grew by 18% over the past year to $539 billion.

- Organic Fundraising: $29 billion in Q4, contributing to over $135 billion for the year.

- Assets Under Management (AUM): Surpassed $1 trillion.

- Liquidity Position: $1.8 billion at the end of the quarter.

- Dividend Increase: 15% increase to an annualized rate of $1.75 or $0.4375 per share per quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Brookfield Asset Management Ltd (BAM, Financial) raised over $135 billion in 2024, including a record $29 billion in the fourth quarter, showcasing strong fundraising capabilities.

- The company achieved an 18% annual growth in its fee-bearing capital base, reaching $539 billion, which generated $2.5 billion in fee-related earnings.

- BAM strategically expanded its credit origination capabilities and bolstered its fundraising organization, contributing to significant growth in its credit business.

- The company surpassed $1 trillion in assets under management, reflecting its strong market position and growth trajectory.

- BAM announced a 15% increase in its quarterly dividend, demonstrating confidence in its financial health and future prospects.

Negative Points

- The M&A market was slower in 2024, which could impact future growth opportunities if the trend continues.

- Despite strong fundraising, the company experienced significant outflows in its credit business, which affected fee-bearing capital.

- The potential for changes in US tax treatment of carried interest could impact compensation structures and financial outcomes.

- The company's reliance on large-scale transactions may lead to longer deal cycles, potentially delaying capital deployment.

- Market conditions, such as higher interest rates and FX fluctuations, could pose challenges to maintaining growth momentum.